- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

SBV

Update news SBV

Vietnam c.bank sets cashless payments as top priority for 2020

The State Bank of Vietnam (SBV) has issued a resolution to boost cashless payments in the country.

The State Bank of Vietnam (SBV) has issued a resolution to boost cashless payments in the country.

Dollar billionaires and hot competition in the banking sector in 2019

Two dollar billionaires in the banking sector emerged in 2019, which also witnessed competition that led to big changes in the economy.

Two dollar billionaires in the banking sector emerged in 2019, which also witnessed competition that led to big changes in the economy.

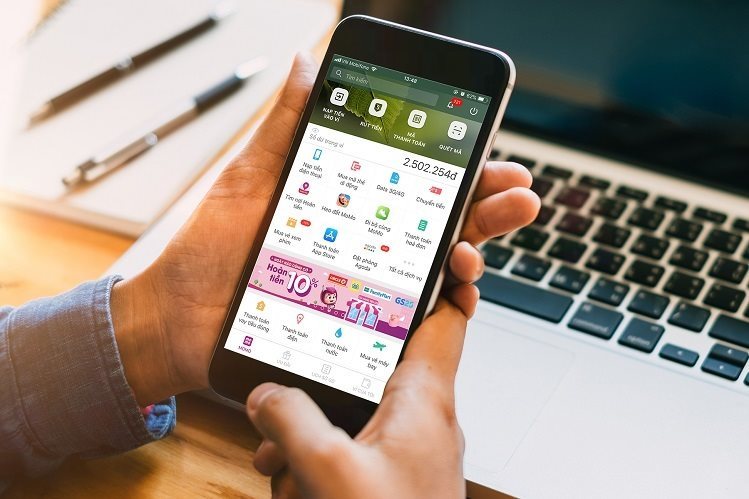

Strong e-payment growth recorded in 2019

Cashless payments grew strongly in 2019, with 635,000 transactions worth a total of VND380 trillion recorded each day, according to statistics from the State Bank of Vietnam (SBV).

Cashless payments grew strongly in 2019, with 635,000 transactions worth a total of VND380 trillion recorded each day, according to statistics from the State Bank of Vietnam (SBV).

Will Vietnam be sued if it restricts foreign investments in fintechs?

The State Bank of Vietnam (SBV) affirmed that regulations are in line with international commitments, which show Vietnam's management rights in the field of payment services.

The State Bank of Vietnam (SBV) affirmed that regulations are in line with international commitments, which show Vietnam's management rights in the field of payment services.

Vietnam banks thrive in 2019, profits exceed targets

2019 has been a good year for the banking sector. Most commercial banks performed well with profit results exceeding the targets set earlier in the year.

2019 has been a good year for the banking sector. Most commercial banks performed well with profit results exceeding the targets set earlier in the year.

Small banks struggle to meet Basel II deadline

Capital difficulties are putting pressure on some banks struggling to meet the central bank’s Basel II deadline of early next year, but experts suggest the central bank should not delay the process.

Capital difficulties are putting pressure on some banks struggling to meet the central bank’s Basel II deadline of early next year, but experts suggest the central bank should not delay the process.

State firms make up 5% of total corporate loans in Vietnam

A major proportion of bank loans are provided for the business community, particularly the private sector and individuals.

A major proportion of bank loans are provided for the business community, particularly the private sector and individuals.

Chinese P2P lenders flock to Vietnam

After the lending model collapsed in China, many P2P lenders flocked to Vietnam to seek opportunities in the country.

After the lending model collapsed in China, many P2P lenders flocked to Vietnam to seek opportunities in the country.

Daegu Bank of RoK to open branch in HCM City

Daegu Bank of the Republic of Korea (RoK) is preparing to open a branch in Ho Chi Minh City after getting the green light from the State Bank of Vietnam (SBV).

Daegu Bank of the Republic of Korea (RoK) is preparing to open a branch in Ho Chi Minh City after getting the green light from the State Bank of Vietnam (SBV).

Vietnam receives record-high foreign currency influx in 2019

The State Bank of Vietnam (SBV) bought a record high amount of foreign currencies this year. The same is expected in 2020.

The State Bank of Vietnam (SBV) bought a record high amount of foreign currencies this year. The same is expected in 2020.

Vietnam's monetary market 2019: earlier forecasts missed the mark

When the State Bank of Vietnam (SBV) late last week slashed the dollar purchase price, the greenback prices quoted by commercial banks were adjusted immediately.

When the State Bank of Vietnam (SBV) late last week slashed the dollar purchase price, the greenback prices quoted by commercial banks were adjusted immediately.

VN financial sector embraces digital era: conference

Many banks and finance companies have proactively adopted technologies to provide digital financial services, Nguyen Hoang Minh, a senior central bank official said.

Many banks and finance companies have proactively adopted technologies to provide digital financial services, Nguyen Hoang Minh, a senior central bank official said.

Banks warned of risks of accepting land as collateral

The State Bank of Vietnam (SBV) has warned commercial banks of the risks associated with accepting land-use rights certificates as collateral for loans.

The State Bank of Vietnam (SBV) has warned commercial banks of the risks associated with accepting land-use rights certificates as collateral for loans.

Vietnam named second in ASEAN in fintech funding in 2019

Vietnam’s fintech firms secured two of the top three largest funding deals in ASEAN in 2019.

Vietnam’s fintech firms secured two of the top three largest funding deals in ASEAN in 2019.

VN Central Bank tightens regulations with bad loans on the rise

The State Bank of Vietnam (SBV) has taken steps to tighten regulations over banks’ use of short-term deposits, reducing its ratio used to finance medium and long term loans from 60 per cent now to 40 per cent by September next year.

The State Bank of Vietnam (SBV) has taken steps to tighten regulations over banks’ use of short-term deposits, reducing its ratio used to finance medium and long term loans from 60 per cent now to 40 per cent by September next year.

Bad debt on the rise among boat owners

The number of non-performing loans had been on the rise among recipients under a Government directive (Decision 67/2014/ND-CP) to support Vietnamese fishermen to build or upgrade their fishing vessels.

The number of non-performing loans had been on the rise among recipients under a Government directive (Decision 67/2014/ND-CP) to support Vietnamese fishermen to build or upgrade their fishing vessels.

VN central bank to tighten control over property loans

The State Bank of Vietnam (SBV) has issued a three-year road map, starting from 2020, to restrict commercial banks from using short-term capital to offer mid- and long-term loans to homebuyers.

The State Bank of Vietnam (SBV) has issued a three-year road map, starting from 2020, to restrict commercial banks from using short-term capital to offer mid- and long-term loans to homebuyers.

Credit institutes must raise charter capital, forex exchange services tightened

The Government has announced new regulations regarding the charter capital required by credit institutions.

The Government has announced new regulations regarding the charter capital required by credit institutions.

IFC divests stake at Vietnam’s state-run Vietinbank

The International Finance Corporation (IFC) remains a major shareholder of Vietinbank with a nearly 6.5% stake.

The International Finance Corporation (IFC) remains a major shareholder of Vietinbank with a nearly 6.5% stake.

Vietnam’s bond market grows 1.9% in Jan-Sep, reaching US$55 billion

This expansion was due mainly to a 4% on-quarter growth in government bonds to US$51 billion as the central bank increased issuance of bills.

This expansion was due mainly to a 4% on-quarter growth in government bonds to US$51 billion as the central bank increased issuance of bills.