- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

securities companies

Update news securities companies

VN securities firms diversify capital sources for expansion

Capital mobilisation plans are now the centre of attention at the 2022 general meeting of shareholders of securities companies, with diversified fundraising channels.

Securities companies offer up fresh capital strategies

As the buoyant and robust inflows to Vietnam’s stock sector are predicted to stay steadfast in 2022, local and foreign-backed securities firms are battling with one another to capture a larger chunk of the market.

Companies' share issuance plans sometimes pressure 'small' investors

In the context of impressive growth of the stock market, many companies have flocked to issue shares to raise capital, but not all achieve the expected result.

Securities firms report improved results in Q1

Recently released financial reports show the earnings of securities companies were positive in the first quarter of 2021.

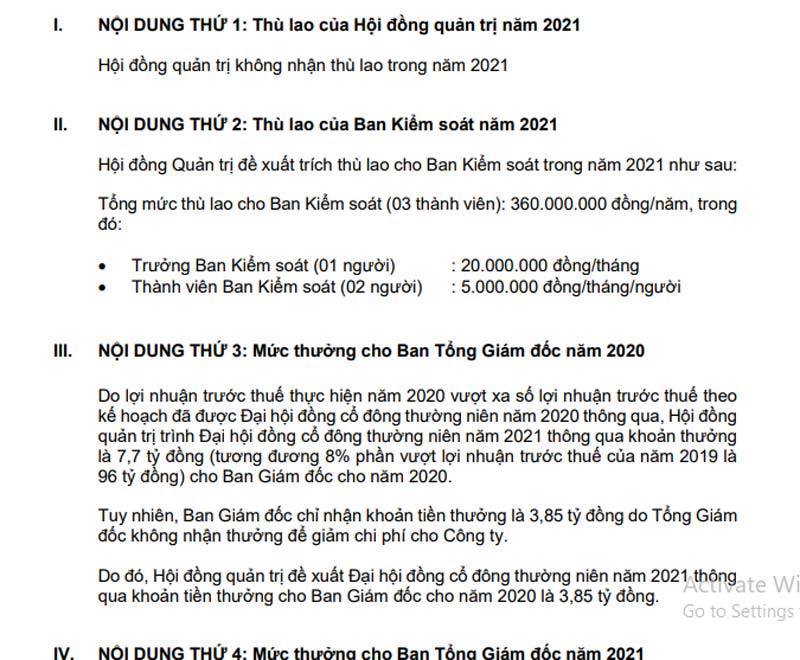

Many business leaders refuse salaries, but still pocket big money

The chair of Viet Capital Securities has received zero dong, and the CEO has refused a bonus worth an apartment, buy they still earn money through shares they hold.

Securities companies report big profits, but Viet Capital sees sharp fall in profits

Viet Capital Securities (VCSC) of Nguyen Thanh Phuong has been showing signs of decline recently, but the stock market is brightening with strong liquidity.

Covid-19 changes positioning of largest securities companies in Vietnam

The number of securities companies that saw profits decrease or took losses in Q1 were much higher than the number of companies that maintained growth.

The number of securities companies that saw profits decrease or took losses in Q1 were much higher than the number of companies that maintained growth.

Three priority tasks set for VN securities commissions in 2020

In addition to promulgating legal documents to ensure the enforcement of the amended Securities Law, the State Securities Commission (SSC) will put the new transaction system into operation and consolidate the corporate bond market.

In addition to promulgating legal documents to ensure the enforcement of the amended Securities Law, the State Securities Commission (SSC) will put the new transaction system into operation and consolidate the corporate bond market.

Derivatives market hopes to start well in 2020

The derivatives market is likely to grow stronger in 2020, offering high profitability to investors, analysts have said.

The derivatives market is likely to grow stronger in 2020, offering high profitability to investors, analysts have said.

As securities services go digital, will robots replace brokers?

Big securities companies are trying to catch up with the technological revolution in the financial industry by employing robots and artificial intelligence (AI) to provide services for their clients.

Big securities companies are trying to catch up with the technological revolution in the financial industry by employing robots and artificial intelligence (AI) to provide services for their clients.

South Korean portfolio investment pours into Vietnam

South Korean invested securities companies are putting pressure on Vietnamese companies, competing in terms of service quality, number of branches and the possibility of providing loans for margin trading.

South Korean invested securities companies are putting pressure on Vietnamese companies, competing in terms of service quality, number of branches and the possibility of providing loans for margin trading.

Covered warrants make debut on Ho Chi Minh Stock Exchange

The Ho Chi Minh Stock Exchange (HOSE) held the first trading session of covered warrants (CWs) on June 28, marking the debut of this type of securities product on the Vietnamese stock market.

The Ho Chi Minh Stock Exchange (HOSE) held the first trading session of covered warrants (CWs) on June 28, marking the debut of this type of securities product on the Vietnamese stock market.

Covered warrants to be officially listed on June 28

Covered warrants (CWs) will be officially listed and traded on the Vietnamese stock market from June 28, according to the State Securities Commission of Vietnam (SSC).

Covered warrants (CWs) will be officially listed and traded on the Vietnamese stock market from June 28, according to the State Securities Commission of Vietnam (SSC).

Securities companies begin brokerage war as Govt scraps minimum rate

Stockbrokers’ revenues are expected to fall sharply after a price war broke out among them in the wake of Circular No 128/2018/TT-BTC, which took effect last February.

Stockbrokers’ revenues are expected to fall sharply after a price war broke out among them in the wake of Circular No 128/2018/TT-BTC, which took effect last February.

Rushing to raise capital, foreign securities companies prepare for new business

A lot of foreign securities companies have announced plans to increase their charter capital within a short time, but Vietnamese companies are being cautious about their capital increase plans.

Securities companies bought by Chinese, Korean and Hong Kong firms

VietNamNet Bridge - A number of small securities companies changed hands in 2017. The buyers were mostly from China and South Korea.

Vietnam not an easy market for foreign-invested securities companies

Despite advantages in capital and experience, foreign-invested securities companies still are finding it difficult to cement their positions in the fledgling stock market.

Securities companies’ capitalization value exceeds VND1 trillion threshold

VietNamNet Bridge - The share prices of many securities companies have increased since the beginning of the year thanks to the rising stock market.

Taking false steps, many big businesses sink like a stone

VietNamNet Bridge - A number of once-famous large corporations are now bogged down in difficulties and losses, with little chance for recovery.

Securities companies open door to foreign investors

VietNamNet Bridge - Two Vietnamese securities companies have announced they will remove the foreign ownership cap on shares. Who will be next?