- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

charter capital

Update news charter capital

Vietnamese banks’ charter capital surged in 2021

Banks increased their charter capital by more than VND110 quadrillion in 2021 - the highest annual growth to date - to enhance financial strength and meet the central bank’s regulations.

Drunk man could open a giant company

Ever started registering a company after you’ve had one too many? One guy in Hanoi did and drunkenly registered a firm with a capital of VND144 trillion (US$6.3 billion), a slight overstatement to say the least!

Ever started registering a company after you’ve had one too many? One guy in Hanoi did and drunkenly registered a firm with a capital of VND144 trillion (US$6.3 billion), a slight overstatement to say the least!

BIDV plans to raise another $229.1 million in charter capital

The Joint Stock Commercial Bank for Investment and Development of Viet Nam (BIDV) plans to issue shares to increase its charter capital by VND5.3 trillion (US$229.1 million).

The Joint Stock Commercial Bank for Investment and Development of Viet Nam (BIDV) plans to issue shares to increase its charter capital by VND5.3 trillion (US$229.1 million).

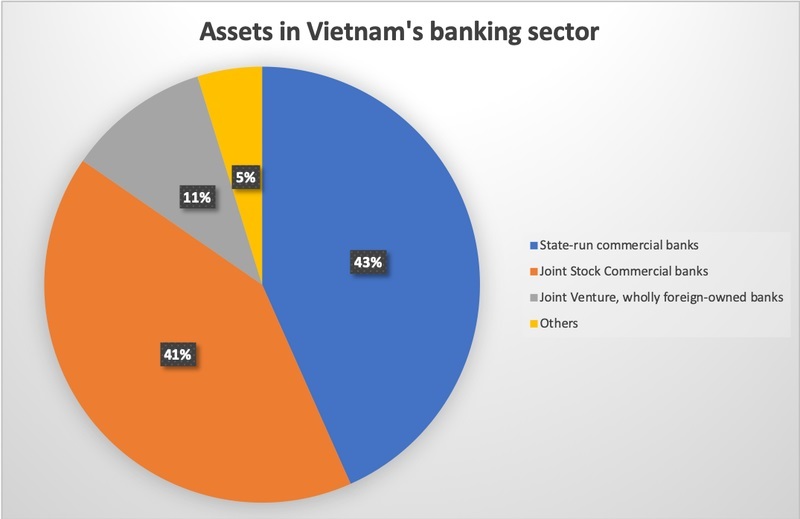

Total assets of banks in Vietnam increase 9% to nearly US$520 billion

The total assets of commercial banks under state ownership accounted for 43.4% of the total of the banking sector, followed by joint stock commercial banks with 41.4%.

The total assets of commercial banks under state ownership accounted for 43.4% of the total of the banking sector, followed by joint stock commercial banks with 41.4%.

Credit institutes must raise charter capital, forex exchange services tightened

The Government has announced new regulations regarding the charter capital required by credit institutions.

The Government has announced new regulations regarding the charter capital required by credit institutions.

National Assembly rejects bank capital hike proposal

The proposal was presented by the NA Economic Committee Chairman Vu Hong Thanh on Monday as a part of the socio-economic development plan for 2020.

The proposal was presented by the NA Economic Committee Chairman Vu Hong Thanh on Monday as a part of the socio-economic development plan for 2020.

93 SOEs to be equitised by 2020

Prime Minister Nguyen Xuan Phuc has signed a decision approving a list of 93 State-owned enterprises which will be equitised from now to the end of 2020.

Prime Minister Nguyen Xuan Phuc has signed a decision approving a list of 93 State-owned enterprises which will be equitised from now to the end of 2020.

Vietnam Bank Association calls for raising charter capital at four major State banks

The Vietnam Bank Association (VBA) has repeated its call for the Government to approve charter capital hikes at four major State-owned commercial banks, noting that the delay could adversely affect money supply for the economy.

The Vietnam Bank Association (VBA) has repeated its call for the Government to approve charter capital hikes at four major State-owned commercial banks, noting that the delay could adversely affect money supply for the economy.

Court postpones trial on PVEP case to summon more witnesses

The People’s Court of Ha Noi on Monday decided to suspend a trial for the case of “abusing position and power to appropriate assets” that occurred at the PetroVietnam Exploration Production Corporation (PVEP).

The People’s Court of Ha Noi on Monday decided to suspend a trial for the case of “abusing position and power to appropriate assets” that occurred at the PetroVietnam Exploration Production Corporation (PVEP).