Amid fierce competition in the global semiconductor market, Vietnam has emerged as a rising star in the high-tech value chain.

Thanks to its open economic policies, attractive investment environment, and strategic geographic location, Vietnam has become a preferred destination for top technology firms such as Intel, Samsung, Foxconn, and Amkor Technology for semiconductor manufacturing and assembly.

Leading international media outlets, including Financial Times, Reuters, Bloomberg, and The Wall Street Journal, have recognized the rapid development of Vietnam’s semiconductor industry.

Talent as the foundation

According to Reuters, Vietnam has attracted billions of dollars in investment from major semiconductor corporations. Foxconn, the world’s largest contract electronics manufacturer, has invested $383 million in a printed circuit board factory in Bac Ninh. This facility is expected to produce 2.79 million units annually, strengthening Vietnam’s role in the global supply chain.

Meanwhile, Bloomberg highlights Vietnam as a top choice for tech giants seeking to diversify their supply chains and reduce reliance on China. Intel, for example, has invested over $1.5 billion in its Ho Chi Minh City facility, making it the company’s largest assembly and testing site worldwide.

According to Nikkei, Vietnam has become a “magnet” for global semiconductor firms due to its skilled workforce and cost-effective operations. Taiwan-based Alchip Technologies, a leading AI chip design service provider, is expanding its R&D team in Vietnam and plans to open its first office this year.

Daniel Wang, Alchip’s Chief Financial Officer, stated that the company could increase its workforce to 100 engineers within two to three years. CEO and Chairman Johnny Shen emphasized Vietnam’s appeal, noting the strong work ethic and technical potential of Vietnamese engineers.

South Korean firms are also shifting to Vietnam, partly to counteract domestic brain drain. According to Nikkei, Vietnam has become a key topic of discussion among South Korean business leaders and officials.

Having a readily available tech workforce during a period of global talent shortages gives Vietnam an advantage in enhancing its supply chain value. Marvell, a leading semiconductor firm, describes Vietnam as a “strategic location for technical talent development.”

Brian Chen, an expert at KPMG, noted that the demand for high-level technical skills in Vietnam currently outpaces supply as more companies move into Southeast Asia. He believes that the country’s talent pool has significant room for growth. Specifically, in chip design, he expects each company to hire at least 300 to 500 employees for their Vietnam offices.

