- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

foreign banks

Update news foreign banks

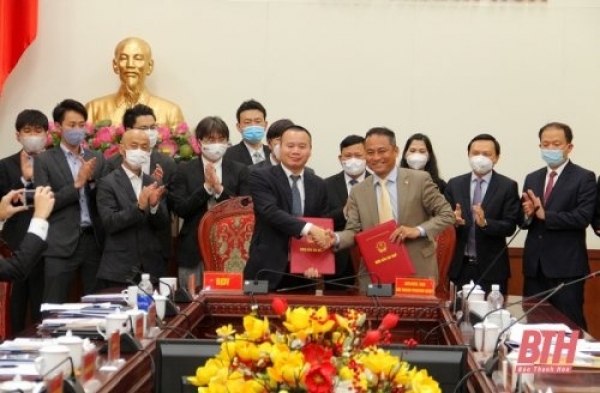

Foreign banks grab slice of investment promotion action

More foreign banks are engaging in the organisation of investment promotion events, facilitating Vietnam to attract more investors to the country.

Total assets of banks in Vietnam stand at $522 billion

Total assets of credit institutions and foreign banks in Vietnam by the end of the first quarter of this year inched down 0.72 per cent to VND12.48 quadrillion (US$521.76 billion) compared with the end of last year.

Total assets of credit institutions and foreign banks in Vietnam by the end of the first quarter of this year inched down 0.72 per cent to VND12.48 quadrillion (US$521.76 billion) compared with the end of last year.

Foreign banks returning to Vietnam

Vietcombank’s completion of the sale of shares to foreign investors in early 2019 and BIDV’s action in late 2019 are expected to help attract foreign banks to Vietnam.

Vietcombank’s completion of the sale of shares to foreign investors in early 2019 and BIDV’s action in late 2019 are expected to help attract foreign banks to Vietnam.

Foreign banks may return soon

The completion of the sale of Vietcombank stake to foreign buyers in early 2019 and of BIDV at the end of last year may bode well for a comeback of foreign banks to Vietnam in 2020.

The completion of the sale of Vietcombank stake to foreign buyers in early 2019 and of BIDV at the end of last year may bode well for a comeback of foreign banks to Vietnam in 2020.

Credit is major ‘rice pot’ for Vietnamese banks

Credit has been growing steadily in the last nine months, helping commercial banks make fat profits.

Credit has been growing steadily in the last nine months, helping commercial banks make fat profits.

Foreign banks enlarge networks, restructure operations in Vietnam

VietNamNet Bridge - The sale of business divisions can be seen as a move by foreign banks to restructure their operations and focus on core business fields to improve business efficiency.

Foreign banks gear up to expand networks in Vietnam

VietNamNet Bridge - In the last two years, Vietnam saw many foreign finance institutions leaving Vietnam or scaling down their investment.

How are foreign banks performing in Vietnam?

VietNamNet Bridge - The number of 100 percent foreign owned banks in Vietnam has increased by twofold in the last two years to nine.

Vietnam banks see more withdrawals of foreign shareholders

The lack of a common voice among managers, the changes in business strategies, and the weak role on the board of directors are some of the reasons foreign shareholders have left Vietnamese banks.

When foreign banks want to leave Vietnamese partners

VietNamNet Bridge - The year 2017 saw a number of foreign investors leaving their Vietnamese partners and divesting from banks they once made every effort to develop.

Foreign banks step up personal banking, increase M&A activity

VietNamNet Bridge - Two foreign bank names are in the list of top 10 taxpayers – HSBC and Shinhan Bank Vietnam. And both have strong retail banking divisions.

Retail sale segment - delicious cake for domestic, foreign banks

Both foreign and domestic banks are racing to develop retail sale strategies in Vietnam, the 93-million-people country-a fertile land for banking retail business.

Overseas Vietnamese want Viet Kieu-invested bank in Vietnam

VietNamNet Bridge - Analysts believe that the current conditions for the establishment and operation of a Viet Kieu-invested bank in Vietnam are more favorable than 25 years ago.

Foreign banks advance slowly but steadily in Vietnam

VietNamNet Bridge - Though foreign banks have expanded their networks and presence in Vietnam, they still have a modest market share in Vietnam.

Foreign bankers hope they can earn more money in Vietnam with AEC

VietNamNet Bridge - More and more foreign bankers are flocking to Vietnam, while the existing bankers have been trying to expand their business in the country.

Administrative violation sanctions in monetary and banking areas

VietNamNet Bridge – Decree 96 supplements some new violations including those related to the regulations on shares and stocks; fees for provision of services; trustee, fiduciary and interbank activities; payments, cash management and treasury;

Foreign banks look local for CEOs

While local banks may prefer a foreign CEO, some foreign banks are now eyeing Vietnamese CEOs.

Foreign banks make high profits in Vietnam

VietNamNet Bridge – Despite many barriers, foreign banks have been prospering in Vietnam, dominating many service market segments.

BUSINESS IN BRIEF 23/12

Oman lifts ban on Vietnam poultry imports; Seafood exports reach $7.9b in 2014; Mobile devices market set for holiday pickings; Two more foreign banks to open branches in Vietnam; Low inflation leaves room for interest rate cuts

Health of banking system in decline

VietNamNet Bridge – The health of the local banking system is falling, which is evident in its capital adequacy ratio (CAR) drop.