Starting March 1, Vietnam’s tax administration has been restructured into a three-tier system, eliminating the General Departments and streamlining operations with 12 central units, 20 regional tax offices, and 350 district-level tax teams.

New tax administration structure

Under Decision No. 381 issued by the Ministry of Finance, the General Department of Taxation now operates in a simplified three-level model:

Central Tax Administration: 12 units, including the Large Business Tax Office and E-Commerce Tax Office, both of which hold independent legal status and have their own seals, tax codes, and accounts at the State Treasury.

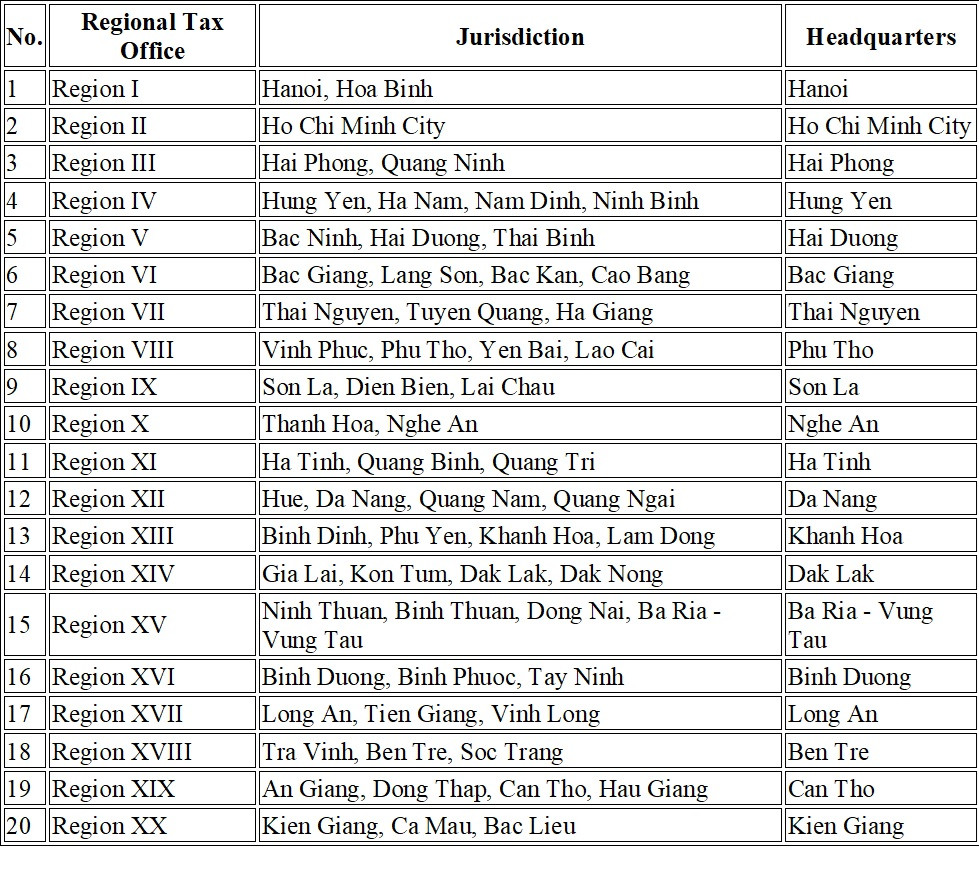

Regional Tax Offices: 20 units managing multiple provinces or municipalities, also with legal status, unique tax codes, and accounts at the State Treasury.

District-Level Tax Teams: 350 teams across districts, towns, and cities under the direct supervision of regional tax offices, each maintaining independent legal status, official seals, tax codes, and State Treasury accounts.

The two largest regional tax offices - Region I (Hanoi and Hoa Binh) and Region II (Ho Chi Minh City) - are authorized to operate up to 19 and 16 internal departments, respectively, while other regional tax offices will be limited to an average of 13 departments.

List of 20 regional tax offices and jurisdictions

Binh Minh