- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

M&As

Update news M&As

Key export sectors the target of M&As by foreign investors

Several of Vietnam’s key export sectors have become magnets for merger and acquisition (M&As) activities, posing a risk of leading enterprises in those sectors being purchased by foreign investors.

Silver lining found in investment channel risk this year

Investors are pinning their hopes on different investment channels this year despite the many difficulties and risks brought about by COVID-19, analysts have said.

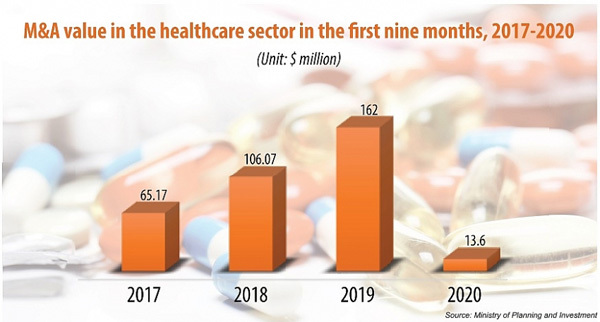

New M&As in healthcare can evade pandemic uncertainties

Mergers and acquisitions in Vietnam’s healthcare and pharmaceutical sector in 2020 have been held up due to the global health crisis – but prospects remaining enticing thanks to new drivers of interest.

Heated hospitality segment for M&As

Merger and acquisition activity is growing across Asia Pacific's real estate market, and in Vietnam there are signs that institutional investors are continuing to increase their allocations in the industry.

Merger and acquisition activity is growing across Asia Pacific's real estate market, and in Vietnam there are signs that institutional investors are continuing to increase their allocations in the industry.

Foreign firms dominate Vietnam logistics market through recent M&As

Foreign companies account for 80% of Vietnam`s logistics market, which is likely to be valued at US$87 billion by 2022.

Foreign companies account for 80% of Vietnam`s logistics market, which is likely to be valued at US$87 billion by 2022.

M&As in electronics market growing

VietNamNet Bridge – Mergers and Acquisitions (M&As) by foreign companies is the fastest way to hold stakes in the Vietnamese electronic and electrical retail market.

More M&A deals expected in domestic real estate sector

VietNamNet Bridge – Mergers and acquisitions (M&As) in the domestic real estate sector are being favoured thanks to the recovery in the market, together with several new policies.

Supermarkets tap into domestic retail sector

VietNamNet Bridge – The considerable potential of Viet Nam's domestic retail market is being actively promoted by large retailers looking to expand their businesses at a faster pace.

Wave of M&As forecast for Vietnam

VietNamNet Bridge – With a raft of free trade agreements on the way, a checklist of equitisations, and new legislation in place to support foreign investment, a new wave of M&As are forecast to sweep across Vietnam.

M&As in real estate getting heated in Vietnam

VietNamNet Bridge – The real estate market has been largely stagnant. While many real estate companies are looking for ways to get out of the market, many large investors want to join in. The Vietnam Business Forum reports.

New thought needed for SOEs to spur M&As

VietNamNet Bridge – Deputy head of Central Institute for Economic Management Vo Tri Thanh weighs over diverse aspects in Vietnam’s M&A market development and explains why it is now a good time for M&A deals.