‘Eagle’ is the word used by Vietnamese economists to talk about major foreign investors. They have predicted the arrival of a lot of eagles in the time to come, when favorable conditions will exist for them to seek business opportunities.

According to Nguyen Anh Tuan, deputy director of the Ministry of Planning and Investment’s (MPI) Foreign Investment Agency (FIA), in the post-Covid period, Vietnam now has great opportunities to receive a new investment wave.

MPI reported that in the first seven months of 2022, Vietnam attracted $15.54 billion worth of newly registered foreign direct investment (FDI) capital, while disbursed capital reached $11.57 billion, increasing by 10.2 percent compared with the same period last year.

This was the highest seven-month increase in FDI capital in the last five years.

Vietnam’s Industrial Zones (IZs) and Economic Zones (EZs) are present in 61 out of 63 cities/provinces, with 403 IZs, and 18 coastal and 26 border-gate EZs.

EZs and IZs play a very important role in attracting investment into the manufacturing sector. There have been 564 IZs planned so far with the total area of 211,700 hectares, of which 292 have become operational. IZs and EZs have attracted more than 10,000 domestic and 11,000 foreign invested projects. The total FDI capital has been $230 billion.

Vietnam is now the destination of many leading conglomerates, such as Samsung, Canon, LG, Sumitomo, Foxconn and VSIP. Some economic groups have been relocating production chains to Vietnam, such as Apple, Dell, Foxconn and Pegatro. Vietnam has been preparing to receive the new investment relocation wave and become an important production base in the world.

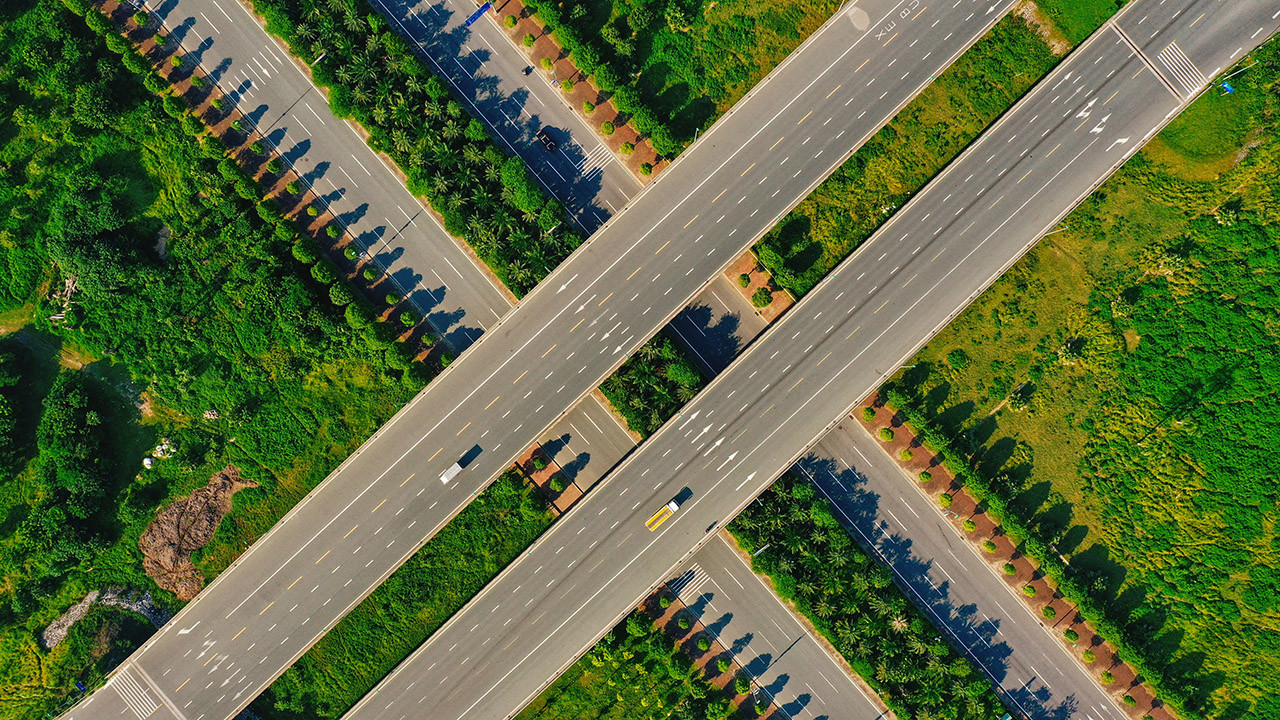

MPI Deputy Minister Tran Quoc Phuong said the current conditions in Vietnam are facilitating the development of IZs, including the improved business environment and technical infrastructure, especially inter-regional and international transport networks, as well as improvement of Vietnam’s position in the international arena, and expansion of export markets thanks to free trade agreements (FTAs) and a workforce which can easily adapt to scientific and technological changes.

John Campbell from Savills Vietnam said Vietnam’s economy is predicted to grow beyond expectations in 2022 when domestic demand recovers and the FDI capital is stable. The reopening is an important factor for the confidence of international investors and promises a prosperous development year in industry.

Removing bottlenecks

In late May 2022, the government issued Decree 35/2022 on EZ and IZ management, giving detailed regulations on the development of an IZ and EZ system, the IZ-urban area-service model, and an ecological IZ. Experts believe the opportunity to create a new investment wave in Vietnam is great.

However, according to Hoang Quang Phong, deputy chair of the Vietnam Confederation of Commerce and Industry (VCCI), though the decree has removed complicated procedures, there are still many problems that need to be removed.

Hoang Viet Phuong from VCCI said that though procedures have been simplified, some barriers still exist, especially in site clearance because by the sharp increase in costs for site clearance. This may lead to tardiness in construction work execution and affect the profit margins in new IZs and EZs with the possible decrease of up to 30-35 percent compared with existing IZs and EZs.

Meanwhile, Nguyen Dinh Nam, CEO of AP Vietnam, pointed out that the regulations related to infrastructure investment and the conditions for logistics, human resources, and support for investment promotion are not detailed enough.

It’s necessary to clarify which conditions investors have to satisfy when building a new IZ or a new EZ and what infrastructure and transport conditions must be.

Meanwhile, in many cases, investors seek permission for IZ development, but only after 5-7 years will the IZs be able to connect to infrastructure. If so, investors will see failure in sales. Investors’ profits will decrease if the investment is good but sales are not.

Duy Anh