- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

monetary market

Update news monetary market

State Bank of Vietnam alleviates market pressures

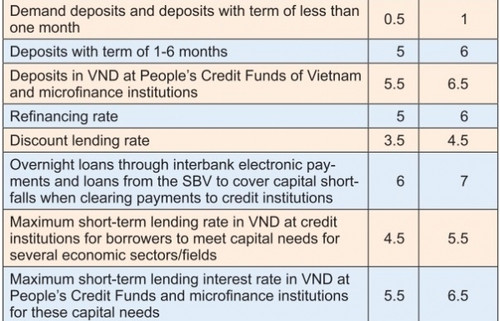

The State Bank of Vietnam adjusted several operating interest rates last week, with the move deemed necessary in the context of a strong USD and increasing domestic pressure on interest rates and exchange rates.

SBV aiming to harmonise monetary market players

The State Bank of Vietnam is attempting to stabilise lending rates while also mobilising credit institutions to continue reducing operating costs and support both individuals and businesses.

VN central bank sells US dollar forward for first time since 2018

The State Bank of Vietnam (SBV) has recently sold US dollar forward for the first time since 2018 to support the liquidity of the foreign exchange market.

Vietnamese currency more stable than other regional peers

Though the unofficial value of the VND has now fallen about 3 percent against the USD, the rate is still a smaller depreciation than that seen by most of Vietnam’s regional peers and is expected to stabilise around that level.

Though the unofficial value of the VND has now fallen about 3 percent against the USD, the rate is still a smaller depreciation than that seen by most of Vietnam’s regional peers and is expected to stabilise around that level.

Should Gov’t issue tax free bonds?

VietNamNet Bridge – Economist Nguyen Tri Hieu talks to the Hai Quan (Customs) newspaper about possible plans to generate money for the Government’s affordable housing scheme in its second phase

BUSINESS IN BRIEF 30/4

Japanese firms invest in Vietnam’s industrial zones; SBV Governor: Monetary market to become stable by year-end; Jan-Apr inflation lowest in 13 years; BIDV raises chartered capital to VND33.5 trillion