Vietnam’s rice sector is predicted to face difficulties in 2020 with strong volatility of production, demand and prices, while the government has not been able to find new export markets, according to Viet Dragon Securities Company (VDSC).

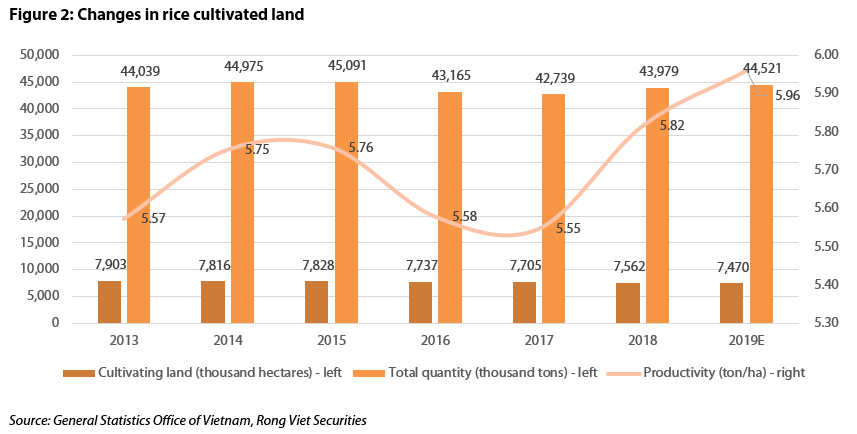

VDSC suggested land use for growing rice will be reduced. According to the Ministry of Agriculture and Rural Development (MARD), in October 2019, there were 7.47 million hectares of available land for rice production, shrinking by 92,300 hectares compared to October 2018.

|

The acreage under rice cultivation will continue to decline by 500,000 hectares in the coming years, which will be used for other purposes such as aquatic or fruit cultivation in order to reduce the pressure on rice production which is higher than demand.

Based on the productivity of 2019, the volume of rice produced in 2020 will be around 41.5 million tons, down 6.7% year-on-year, stated VDSC.

|

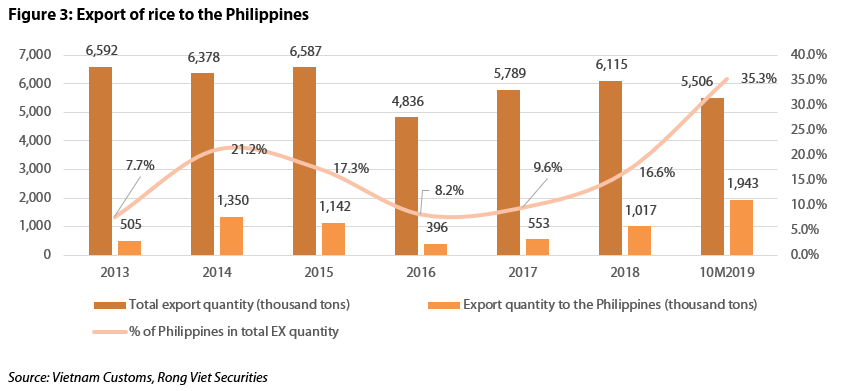

Moreover, the Philippines and China, Vietnam’s two major rice export markets, may reduce the amount of imported rice. The Philippine Department of Agriculture (DA) publicly announced the end of a preliminary investigation on the application of global self-protection on imported rice into the Philippines. However, they are still able to use other methods allowed by the World Trade Organization (WTO) and ASEAN to affect the volume of imported rice.

