The global semiconductor industry took 66 years to reach a market value of $500 billion but is projected to double to $1 trillion in just nine years. However, in Vietnam, local ownership in chip design and manufacturing is virtually nonexistent, with the sector dominated by foreign direct investment (FDI).

A global industry at a critical juncture

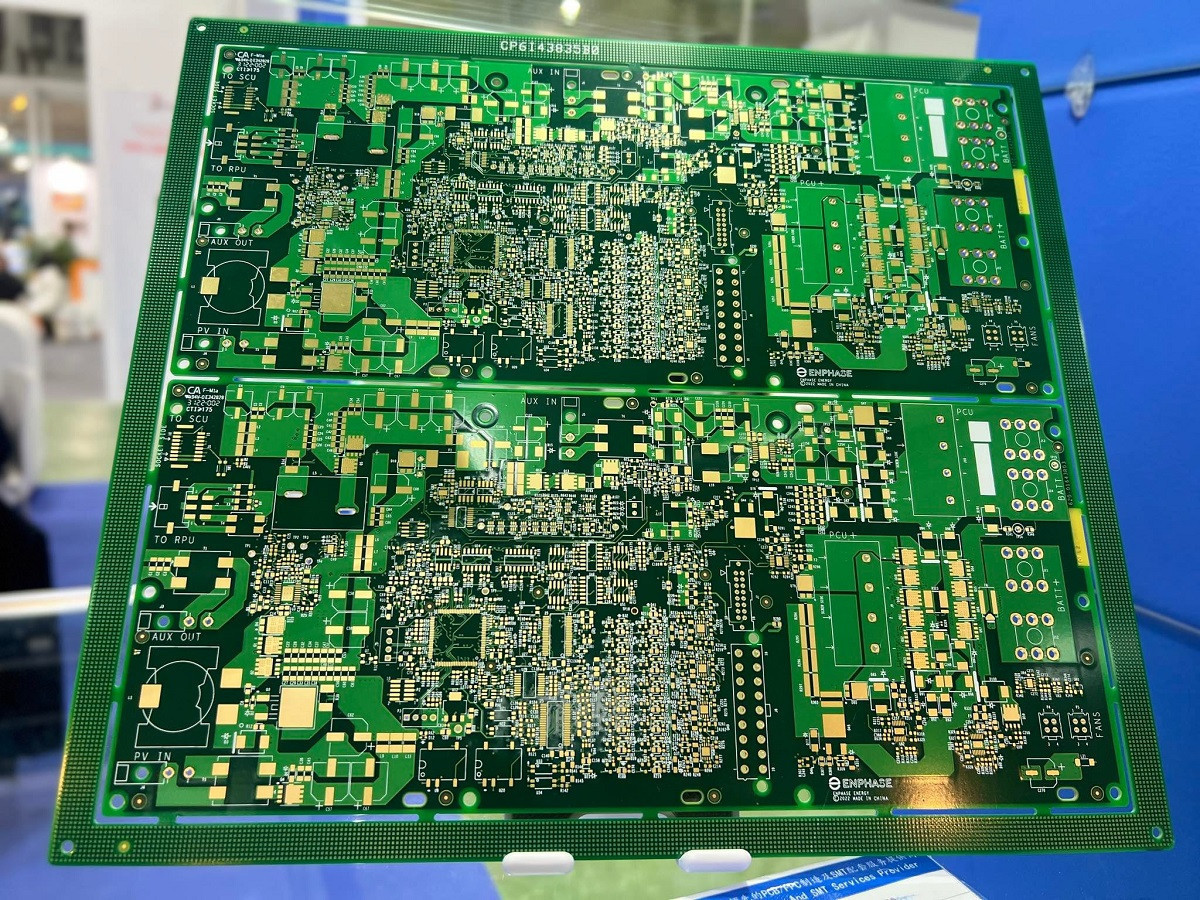

At a recent seminar titled "The Current State, Challenges, and Prospects of Vietnam's Semiconductor Industry," held in Hanoi on November 29, Nguyen Thanh Yen, CEO of CoAsia SEMI, highlighted the ubiquity of semiconductors. In 2021 alone, the world sold one trillion chips, averaging 120 chips consumed per person annually.

"Today, it's nearly impossible to find a device without a chip," Yen emphasized.

Citing data from Vietnamese-American semiconductor expert Dr. Nguyen Thi Bich Yen, Nguyen Thanh Yen illustrated how the global semiconductor market is entering a pivotal growth phase. It took decades to reach $500 billion in 2021, but rapid advancements in fields like AI, autonomous vehicles, and 6G technology are expected to propel the industry to $1 trillion by 2030.

Asia, particularly, is poised to be the central hub of semiconductor production. From raw materials in China to high-tech facilities in Taiwan, Japan, Malaysia, and Vietnam, the region dominates critical stages of the supply chain.

Vietnam's window of opportunity

Despite the dominance of FDI, Vietnam has significant potential in the global semiconductor ecosystem, especially in addressing the industry’s acute talent shortage. Dr. Nguyen Thi Bich Yen identified this shortage, along with supply chain disruptions and rising R&D costs, as major global challenges over the next three years.

"Vietnam has a young, motivated labor force, with over half a million students entering universities annually," Yen stated, emphasizing that the country could play a vital role in alleviating the global talent crunch.

However, the CEO warned that Vietnam's opportunity is limited to the next three years. If the country fails to act, it risks losing its chance to capitalize on this booming sector. He also noted that young Vietnamese professionals must invest in long-term training to build the expertise needed for semiconductor design and manufacturing - a field where errors can lead to multimillion-dollar losses.

As of November 2024, Vietnam’s semiconductor industry comprises approximately 50 chip design companies, seven packaging and testing facilities, and no chip manufacturing plants. The sector employs around 26,000 engineers and generates $20 billion in revenue annually.

To meet its ambitious national semiconductor development strategy, Vietnam aims to double the number of chip design companies, establish its first chip manufacturing plant, and significantly expand its workforce by 2030.

However, Vietnam faces three critical challenges:

Incomplete Ecosystem: While Vietnam boasts consumer demand and chip-related facilities, it lacks a comprehensive ecosystem integrating design, manufacturing, and testing.

Policy Bottlenecks: Regulatory hurdles, such as delays in customs clearance for imported electronic samples, hinder progress despite well-intentioned policies.

Lack of Local Ownership: Vietnam’s chip sector is entirely reliant on FDI. By contrast, countries like South Korea and Taiwan balance foreign partnerships with robust local industries, ensuring product ownership and long-term growth.

Yen urged Vietnam to learn from regional leaders like South Korea and Taiwan, where companies like Samsung and TSMC have established global dominance. "Ownership is critical. Vietnam must decide whether to merely attract FDI or build its own capabilities alongside foreign investments," he advised.

The Vietnamese government recently approved a comprehensive semiconductor development strategy with specific goals for 2030, 2040, and 2050. By 2030, Vietnam aims to have 100 chip design companies, at least one manufacturing plant, and 50,000 industry professionals. These targets will scale up in subsequent decades, positioning Vietnam as a potential regional leader in semiconductors.

Binh Minh