- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

investment incentives

Update news investment incentives

VN's southeastern region opens door wide for foreign investors

Localities in the southeastern region remain a magnet to foreign investors thanks to their huge potential and incentives.

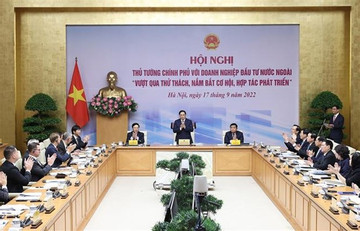

Vietnam facilitates foreign firms’ investment activities: PM

PM Pham Minh Chinh chaired a hybrid meeting with foreign-invested enterprises and business associations on September 17, during which he pledged to create favourable conditions for FDI enterprises to invest successfully and sustainably in Vietnam.

Key industries can’t develop as private businesses remain small, weak

The processing and manufacturing industry is key to Vietnam’s prosperity, but the development of private enterprises in this sector faces obstacles.

Government signs decision on special investment incentives

Standing Deputy Prime Minister Pham Binh Minh has just signed Decision No 29/2021/QĐ-TTg of the Prime Minister on special investment incentives.

Special incentives in pipeline for investors

The business community and investors are expected to benefit from the government’s upcoming decision offering special investment incentives, but experts said such bonanzas will need to be further clarified.

What's new in Vietnam's amended Investment Law?

This law version bans the debt collection service.

Many foreign investors circumvent the laws

Experts have warned of the attempt by many foreign invested enterprises (FIEs) to dodge the laws to enjoy preferences and make local authorities ‘lose lock, stock and barrel’.

Experts have warned of the attempt by many foreign invested enterprises (FIEs) to dodge the laws to enjoy preferences and make local authorities ‘lose lock, stock and barrel’.

Difficulty in land access hinders 4.0 agriculture in Vietnam

Hi-tech agriculture cooperatives in HCMC are finding it difficult to expand production scale, while farmers are reluctant to make investments because of complicated procedures.

Hi-tech agriculture cooperatives in HCMC are finding it difficult to expand production scale, while farmers are reluctant to make investments because of complicated procedures.

FIEs favored while Vietnamese enterprises at a disadvantage

The problems caused by FIEs, such as transfer pricing and investment under others’ names, have been noted in the Party Politburo’s Resolution 50 for the first time.

The problems caused by FIEs, such as transfer pricing and investment under others’ names, have been noted in the Party Politburo’s Resolution 50 for the first time.

Why foreign retailers withdraw from Vietnam?

Capital withdrawals of foreign retailers in Vietnam have fielded a number of queries on whether the firms had sustained losses or if the local business climate lacked enough incentives.

Capital withdrawals of foreign retailers in Vietnam have fielded a number of queries on whether the firms had sustained losses or if the local business climate lacked enough incentives.

Ministry insists on ’99-year policy’, but economists oppose

While National Assembly’s deputies believe that allocating land for up to 99 years in special economic zones SEZs is not a good policy, the Ministry of Planning and Investment (MPI) still persists in its opinion.

Small IT firms fear they can't get jobs

VietNamNet Bridge - Analysts commented that IT firms will have too many jobs as the government’s Resolution 36 on e-government has been released. However, small firms fear they may not get the jobs.

New investment incentives come into effect in Vietnam in December

New regulations on investment incentives in the 2014 Investment Law, such as a list of sectors offering investment incentives and investment incentive procedures, which are guided by Decree No 118/2015/ND-CP, came into effect on December 27, 2015.

Public disagrees with MOIT on calling Samsung products ‘Vietnamese’

VietNamNet Bridge - The statement that products made by Samsung Vietnam are ‘Vietnamese’ has led to harsh criticism from the public.

Viettel envies Samsung for investment incentives

VietNamNet Bridge - While foreign investors are treated as ‘VIP customers’, Vietnamese enterprises meet difficulties when working with authorities.

Vietnam gives excessive incentives to foreign investors

Vietnam gives big incentives for FDI enterprises with the expectation that they will perform technology transfer in the country, but the fact is that only 20% of foreign firms were engaged in technology transfer in the past 5 years.

Da Nang asks for incentives for major investors in IT park

VietNamNet Bridge – The central city of Da Nang has asked for the government’s permission to offer incentives to foreign-invested projects with capital of over $200 million in its IT park.

High-tech firms question new rules on tax incentives

Electronics, hardware and software firms are unsure whether they can qualify for tax incentives offered to hi-tech businesses.

BUSINESS IN BRIEF 30/3

Few provincial decisions on investment incentives get beyond limits; Small disbursements of low-cost home loans; Cashew needs new answers; New agriculture stimulus discussed; Lax firms suffer as their brands are duplicated

BUSINESS IN BRIEF 11/10

Steel sector struggles to escape rut; VN pledges to adopt global mining standard; Experts promote sustainable aquaculture practices; Tea industry needs to plan for the future