- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

JLL

Update news JLL

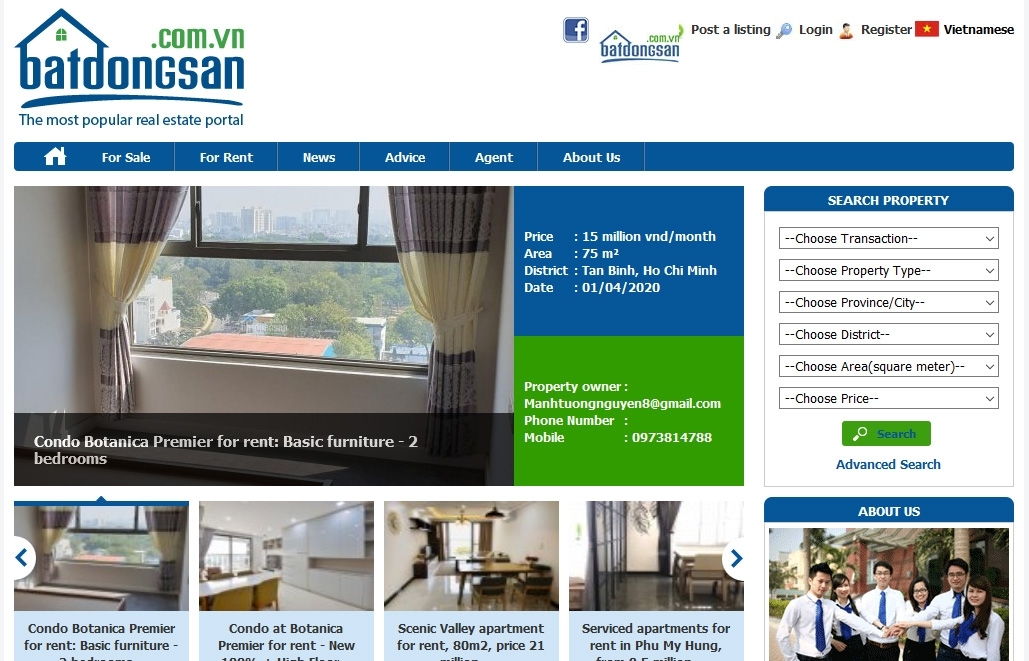

COVID-19 could shake up realty rent market in Vietnam

Le Thu Cuc pastes a notice in her cafe to tell her customers she will continue serving them in a cafe 500m away.

Asian hotel investors pivot to debt financing as owners look to shore up balance sheets

Hotel owners across Asia are seeking greater access to debt financing to bolster cash flows as they face historically low occupancy rates.

Hotel owners across Asia are seeking greater access to debt financing to bolster cash flows as they face historically low occupancy rates.

More foreign manufacturers turn to Vietnam amid pandemic: JLL

With the novel coronavirus pandemic and trade tensions driving the shift of production lines from China to Southeast Asia, Vietnam, in particular, seems to have emerged as an attractive destination for investors and manufacturers alike.

With the novel coronavirus pandemic and trade tensions driving the shift of production lines from China to Southeast Asia, Vietnam, in particular, seems to have emerged as an attractive destination for investors and manufacturers alike.

Local retail property market over saturation point

The local retail property market has reached the saturation point years ago and now empty storefronts and shopping centres are putting a dent in forecasts.

The local retail property market has reached the saturation point years ago and now empty storefronts and shopping centres are putting a dent in forecasts.

JLL names five key trends of Vietnam property market 2020

Vietnam is expected to be one of the most favorite destinations for property investors thanks to its export-driven economy and stronger journey of international integration, professional services firm JLL has said in a recent report.

Vietnam is expected to be one of the most favorite destinations for property investors thanks to its export-driven economy and stronger journey of international integration, professional services firm JLL has said in a recent report.

Vietnam’s two big cities lead region in dynamic growth: JLL

HCM City and Hanoi continue to lead the momentum in Southeast Asia, ranking third and seventh among the most dynamic cities in the world, according to the City Momentum Index recently issued by property consultant Jones Lang LaSalle.

HCM City and Hanoi continue to lead the momentum in Southeast Asia, ranking third and seventh among the most dynamic cities in the world, according to the City Momentum Index recently issued by property consultant Jones Lang LaSalle.

Asian investors eye low-cost housing

JLL estimates that hundreds of millions of dollars from Japan, South Korea, Singapore and China are waiting to be funneled into Vietnam’s real estate market.

JLL estimates that hundreds of millions of dollars from Japan, South Korea, Singapore and China are waiting to be funneled into Vietnam’s real estate market.

HCMC and Hanoi remain most dynamic cities worldwide

JLL expects Vietnam’s fastest growing cities to maintain the level of interest from overseas investors, and continue on its growth trajectory, particularly with the help of government policy to resolve infrastructure deficit and city sustainability.

JLL expects Vietnam’s fastest growing cities to maintain the level of interest from overseas investors, and continue on its growth trajectory, particularly with the help of government policy to resolve infrastructure deficit and city sustainability.

High uncertainties remain for HCMC apartment market

Some 30,000 - 35,000 apartments are expected to launched officially in Ho Chi Minh City this year, mainly contributed by Vinhomes Grand Park project, said the real estate services provider JLL Vietnam.

Some 30,000 - 35,000 apartments are expected to launched officially in Ho Chi Minh City this year, mainly contributed by Vinhomes Grand Park project, said the real estate services provider JLL Vietnam.

Foreign investors ready to invest big in Vietnam housing

JLL observes that there are hundreds of million dollars waiting to be poured into the market in most segments of real estate.

JLL observes that there are hundreds of million dollars waiting to be poured into the market in most segments of real estate.

Vietnam’s retail pie sweet but hard to get: JLL

As one of the most dynamic economies in the region, Vietnam’s young retail market has great potential as it is increasingly more competitive and attractive to foreign investors.

As one of the most dynamic economies in the region, Vietnam’s young retail market has great potential as it is increasingly more competitive and attractive to foreign investors.

The new real estate mission for tech groups old and new

Proptech in Vietnam is developing and expanding on the back of strong momentum in the Vietnamese real estate market, due to its benefits in improving accuracy and speed, as well as cost savings and convenience.

Proptech in Vietnam is developing and expanding on the back of strong momentum in the Vietnamese real estate market, due to its benefits in improving accuracy and speed, as well as cost savings and convenience.

F&B to drive retail property market in HCM City

Food and beverage and fashion and lifestyle will continue to drive demand in HCM City’s retail property market, according to real estate consultancies.

Food and beverage and fashion and lifestyle will continue to drive demand in HCM City’s retail property market, according to real estate consultancies.

Vietnam's industrial real estate attracting investors amid global uncertainty: JLL

Trade tensions between the US and China are driving increased real estate investor interest in Southeast Asian countries, with Vietnam’s industrial sector a key focal point, according to JLL Vietnam.

Trade tensions between the US and China are driving increased real estate investor interest in Southeast Asian countries, with Vietnam’s industrial sector a key focal point, according to JLL Vietnam.

Proptech expands in Vietnam: JLL

Despite inherent barriers arising from a traditional mindset and the high requirement for trust in the real estate industry, the prospects for proptech in Vietnam are still positive.

Despite inherent barriers arising from a traditional mindset and the high requirement for trust in the real estate industry, the prospects for proptech in Vietnam are still positive.

Offices for lease yield high profits for investors

The occupancy rates of office buildings located in advantageous positions are at a record high.

The occupancy rates of office buildings located in advantageous positions are at a record high.