- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

fintech

Update news fintech

Fintech firms become capital providers for small and micro firms

Financial technology (fintech) companies could be a great source of capital for small and micro enterprises, but a complete legal framework is needed to sustainably develop the capital channel, experts said.

Regulatory sandbox to be developed for three fintech solutions only

In the latest draft, the regulatory sandbox will be developed for three fintech solutions, including credit scoring, open application programming interface (API) and P2P lending.

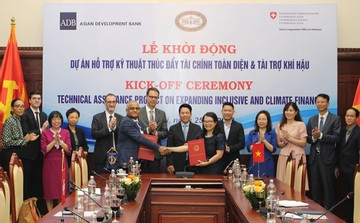

ADB, Switzerland aid fintech development in Vietnam

The Asian Development Bank and the State Bank of Vietnam held a kick-off ceremony marking the implementation of the Swiss-funded $5mil technical assistance, which aims to nurture financial technologies serving financial inclusion improvement in VN.

Decree on regulatory sandbox for Fintech to be introduced

Scores of Fintech companies have had to cut their workforce by half because of slumps in sales and struggles navigating the law's grey areas.

Vietnam's fintech landscape poised for significant growth

Despite a drop in funding, Vietnam will continue to breed upcoming fintech unicorns in the long term thanks to its burgeoning fintech sector.

FPT Smart Cloud partners with Home Credit Indonesia

FPT Smart Cloud has joined forces with Home Credit Indonesia - a tech-based financing company with 6-million customers - in an official strategic partnership for AI development.

Opportunities for Swiss fintech startups numeral in Vietnam: report

Swiss fintech startups should tap into opportunities in VN – the country with rising demand for digital financial solutions, supportive policies, and government initiatives to nurture fintech innovation, according to a new Vietnam Fintech report.

Banks digitize as they feel pressure from fintech

Commercial banks, which see fintechs as a threat, are creating digital banking divisions or developing technology centers to create resources for digital transformation.

ADB, Switzerland grant US$5 mln to support Vietnam improve fintech

The Asian Development Bank (ADB) and Switzerland have signed a cofinancing agreement of up to $5 million to develop financial technologies (fintech) that can help address low financial inclusion in Vietnam.

Laws play catchup with fintech

Fintech is rapidly transforming the financial sector in Viet Nam, but regulatory gaps still exist because laws have not kept up with the advances in technology.

Vietnamese Fintech unicorn among top 10 global financial platforms

Vietnam has one representative in the Global Platforms Ranking 2023, announced by TABInsights under The Asian Banker.

Vietnam’s fintech reaches new heights

VGP - Viet Nam's fintech has reached new heights and the newly introduced regulatory sandbox is further fueling its growth.

Innovative start-ups in the e-commerce sector

E-commerce start-ups are becoming more and more popular and are considered relatively safe in the fields of innovative start-ups in Vietnam today.

Fintech startups urged to think for long term

While tech businesses around the world struggle to raise funds, some fintech companies in Southeast Asia continue to receive large sums.

Fintech firms step up cooperation with banks to boost lending

Both foreign and domestic fintech firms are promoting connections with commercial banks to lend unsecured loans to individuals, and small and micro enterprises as demand for consumer and business loans at the end of the year is rising.

Vietnamese interested in metaverse and fintech

According to a recent report by Meta and Bain & Company, Vietnam is among the top 3 countries besides Indonesia and the Philippines to adopt new technologies such as fintech and metaverse.

DigiEx Group & Shinhan DS partner to develop Offshore Development Center

DigiEx Group and Shinhan DS Vietnam have signed a memorandum of understanding on strategic partnership to expand the Offshore Development Center and build the Ecosystem of Digital Talent Developers in Vietnam for Fintech Solutions.

Fintech future in store for smarter M&A deals

Cross-border merger and acquisition deals are being altered as a direct result of increasing inflation. Nevertheless, foreign investors are exploring untapped potential in the fintech industry to stay competitive in the digital era.

Nearly 60% of digital consumers in Vietnam use fintech solutions

Vietnam is a top market in adopting new technologies, in which 58% of digital consumers have used online banking solutions, e-wallets, money transfer applications, and digital banking.

Embedded finance the next big thing: summit

Embedded finance is the next big thing in the financial services industry as it has integrated seamlessly into the local fintech landscape in recent years, experts said at a meeting last Friday in HCM City.