A supportive government and regulator could boost 5G network deployments while domestic manufacturing of 5G handsets could lower device costs and lend tailwinds to adoption, according to Fitch Solutions, a subsidiary of Fitch Group.

|

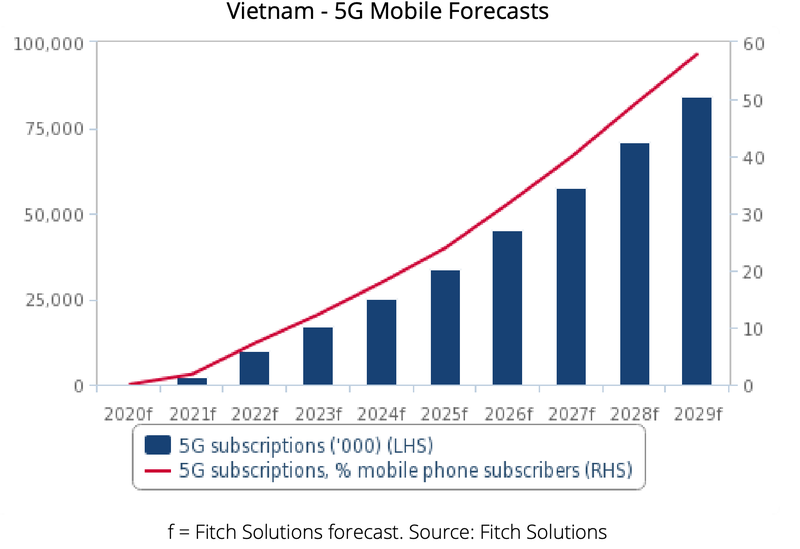

| 5G is set to take off in the medium term in Vietnam. |

5G appears to be high on the Vietnamese government’s priority list, with the earliest of services set to be commercialized in mid-2020 following trials conducted through 2019.

Fitch believes the impact will be greatest in the enterprise segment, particularly in Vietnam’s rapidly growing manufacturing sector, with government initiatives supporting industry uptake.

At the consumer level, Fitch expected early launches to center on larger, higher-income cities, with operators likely to focus on both mobile and fixed-wireless services.

While fiber-based broadband connections in Vietnam have grown significantly in recent quarters, it is expected that fixed-wireless 5G can still serve as a complement to existing fixed services and support the development and adoption of higher bandwidth services, such as virtual reality (VR) video streaming and cloud gaming applications.

However, Fitch anticipated a potential delay to 5G launches as a result of the Covid-19 pandemic, which has forced operators to increase investments into their existing 4G networks and raise bandwidth on existing fixed broadband connections; reportedly, Viettel had to double bandwidth for all fiber-to-the-home (FTTH) subscribers and, together with other state-owned operators Vinaphone and Mobifone, introduce bigger mobile data allocations.

While these short term moves could put investments into 5G networks on the backburner, the Vietnamese government could pressure the state-owned operators to focus on 5G deployment.

Licenses and spectrum are yet to be allocated, although the Ministry of Information and Communications (MIC) could convert 5G trial licenses, allocated in 2019, into commercial licenses.

Viettel was the first operator to receive 5G trial spectrum, with bandwidth in the 2.6GHz, 3.6GHz, and 26GHz bands awarded to the mobile market leader in January 2019. This was followed by the award of trial spectrum to Vinaphone and Mobifone in April 2019.

Smallest operator Vietnamobile, however, has not made any indication whether it has received 5G trial licenses, and appears unlikely to follow the three state-owned operators in commercializing services in the short term.

Viettel announced in late-2019 that it will not use Huawei equipment in its 5G networks, and claims to have developed its own in-house equipment, which will be used to launch its network in mid-2020.

Strong use of 5G in manufacturing sector

Through Resolution 52, introduced in September 2019, the government aims to actively involve itself in the wider adoption of Industry 4.0 technologies to drive the country’s economic growth.

Fitch expected the government to lend support to the wider 5G ecosystem through the creation of test beds, or through enterprise grants to adopt 5G technologies.

The MIC is already looking at licensing certain frequencies to domestic manufacturers of 5G products, and has stated that it will support the development of 5G-capable chips, although further details have not been disclosed.

Viettel has 5G partnerships with Ericsson and Nokia, while Mobifone has an agreement with Samsung. Vinaphone is working with Nokia.

Vietnamese conglomerate Vingroup signed an agreement with Fujitsu and Qualcomm in June 2019 to jointly develop and manufacture 5G-compatible handsets in Vietnam.

Vingroup had already started manufacturing its own 4G-capable handsets in December 2018 following its acquisition of a majority stake in Spanish phone maker BQ. The company is likely looking to target cost-conscious and lower-income consumers who want to take up a 5G SIM, but are unable to afford a 5G smartphone given their relatively higher cost; the company is hoping that the expansion of its production capacity, which is set to reach 125 million units, will help it lower costs.

The wider availability of low-cost 5G devices in Vietnam will support uptake, primarily among cost-conscious consumers. In terms of industry applications, Fitch expected to see strong use of 5G in the manufacturing sector.

Adoption of 5G-enabled sensors across the production line is a certainty, although this will center most largely on the use of private networks in the short run, such as those developed by private players like Sigfox. Operators have made no indication of their 5G plans for the enterprise and industrial sectors, although Fitch expected them to look at developing 5G networks in key economic zones and industrial areas. Hanoitimes

Hai Yen

Vietnam’s second largest telco gets green light for 5G tech tests

Vietnam’s second largest telco is ready in terms of technology, technology and network structure for deploying commercial 5G network.

5G to fuel smart manufacturing in Vietnam

As 5G has already gone live in several markets around the world, people are getting a first-hand experience of the technology.

5G appears to be high on the Vietnamese government’s priority list, with the earliest of services set to be commercialized in mid-2020 following trials conducted through 2019." itemprop="description" />

5G appears to be high on the Vietnamese government’s priority list, with the earliest of services set to be commercialized in mid-2020 following trials conducted through 2019." itemprop="description" />