- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

black credit

Update news black credit

Lenders in 'black credit' make threatening calls to demand debt payment

Businesses are complaining that they have been regularly bothered by black creditors. The creditors make hundreds of calls a day to ask them to pay debts for their employees.

P2P lending policy is hot issue on National Assembly’s agenda

Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong says the lack of a legal framework for peer-to-peer (P2P) lending has caused many problems. Ministries plan to issue legal documents on the issue soon.

Unable to access bank loans, businesses seek black credit

Many small and medium sized enterprises (SMEs) have had to borrow money from black credit sources.

Black credit returns, usurers chase debtors with constant phone calls

The days before Tet are the time when usurers try to collect debts. They use every possible method to force debtors to make payments, including the “laws” of the “underworld”.

Businesses ‘tortured’ by calls from debt collectors

Business managers are receiving calls asking them to pay their debts from black credit sources. But the debts were personal loans taken out by their employees.

Banks criticized for sky-high interest rates, burdening businesses

Many banks made a high profit in 2021 thanks to high lending interest rates. However, they have been warned of ‘making a rod for their own back’.

Black credit victims borrow VND1.5 billion, incur debt of VND15 billion

With exorbitant interest rates and gangster-style debt chasing, black credit has become a burning issue. The police have also warned that Vietnam may become a destination for foreign usurers.

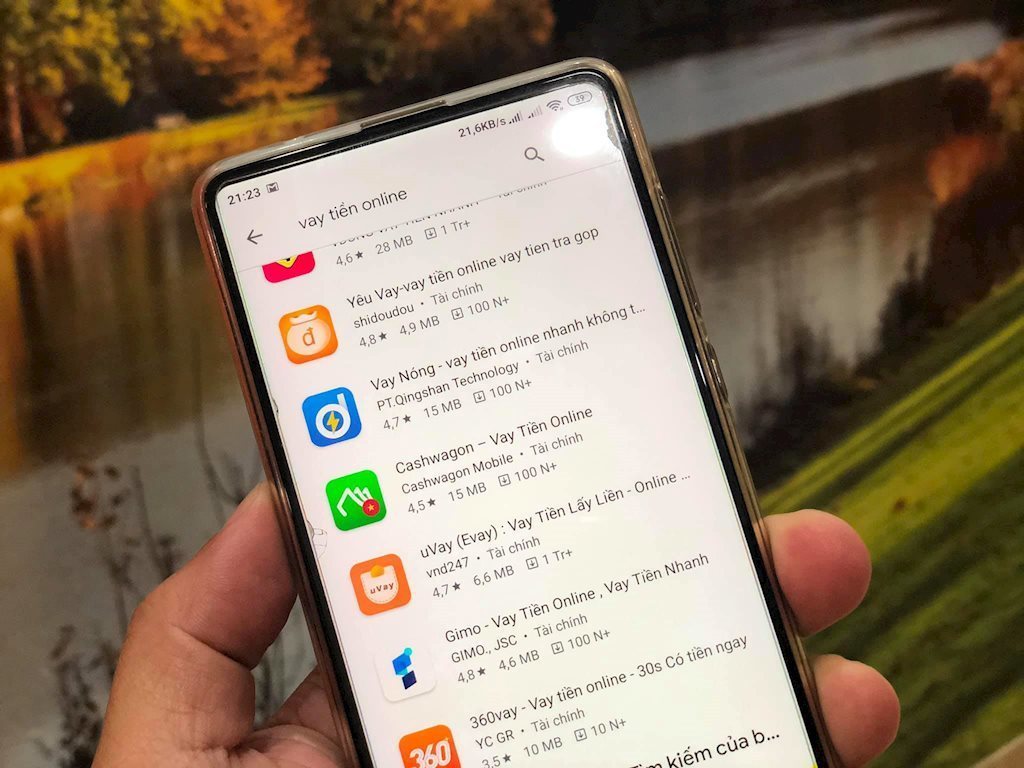

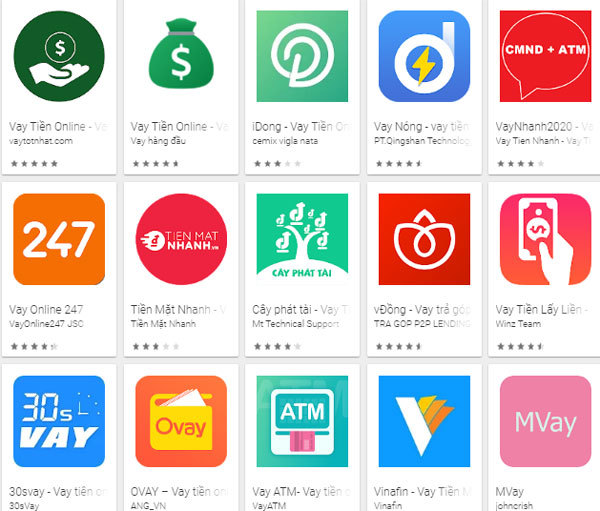

Technology becomes weapon against black credit

Social networks are now flooded with advertisements for easy loans with low interest rates and simple procedures through apps.

More businesses seek black credit as cash flow plummets

Seventy-one percent of businesses anticipate revenue decreases in 2021, higher than the 65 percent figure in 2020, according to a survey.

Borrowers fall into trap of low-interest loans offered online

Scammers are impersonating officers of online lending apps, promising loans at low interest rates in order to appropriate money from people.

Running out of money, businesspeople fall into black credit hole

Many businesspeople have complained that they have had to sell cars and fixed assets to maintain operations. Some have even sought capital from black credit sources with exorbitant interest rates.

People lose everything as they fall into consumer-loan trap

Some people who have not earned enough money because of Covid-19 and have had to borrow money have fallen into traps set by usurers.

'Black-credit' lenders pose serious threat to borrowers

Experts have repeatedly rung the alarm bell over black credit, which is causing serious consequences to families and society.

Over 6.4 million poor households access social policy bank loans

As of March, more than 6.4 million poor and near-poor households had won access to loans from the Vietnam Bank for Social Policies (VBSP).

Woman holds fake funeral to escape creditors

The Cu Lao Dung district Police in Soc Trang province on March 31 detained and questioned Tran Thi Tuyen about the organization of a fake funeral at her home.

The poor, as well as businesses, fall into 'black credit' trap

The poor, who lack financial information and knowledge, are often hurt by black credit. But many businesspeople have also become victims.

P2P lending needs better management to avoid black credit

The Ministry of Planning and Investment (MPI) has warned about the increasing use of foreign peer-to-peer (P2P) lending in Vietnam with potential risks of black credit.

2020: black credit pushes people to the wall

Black credit grew strongly in 2020 when many people lost jobs because of Covid-19 and faced financial problems.

Prime Minister urges banks to further cut interest rates

The Central bank has lowered its interest rate cap three times by a combined of 1.5-2 percentage points per annum, which is the largest cut in the region.

Black credit trap pushes borrowers into corner

A young woman borrowed VND8 million via an app, but the total amount of money she had to pay after three months reached VND200 million. Unable to pay the debt, she killed herself.