- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

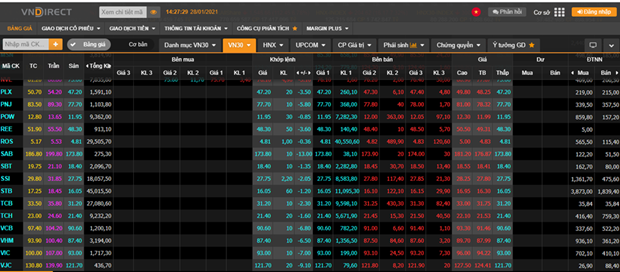

VN-Index

Vietnamnet liên tục cập nhật các chỉ số VN-Index hôm nay, phân tích và dự báo thị trường chứng khoán để độc giả có cái nhìn đúng nhất

Pouring money into stocks: a new trend

The VN-Index set an all-time high record recently, reaching over 1,230 points and daily liquidity totaling around $1 billion.

Market reverses course, but losses capped by gains in real estate stocks

Vietnam's stock market edged lower on Tuesday as selling pressure reappeared in many sectors.

Shares to climb on positive Q1 earning results

Shares are forecast to go up this week, propelled by foreign net buying and positive first-quarter business results from listed companies.

Vn-Index predicted to hit all-time high of 1,300 pts in April

Strong involvement of individual investors and participation of new foreign fund would help offset the net selling trend of foreign investors.

Shares gain on bank and real estate stocks

The market closed higher on Monday as a series of banking and real estate stocks surged, propelling the indices.

Stock market suffers sharpest fall in history as new COVID-19 cases found

Vietnam’s stock market suffered its sharpest drop in history on January 28 as a result of panic selling after new community transmissions of the coronavirus were reported.

VN-Index suffers big loss, liquidity exceeds $1 bln

Shares bounced back slightly in the afternoon trade but the VN-Index still lost 60.94 points, or 5.11 percent, closing the January 19 session at 1,131 points.

Stock market 2021: Positives and risks

The stock market ended 2020 with diverse notes, from the selloff in Q1 which sent the VN-Index down to 660 points, the lowest in four years, to the recovery and strong rally, especially in Q4.

Vietnam’s strong economic recovery to further take Vn-Index to nearly 1,300 in 2021

The fact that interest rates are still very low, will help the local stock markets continue to be an attractive and profitable channel, thereby attracting domestic investor.

PM decides to establish Vietnam Stock Exchange

Prime Minister Nguyen Xuan Phuc has signed Decision 37/2020/QD-TTg on the establishment of the Vietnam Stock Exchange (VNX), with the aim of unifying the stock market and ensuring efficient, fair, open and transparent activities.

Vn-Index on track to reach 1,800 points: Pyn Elite Fund

The Vietnamese stock market can surprise investors with a “big year” returns during the 2020-24 period.

Shares to go up on upbeat sentiment

The Vietnamese stock market is forecast to maintain an upward trend this week on upbeat investor sentiment, after seven consecutive gaining weeks of the market with increased liquidity.

Rally may keep going as investors are hungry for more: experts

The Vietnamese stock market climbed to its 32-month high last week and the rally may keep going in the coming week.

Vietnamese stock market still booming amid pandemic: SSC Chairman

The Vietnamese stock market has flourished amid global uncertainties due to the COVID-19 pandemic, said Tran Van Dung, Chairman of the State Securities Commission (SSC).

Market’s uptrend may weaken after five consecutive gaining weeks

Although Vietnam's stock market has experienced five consecutive weeks of gains with record-high liquidity, analysts said investors’ caution and the uptrend would weaken as the VN-Index approaches the resistance level of 1,030 points.

Market rally to go on, corporate earnings in the sight

Vietnam’s benchmark VN-Index climbed to a 10-month high last week and the market rally will keep on going, experts and securities firms forecast.

Vietnam benchmark VN-Index set to go sideways in November

The VN-Index edged up 2% month-on-month in October to finish at 925.47 and was among the best-performers in the world.

Profit taking to weigh on local market, but September may be bright

Vietnam’s stock market rally may slow this week as investors eye profits but the one-month projection is still optimistic.

Funds enjoy growth in August

Investment funds involved in Vietnam’s equity market reported positive growth in net asset value (NAV) in August due to a stock market upturn.

Ministry to halt market trading in emergency cases

If serious turbulence is caused by large-scale sell-offs and considered a threat to the security of the equity market, the Ministry of Finance will have to switch the market off.