- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

real estate firms

Update news real estate firms

Real estate businesses return to the bond channel

Many real estate businesses have returned to the bond channel to raise capital after the absence in April, mobilising thousands of billions of Vietnamese dong.

Experts warn of high risks from real estate firms' corporate bond issuance

Corporate bonds issued by real estate firms account for a high proportion of securities that mature in three years. Experts warn of high risks if the real estate market cannot recover by that time.

Vietnam raises US$1.7 billion via government bonds in Q1

As of March, the total value of G-bonds reached more than VND1,340 trillion ($58.3 billion), slightly down 0.7% against late 2020.

Businesses borrow VND400 trillion at high interest rates, raising concerns about solvency

The financial health of many enterprises that issued bonds in 2020 is getting worse, with profits not high enough to pay bond interest.

Real estate bond interest rates are too high, say experts

The HCM City Real Estate Association (HOREA), in its report about the real estate market in 2020 and prospects in 2021, says the real estate bond market will continue to grow well this year.

Watchdog agency tightens control over bond issuance

The movement of issuing corporate bonds has cooled down, but the large number of bonds that have been issued with no collateral, or untrustworthy collateral, is viewed as a ‘bubble’ that may burst at any time.

Experts warn of ‘bond bubble’

Businesses are creating virtual assets by issuing corporate bonds, but experts warn that during the Covid-19 pandemic, a ‘bond bubble’ will bring high risks to the economy.

Investors still pouring money into corporate bonds, despite warnings

Investors are still preferring corporate bonds to bank deposits, and are withdrawing money from banks to buy corporate bonds to enjoy higher interest rates.

VN bond market remains underdeveloped despite years of existence

While in developed markets corporate bonds act as the major channel that conducts capital for the economy, in Vietnam they are still in a very early stage of development.

VN realty firms try their best to cope with COVID-19

Cutting costs and restructuring products are what many real estate firms are doing to deal with difficulties caused by COVID-19.

Cutting costs and restructuring products are what many real estate firms are doing to deal with difficulties caused by COVID-19.

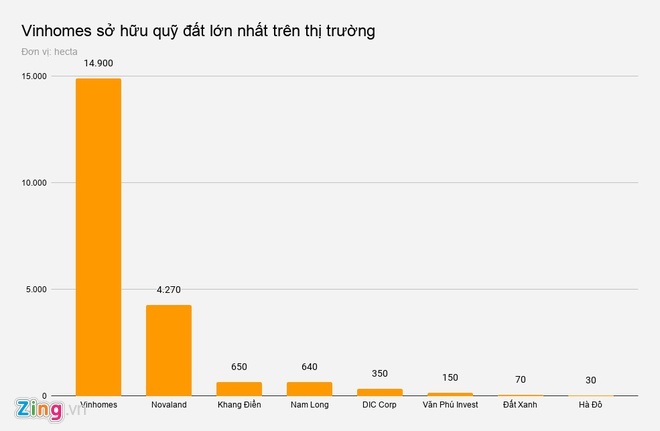

Real estate firms with large land holdings expect good year

2020 is expected to be a tough year for real estate developers, but some real estate firms still have high hopes thanks to the large land holdings they own.

2020 is expected to be a tough year for real estate developers, but some real estate firms still have high hopes thanks to the large land holdings they own.

Vietnam’s estate companies seek investment opportunities in foreign markets

More and more domestic real estate firms have begun to seek investment opportunities in global markets, according to Savills Vietnam.

VN real estate firms issue bonds again

There are two typical characteristics of the real estate firms’ race to issue bonds – the high amount of bonds issued and the high interest rates.

There are two typical characteristics of the real estate firms’ race to issue bonds – the high amount of bonds issued and the high interest rates.

Vietnamese banks issue more international bonds this year

Commercial banks are issuing international bonds because they need foreign currencies to satisfy dollar capital demand.

Commercial banks are issuing international bonds because they need foreign currencies to satisfy dollar capital demand.

Will VN real estate firms issue international bonds?

Whether to allow real estate firms to issue bonds in the international market remains a controversial issue.

Whether to allow real estate firms to issue bonds in the international market remains a controversial issue.

Who are the buyers of bank bonds?

Forty percent of bonds issued by banks are bought by securities companies, but analysts believe that the real bond holders are commercial banks.

Forty percent of bonds issued by banks are bought by securities companies, but analysts believe that the real bond holders are commercial banks.

VN banks told to be careful with corporate bonds

Commercial banks’ purchase of real estate corporate bonds is considered indirect lending to real estate firms, experts say.

Commercial banks’ purchase of real estate corporate bonds is considered indirect lending to real estate firms, experts say.

Vietnam cautious about interest rate policy

Vietnam is following a skeptical interest rate policy, with few and minor adjustments.

Vietnam is following a skeptical interest rate policy, with few and minor adjustments.

What's behind real estate firms’ race to issue corporate bonds?

Real estate firms are rushing to issue corporate bonds, which analysts say shows their thirst for capital. But there are risks.

Real estate firms are rushing to issue corporate bonds, which analysts say shows their thirst for capital. But there are risks.

Money flows into corporate bonds

Personal money appears to be shifting from stocks and bank deposits to corporate bonds.

Personal money appears to be shifting from stocks and bank deposits to corporate bonds.