- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

VN-Index

Vietnamnet liên tục cập nhật các chỉ số VN-Index hôm nay, phân tích và dự báo thị trường chứng khoán để độc giả có cái nhìn đúng nhất

Vietnamese stocks to struggle with increased caution

The Vietnamese stock market is forecast to struggle this week with rising caution among investors as they wait for the market to reach its balance point.

Market to grow slowly amid ETF reviews, more selling

The Vietnamese stock market may move marginally up as investors look forward to foreign exchange-traded funds (ETFs) to complete their quarterly investment reviews.

The Vietnamese stock market may move marginally up as investors look forward to foreign exchange-traded funds (ETFs) to complete their quarterly investment reviews.

Market to grow slowly amid ETF reviews, more selling

The Vietnamese stock market may move marginally up as investors look forward to foreign exchange-traded funds (ETFs) to complete their quarterly investment reviews.

The Vietnamese stock market may move marginally up as investors look forward to foreign exchange-traded funds (ETFs) to complete their quarterly investment reviews.

Share set to increase, facing corrections

Vietnamese stock market is forecast to move higher this week, where correction and volatility is expected.

Vietnamese stock market is forecast to move higher this week, where correction and volatility is expected.

P/B, P/E ratios at five-year low, banks should be good options

With average price-to-earnings (P/E) and price-to-book (P/B) ratios at a five-year low, bank stocks are among the good options available for investors right now, analysts said.

With average price-to-earnings (P/E) and price-to-book (P/B) ratios at a five-year low, bank stocks are among the good options available for investors right now, analysts said.

Lack of good news to slow market growth: analysts

Local stocks are expected to keep rising this week but their growth would be slower as goods news dries up.

Local stocks are expected to keep rising this week but their growth would be slower as goods news dries up.

Positive market signs emerge for Vietnam’s grand reopening

Instead of adopting the age-old “sell in May and go away” strategy, and focusing on months with traditionally stronger market growth, investors now could be more bullish about a stock rally, buoyed by optimism about a gradual reopening of businesses.

Instead of adopting the age-old “sell in May and go away” strategy, and focusing on months with traditionally stronger market growth, investors now could be more bullish about a stock rally, buoyed by optimism about a gradual reopening of businesses.

Shares to move sideway as investors brace for Q1 earning reports

Shares are forecast to move sideways this week as investors brace for dreary quarterly earnings reports that could offer more clarity on how badly corporate profits have been damaged by the novel coronavirus pandemic.

Shares are forecast to move sideways this week as investors brace for dreary quarterly earnings reports that could offer more clarity on how badly corporate profits have been damaged by the novel coronavirus pandemic.

Positive signs in COVID-19 prevention buoy VN-Index up

Thanks to positive signs in COVID-19 prevention, the VN-Index had a fabulous run since early April.

Thanks to positive signs in COVID-19 prevention, the VN-Index had a fabulous run since early April.

VN stock market has torrid time in March

The stock market fell sharply in March, with all indices dropping steeply, according to the Ho Chi Minh Stock Exchange.

The stock market fell sharply in March, with all indices dropping steeply, according to the Ho Chi Minh Stock Exchange.

Market capitalisation of listed shares on HOSE drops in March

The COVID-19 pandemic has had significant impacts on the stock market, with all indexes on the Ho Chi Minh City Stock Exchange (HOSE) falling sharply in March.

The COVID-19 pandemic has had significant impacts on the stock market, with all indexes on the Ho Chi Minh City Stock Exchange (HOSE) falling sharply in March.

Shares not ready for stable growth on concerns over persistent risks

A three-day rally does not mean Vietnamese shares have returned to the growth track as risks are still persistent and there is no clue they have faded away, experts have said.

A three-day rally does not mean Vietnamese shares have returned to the growth track as risks are still persistent and there is no clue they have faded away, experts have said.

Securities trading uninterrupted during COVID-19 fight: SSC

Trading on the Vietnamese securities market was essential and would not be disrupted under any circumstances during the fight against COVID-19, the State Securities Commission (SSC) said on March 31.

Trading on the Vietnamese securities market was essential and would not be disrupted under any circumstances during the fight against COVID-19, the State Securities Commission (SSC) said on March 31.

Markets tense up for prolonged uncertainty

The turbulent moves of foreign selloffs in Vietnam’s stock market over the past few weeks have indicated that riskier assets are still in the midst of a tenuous recovery.

The turbulent moves of foreign selloffs in Vietnam’s stock market over the past few weeks have indicated that riskier assets are still in the midst of a tenuous recovery.

Private-equity banks cushion market

Private-equity bank shares have performed well amid fears of COVID-19 in the last five weeks.

Private-equity bank shares have performed well amid fears of COVID-19 in the last five weeks.

Profits of Vietnam’s stock market predicted to stay flat in 2020

It is expected the Vietnamese stock market will be less volatile in March compared to the previous months.

It is expected the Vietnamese stock market will be less volatile in March compared to the previous months.

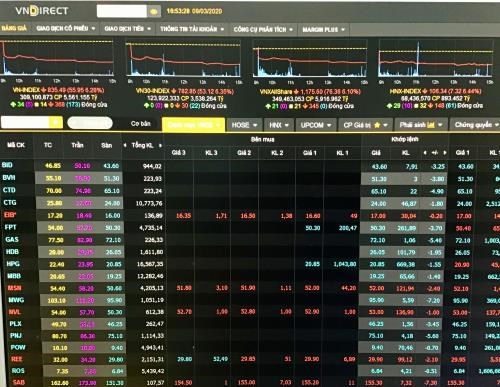

VN-Index hits rock bottom in past 18 years

The benchmark VN-Index on the Ho Chi Minh Stock Exchange (HoSE) took a nosedive to close at 835.49 points on March 9, recording the worst slump since 2002.

The benchmark VN-Index on the Ho Chi Minh Stock Exchange (HoSE) took a nosedive to close at 835.49 points on March 9, recording the worst slump since 2002.

Trading remains quiet amid risk concerns

Brokerage firms and market experts remain pessimistic about market trading this week as investors run out of supportive information while international stocks continue to be weighed down by the novel coronavirus (COVID-19).

Brokerage firms and market experts remain pessimistic about market trading this week as investors run out of supportive information while international stocks continue to be weighed down by the novel coronavirus (COVID-19).

Vietnam finance ministry takes step to stabilize market sentiment

Vietnam’s stock market over the last few days has gradually recovered and rebounded, said Vice Minister of Finance Vu Thi Mai.

Vietnam’s stock market over the last few days has gradually recovered and rebounded, said Vice Minister of Finance Vu Thi Mai.

Pharmaceutical stocks benefit from disease spread

Pharmaceutical stocks are experiencing an upsurge as fears of coronavirus have boosted demand for healthcare products and services, lifting demand for shares.

Pharmaceutical stocks are experiencing an upsurge as fears of coronavirus have boosted demand for healthcare products and services, lifting demand for shares.