- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

e-payment

Update news e-payment

VNPAY biometric recognition technology attains international quality standards

Certified for quality by reputable agencies such as iBeta and BSI, VNPAY’s eKYC technology is not only highly appreciated by domestic banks, but also recognized by prestigious accreditation organizations.

Era of digital payments has arrived

As one of the emerging economies in Southeast Asia, Vietnam has potential for e-payments.

Contactless economy: unexpected momentum and the future at hand

It's been two years since the Covid-19 pandemic turned the world upside down. The usual daily life is restricted, but that was the impetus for the new normal such as "no contact" and "social distancing" to appear.

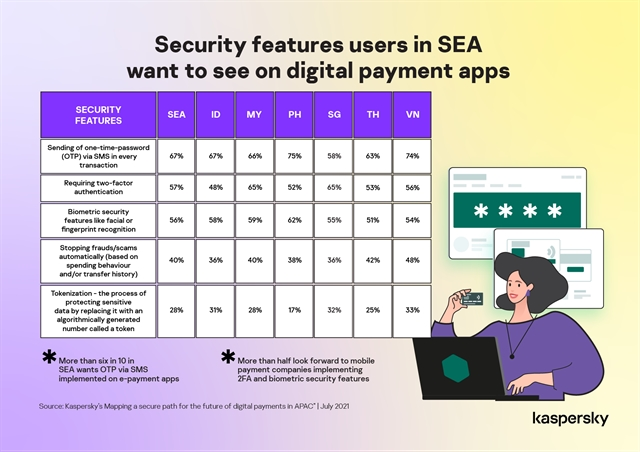

74% in VN want OTP for every e-payment transaction: Kaspersky study

More than three in five (67 per cent) users of digital banking and e-wallet apps in Southeast Asia prefer one-time-passwords by SMS for every transaction, a recent Kaspersky research has found.

E-government development among outstanding achievements of Vietnam: PM

One of the highlights in the e-government building of Vietnam in the last two years is the inauguration of the National Public Service Portal on December 9, 2019, reported the Government Office at a meeting of the National Committee for E-Government.

National social security system needed

Nguyen Ngoc Toan, Deputy Director-General of the Social Security Department in the Ministry of Labour, Invalids and Social Affairs, speaks on his ministry’s plan to develop a national social security system in all provinces and cities nationwide.

Mobile money to add up 0.5 ppts to Vietnam economic growth

Over 50% of the Vietnamese population does not have a payment account at banks, therefore, mobile money would offer a non-cash payment method for a large base of customers.

Over 50% of the Vietnamese population does not have a payment account at banks, therefore, mobile money would offer a non-cash payment method for a large base of customers.

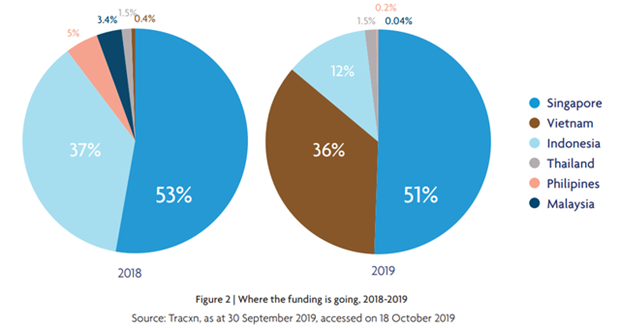

Vietnam ranks second in fintech investment in Southeast Asia

Venture capital funding pouring into Vietnamese fintech companies accounted for 36 percent of the total fintech investment in Southeast Asia.

Venture capital funding pouring into Vietnamese fintech companies accounted for 36 percent of the total fintech investment in Southeast Asia.

Promoting cashless payments to boost internet economy in Vietnam

Cashless payments would not only increase of the circulation of capital, it would also help boost the internet economy, said Deputy Prime Minister Vu Duc Dam.

Cashless payments would not only increase of the circulation of capital, it would also help boost the internet economy, said Deputy Prime Minister Vu Duc Dam.

E-payments becoming easier than ever

E-payment channels are flourushing but few people are choosing the payment channels.

E-payment channels are flourushing but few people are choosing the payment channels.

New rival in e-payment service market anticipated

VietNamNet Bridge - The PM has approved a pilot program on using telecommunication accounts for payments for digital content services and small-scale e-commerce transactions.

‘Touch-to-pay’ ecosystem taking shape in Vietnam

VietNamNet Bridge - The mobile payment service market in Vietnam has yet to enter a boom period, but many big players are present.

Foreign firms enter Vietnam’s payment market, charge low fees

VietNamNet Bridge - While Vietnamese banks are trying to collect fee from clients, e-wallet service providers are not charging fees, or collecting low fees to lure more users, analysts say.

Cashless economy is coming

“A non-cash society is coming to Vietnam,” Chairman of Alibaba Jack Ma told the Vietnam E- Payment Forum (VEPF) held on November 6 in Hanoi with the main topic “Mobile Payments”.