|

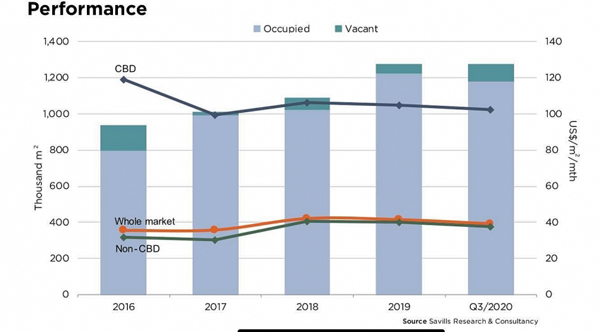

| Retail property performance to date. |

According to the third-quarter report on the real estate market of Savills Vietnam, the total stock of approximately 1.6 million square metres was stable on-quarter and up 5 per cent on-year. Over the past five years, stock growth has averaged 6 per cent per annum. The highest retail density was measured at the Hanoi city centre, with 42 per cent, equivalent to 0.48sq.m per person.

Average ground floor gross rent eased -1 per cent on-quarter and -3 per cent on-year to a three-year low. Average occupancy eased -1 percentage points on-quarter and -4 percentage points on-year to a four-year low. Take-up in the third quarter was -7,000sq.m, down to -45,000sq.m year to date. Shopping centres were the slowest segment, while the west was the slowest area.

Landlord and tenant outlook improved as containment measures eased. Shopper traffic is slowly recovering but remains low. Notably, enquiries are mostly from existing food and beverage operators expanding from Ho Chi Minh City into Hanoi. New foreign retailers are postponing entries.

"Shopper footfall is slowly recovering but remains low. Consumer confidence is expected to recover in the first quarter next year," Hoang Dieu Trang, senior manager of Savills Hanoi's Commercial Leasing said.

Macroeconomic recovery

In the third quarter, total retail sales of goods and services amounted to VND136.1 trillion ($6.6 billion), up 13.9 per cent on-quarter and 5.8 per cent on-year. Sales stood at VND421.7 trillion ($18.1 billion), up 2 per cent on-year. Performance in August fell after the second COVID-19 wave in late July but recovered in September after containment; most outlets resumed with health-check measures.

In the quarter, retail sales of goods valued at VND99.1 trillion ($4.3 billion), up 9.2 per cent on-quarter and 10.2 per cent on-year. Sales in the first nine months of 2020 worth VND277.5 trillion ($11.9 billion) showed strong 9.6 per cent on-year growth. Notable improvements were in household appliances and equipment was up 19.8 per cent, food and foodstuff were up 18.7 per cent, while garments and textiles were up 14.1 per cent.

The Asian Development Bank (ADB) forecasts national GDP growth easing back to 1.8 per cent in 2020 and rebounding to 6.3 per cent in 2021. Vietnam is expected to maintain economic stability and remain one of the fastest-growing Southeast Asian nations.

The EVFTA coming into effect on August 1, 2020, will provide extensive growth opportunities, encourage innovation and competitiveness.

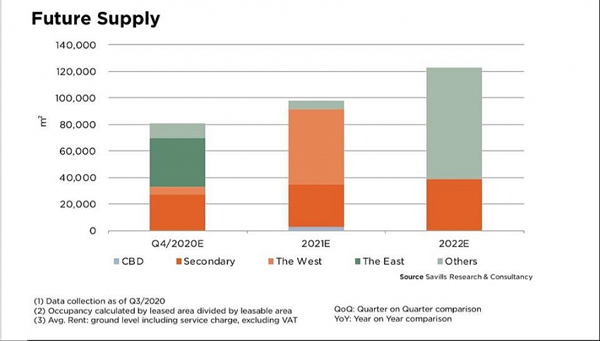

|

| The future supply of retail property will continue to increase. |

Outlook

Until 2022, 20 projects supplying approximately 302,000 sq.m are scheduled for launch. Notable developments include Vincom Mega Mall Ocean Park in the fourth quarter of 2020, Vincom Mega Mall Smart City in 2021, and Lotte Mall together with Aeon Mall Hoang Mai Giap Bat in 2022. Continuous supply expansion to non-CBD areas will pressure rentals.

Internet use is up to 68 million or 70 per cent of the population. According to GlobalData, the projected compound annual growth rate (CAGR) of 16 per cent in e-commerce will see online sales worth $9.4 billion in 2019, increasing to $17.3 billion by 2023. This potential has prompted the international business to invest in local e-commerce companies. Rising consumer confidence and improving online payment services are expected to drive further growth. VIR

Nguyen Huong

Retailers say rent for retail premised are too expensive

Chair of the Vietnam Retail Association (VRA) Vu Thi Hau, at a recently held event, complained about the suffering borne by Vietnamese retailers.

New trends influencing Vietnamese real estate market

CBRE Vietnam’s senior director Dung Duong offers her take on the new trends that will shape the local real estate market since the COVID-19 outbreak.