Vietnam ranked second out of 50 economies in the mergers and acquisitions (M&A) Investment Index, which reflects the expected level of investment, activity and attractiveness of the global M&A market amid macroeconomic and financial shocks, according to market research firm Euromonitor.

|

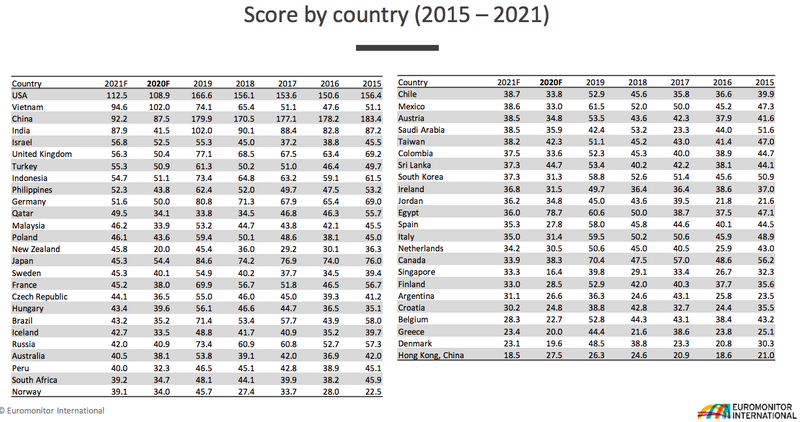

The country is set to score 102 and 94.6 out of the maximum of 250 in 2020 and 2021, staying behind only the US with its respective scores of 108.9 and 112.5. Other countries in Euromonitor’s top 5 included China, India and Israel.

The score is divided into four groups, with 100+ indicating high M&A activity, 75 – 100: moderate to high M&A activity, 50 – 75: moderate to low M&A activity,

|

In terms of the score growth, Vietnam is predicted to be the fifth in the raking with an expansion rate of 23.67% in the 2020 – 2021, behind countries such as Singapore, Ireland, the Philippines and Qatar.

According to the report, turmoil caused by Covid-19 in global markets severely impacted the M&A markets, while political and economic disputes between China and the US impacted both markets considerably in 2020.

In the first half of 2020, the number of M&A deals globally declined by 25% year-on-year due to the Covid-19 pandemic.

As Western economies diversify their supply and value chain strategies away from China, Southeast Asian economies like Vietnam are forecast to grow in investment and is an area for growing M&A activity, stated Euromonitor.

Vietnam’s momentum has been driven up in parallel as the 49% foreign ownership cap on listed companies by 2019 has been removed, which adds to the positive outlook of the country.

Euromonitor’s M&A Investment Index covers a total of 314,002 M&A deals from 50 countries and over 150 industries worldwide between 2015–2020. Hanoitimes

Hai Yen

Real estate market: big investors prefer M&A deals

The real estate market is facing difficulties because of both Covid-19 and legal problems. Businesses with powerful financial capability are now hunting for land and projects, reported Doanh Nhan Sai Gon.

Increase in M&A deals looks imminent in property sector

Many analysts think now is a good time for investors looking for acquisitions in the property industry to act since difficulties caused by the Covide-19 pandemic have thrown up opportunities.