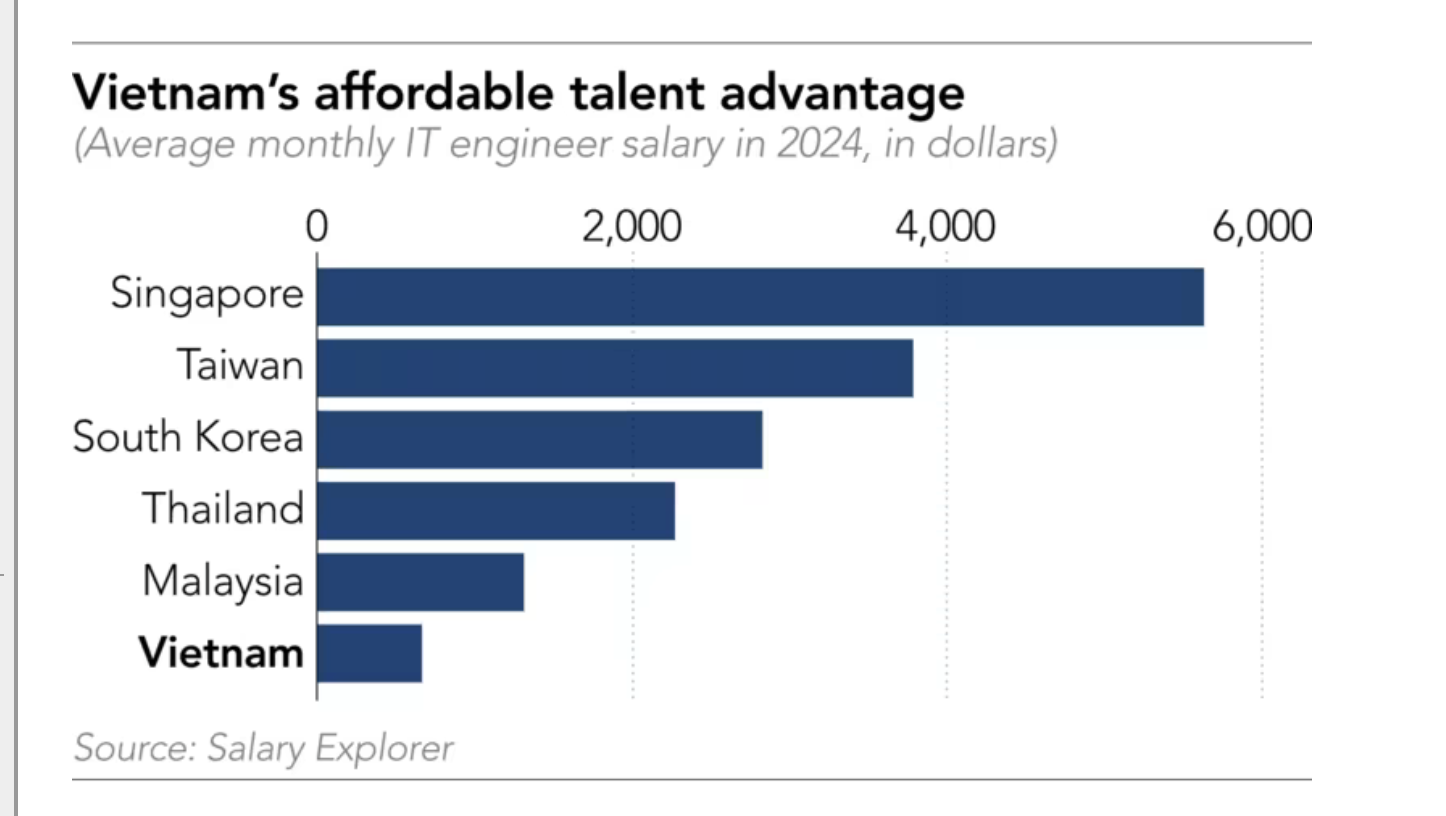

Compared to Taiwan (China) and South Korea, Vietnam’s engineering salaries and productivity levels make it an attractive, cost-effective option. Chen pointed out that Ho Chi Minh City remains the top choice for foreign firms due to its vibrant business environment and quality of life, with Hanoi as the next preferred destination.

The road ahead

Financial Times reports that the Vietnamese government has committed to ensuring sufficient energy and infrastructure to support the semiconductor industry's growth. Policies such as tax incentives, infrastructure support, and streamlined administrative procedures have encouraged increased investments from global technology firms.

Vietnam has also implemented the Semiconductor Industry Development Strategy for 2021-2030, aiming to establish itself as a leading regional semiconductor manufacturing and export hub. Public-private partnerships and the development of high-tech zones are part of the government’s broader strategy to create a sustainable semiconductor ecosystem.

As part of this vision, Vietnam aims to train 50,000 semiconductor engineers by 2030 through collaborations with major corporations and prestigious universities. Training programs and internships at companies like Intel and Samsung have enabled Vietnamese engineers to gain exposure to cutting-edge technologies.

The Wall Street Journal highlights Vietnam’s young, dynamic, and highly skilled workforce as a key factor in the country’s semiconductor success. More than 40% of Vietnamese university graduates specialize in engineering, computer science, and information technology, providing a strong talent pipeline for the tech sector.

Robert Li, Vice President of Sales for Synopsys in Taiwan and Southeast Asia, remarked that “the high level of interest among Vietnamese students and the government’s funding programs will help position Vietnam as a major semiconductor talent hub.”

With such strong endorsements from the global press, Vietnam appears well on its way to becoming a key semiconductor hub in the region and beyond. The combination of a robust national strategy, high-quality human resources, and continuous investment flows has laid the foundation for sustainable industry growth.

If Vietnam continues to leverage its strengths and address remaining challenges, the country could soon become one of the most critical links in the global semiconductor supply chain.

The Vinh