|

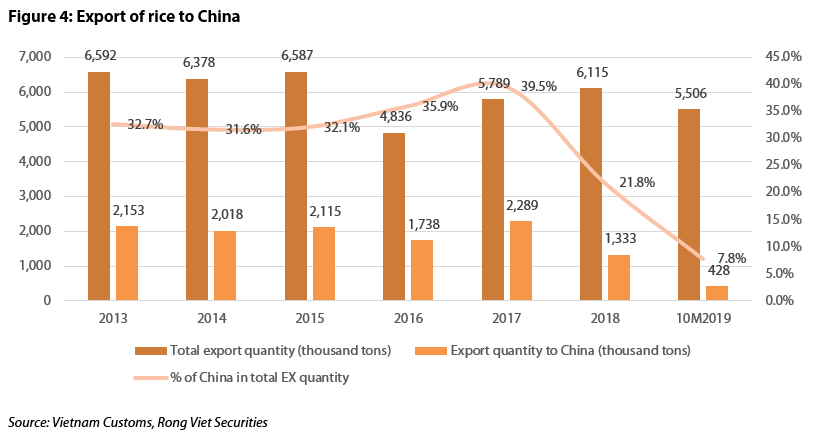

Meanwhile, the US Department of Agriculture is expected to maintain tight control over Chinese rice imports. As a result, China will not change the amount of rice to be imported from Vietnam. Moreover, China tends to increase its imports from Cambodia.

In the first nine months of 2019, China’s rice imports from Cambodia grew 44% year-on-year, according to Xinhuanet.

Additionally, the prices may fall in 2020. The MARD stated that the demand for rice has been decreasing. Actually, some countries have restructured their agriculture sector in order to improve the domestic supply and satisfy local demand. Vietnam is struggling to find other customers so that a decline in prices in 2020 could negatively affect the sector.

Few positives for Vietnamese rice in 2020

However, there are few positives for 2020 for Vietnamese rice, stated VDSC. Firstly, Vietnam’s ST25 rice was awarded the world’s best variety, surpassing Thai and Cambodian rice. This is an opportunity for Vietnam to improve its image globally.

Secondly, there are opportunities to export rice to Singapore and Japan. In 2019, Thailand faced problems due to the drought season which led to lower available quantities for exports.

Consequently, Singapore, who imports 30-40% of its needs from Thailand, had to diversify its suppliers. The MARD plans to approach this market in order to take advantage of the close distance between the two countries. Meanwhile, Japan also wants to diversify its source of supply. The country’s rice imports are very US-dependent. Currently, they are looking for another supplier who is a member of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and Vietnam qualifies for this criterion.

|

According to the Food and Agriculture Organization (FAO), the production of rice worldwide has not changed much lately as the supply remained at 427.83 million tons in the first 10 months of 2019, decreasing by 0.83% compared to the same period last year. In terms of price, Japonica prices went up by 3.9% meanwhile all others witnessed a price decline. On average, rice prices dropped by 1%.

In Vietnam, total rice cultivated area in the first ten months of 2019 was 7.47 million hectares which is lower than last year by 1.2%. However, until October, there are only 6.35 hectares ready to be harvested and the productivity was 5.96 tons per hectare, up 0.03 tons per hectare year-on-year. Hence, total production stood at 37.8 million tons, down 3,600 tons year-on-year.

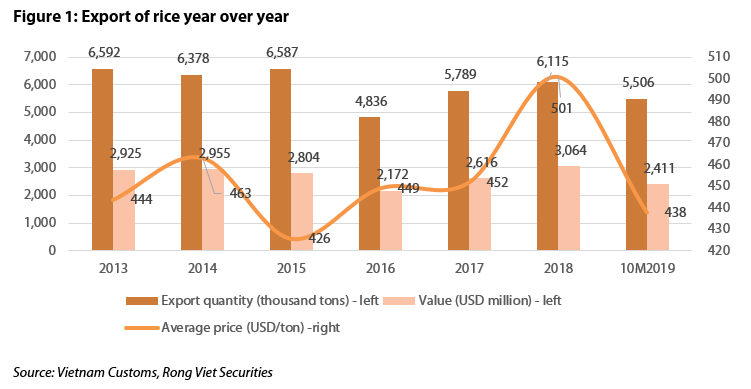

According to the General Department of Vietnam Customs, 5.506 million tons of rice was exported in the January – October period, which represent 14.6% of the total production.

This was an increase of 6.1% year-on-year in volume (mostly comes from the rise in importing of the Philippines), but a 9.1% decline in value because of a decrease in the price. The Philippines is the largest export market as they imported 1.94 million tons of rice, accounting for 35.3% of the total export amount. Prices fell by 13.4% compared to last year. In fact, the average price of exported rice as of October was US$435.6 per ton. Hanoitimes

Nguyen Tung

The Philippines and China, Vietnam’s two major rice export markets, may reduce rice imports in 2020." itemprop="description" />

The Philippines and China, Vietnam’s two major rice export markets, may reduce rice imports in 2020." itemprop="description" />