- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

financial market

Update news financial market

What does the collapse of Silicon Valley Bank mean for Vietnam?

The collapse of Silicon Valley Bank in the US is expected to cause upheavals in the global financial market and problems for countries, including Vietnam. However, economic growth will still continue to be good.

Central bank pumps more money into circulation

The State Bank of Vietnam (SBV) has pumped more money into circulation after three weeks of consecutive net withdrawal. Overnight interest rates are high, while liquidity demand has increased on pre-Tet days.

Vietnam recovers impressively amid world uncertainties

With a high gross domestic product (GDP) growth rate, low inflation rate and stable exchange rate, Vietnam is a bright spot in the global economic picture.

VN central bank takes supportive stance to finance firms

State Bank of Vietnam has lifted caps on credit growth to boost credit to the economy as firms need bank loans to scale up production towards year-end.

Commercial banks allowed to expand room for credit

About 15 commercial banks have just been allowed to expand their credit limit by 1 percent to 4 percent by the State Bank, but this time expansion has not satisfied the market's thirst for capital after a long wait.

The credit growth limit: pending questions

The State Bank of Vietnam (SBV) has said it has adjusted the credit growth rate limits of some commercial banks in 2022. As usual, the adjustments were not made public.

Macro stability - a land to cultivate market confidence

Attending the recent patriotic emulation congress of the Ministry of Finance, Prime Minister Nguyen Xuan Phuc expressed satisfaction with the stricter fiscal policy after a prolonged period of expansion.

Alibaba’s Ant Financial quietly acquires stake in Vietnamese e-wallet firm

Ant will not control more than 50% of eMonkey, but is expected to have significant influence and provide technical expertise to the e-wallet

Vietnam to consider reducing ownership at state-run commercial banks

Vietnam is committed to opening the financial market to foreign investors, particularly in financial services.

Vietnam is committed to opening the financial market to foreign investors, particularly in financial services.

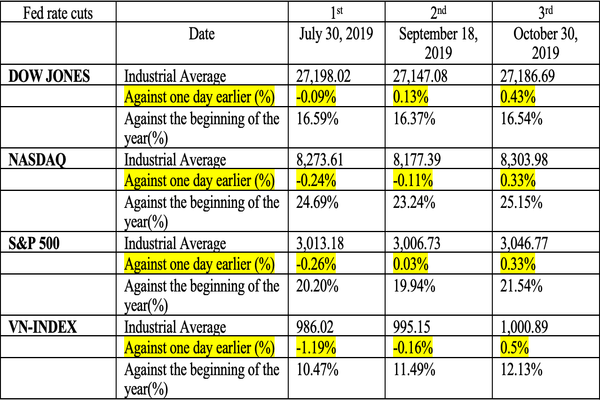

Vietnam’s financial markets respond positively to Fed rate cut

This time, Vietnam’s stock market responded differently compared to the previous two rate cuts with minimal impacts.

This time, Vietnam’s stock market responded differently compared to the previous two rate cuts with minimal impacts.

US-China trade war brings great opportunities, challenges

Asked about influence of the US-China trade war on their business performance, Vietnamese enterprises said they can see opportunities, but find it difficult to grab them.

Asked about influence of the US-China trade war on their business performance, Vietnamese enterprises said they can see opportunities, but find it difficult to grab them.

South Korean securities immersed in M&A deals

Financiers from South Korea are taking over Vietnam’s securities firms at a breakneck pace, as part of their quest to gain access to the fast-growing financial market in the country.

Financiers from South Korea are taking over Vietnam’s securities firms at a breakneck pace, as part of their quest to gain access to the fast-growing financial market in the country.

Volatility returns to foreign exchange rates

On May 29 the State Bank of Viet Nam adjusted the dong-US dollar exchange rate, weakening the Vietnamese currency by VND9 to VND22,605 per dollar, which represented the greenback’s biggest rise so far this year.

Government News 7/3

Vietnam, Laos NA ethnic councils seek stronger cooperation, Committee urged to focus proposals on macro economy, financial market, Vietnam learns from Japan’s experience in public sector ethics promotion

VN named bright spot in ASEAN

VietNamNet Bridge – Viet Nam’s gross domestic product (GDP) is expected to stay between 6 and 7 per cent from 2016 to 2018,

Domestic banks look hard for foreign strategic partners

VietNamNet Bridge – Domestic commercial banks are finding it hard to look for foreign strategic partners due to difficulties in the financial market and the current rules on foreign ownership limits.

Global crude oil prices affect Vietnam’s financial market

VietNamNet Bridge – The gold price has tumbled, the stock market is witnessing a drop in oil and gas share prices, and the US dollar continues to rise.

State to open derivatives market in 2016

VietNamNet Bridge – Prime Minister Nguyen Tan Dung has approved a project to develop a State-controlled centralised derivatives market, which will begin operating in 2016 and follow international technical standards.