Vietnam should be careful not to become a transshipment point for China and South Korea in re-routing their exports to the US and circumvent levies, economists of the Vietnam Institute for Economic and Policy Research (VEPR) have warned.

|

| Overview of the VEPR's launching conference of its annual economic report. Photo: Ngoc Thuy. |

“Being a deeply integrated economy with growth driving forces relying heavily on international trade, Vietnam is highly susceptible to external shocks, including policies changes from major economies or regional and global tensions,” said Nguyen Duc Thanh, former director of VEPR, at the launch of the think tank's annual economic report on June 17.

The US – China trade war, and to a lesser extent, the tension between South Korea and Japan, caused investors to shift investment to countries less affected by friction.

As a result, more and more multinationals are looking for an alternative for China and South Korea, Thanh stated.

In this circumstance, Vietnam, with a dynamic economy and member of major free trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), EU – Vietnam Free Trade Agreement (EVFTA) and the upcoming Regional Comprehensive Economic Partnership (RCEP), among others, is emerging as an attractive alternative to China.

|

| Source: GSO. |

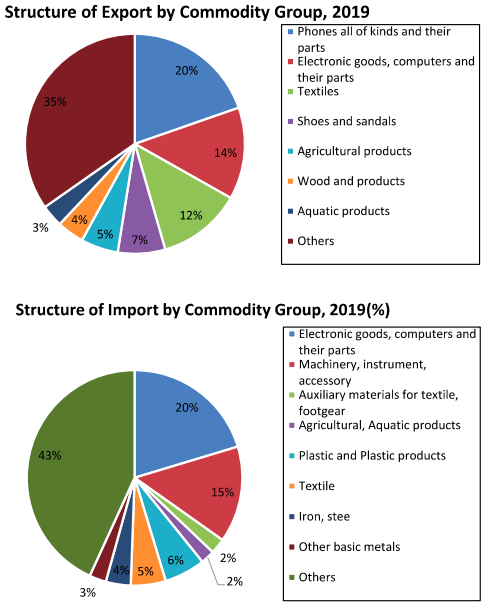

In 2019, the US was Vietnam’s largest export market with a turnover of US$60.7 billion, up 27.8% year-on-year. Capital goods for manufacturing and processing industries reached US$144.12 billion, or 90.6% of total import turnover. China was the largest import market of Vietnam, with a turnover of US$75.3 billion, up 14.9% year-on-year.

For this year, although the Covid-19 pandemic has caused a major disruption to global value chain, the US remained Vietnam’s largest buyer spending US$25.11 billion on Vietnamese goods in the first five months, up 10.6% year-on-year and accounting for 25.1% of Vietnam’s total exports.

VEPR’s report suggested Vietnam to review the tax or land preferential policies for foreign-invested companies, in order to create a more equal environment for domestic firms.

Moreover, the country should put in places tighter measures related to origin of goods and products to avoid risks of lawsuits or being taken advantage of by other countries to evade US import tariffs.

Vietnam's GDP growth forecast revised up

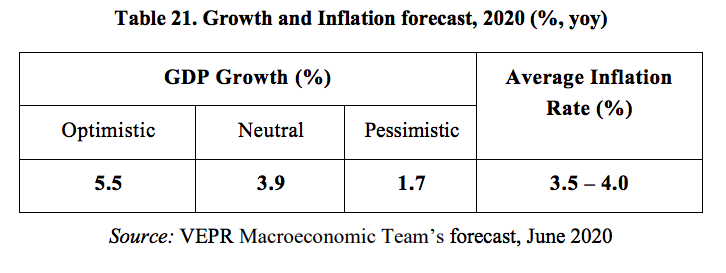

With the removal of the social distancing earlier than expected (from the end of April compared to the expected end of May before), VEPR has revised up Vietnam's economic growth to be higher than the previous forecast of 4.2% for optimistic scenario.

|

| VEPR revised up Vietnam's GDP growth forecast from the previous 4.2% for optimistic scenario. |

The most optimistic scenario is based on the assumption that the disease is completely controlled domestically by the end of April and the economic activity gradually returned to normal. Meanwhile, the world has begun to relax lockdown measures since the beginning of June, helping Vietnam's goods export industry grow well in the second half of the year.

However, economic activities in the field of tourism, accommodation and passenger transport are still reserved and only gradually recover.

With this optimistic scenario, Vietnam's economic growth is forecast to reach up to 5.5% in 2020.

Under the neutral and pessimistic scenarios, the pandemic is presumed to recur and countries must extend the lockdown period to the second half of the third quarter, even the fourth quarter of 2020. The impact of Covid – 19 on the agriculture, forestry & fishery, manufacturing sector and service sector will be more serious. Economic growth in 2020 might be only 3.9% in the neutral scenario, or just 1.7% in the pessimistic scenario.

In line with the current short-term policies to mitigate the negative impacts of Covid-19, Vietnam should continue working on longer-term policies to improve macroeconomic foundation and reduce future risks, stated VEPR.

In all situations, inflation, interest rates, and exchange rates need to be kept stable. Diversification of export/import markets needs to be paid more attention to to avoid heavy dependence on some major economic partners.

In this time of difficulties, many inadequacies in managing economic policies have been revealed, so efforts to improve the institutional environment need to be sustained. Especially, Vietnam should gradually build a fiscal buffer to prevent external shocks, the report suggested.

VEPR’s GDP growth forecast is in line with Prime Minister Nguyen Xuan Phuc’s estimation of an economic expansion of over 5% for this year, significantly higher than the International Monetary Fund (IMF)’s estimate of 2.7%.

The World Bank predicted the country’s economic growth at a slightly lower rate of 4.8%. ADB's growth prediction is similar to the World Bank's of 4.9%, while Fitch Ratings anticipated the country's growth at 3.3%. Hanoitimes

Ngoc Thuy

Prospects for those with good grip on rule of origin

The enforcement of the landmark EU-Vietnam Free Trade Agreement can become reality within the next few months, ushering in multiple benefits for both sides.

Chinese found counterfeiting Vietnamese origin for woodwork exports

Many Chinese wooden furniture manufacturers have been found setting up foreign invested enterprises (FIEs) in Vietnam to ‘fabricate’ Vietnamese origin for their exports to the US.