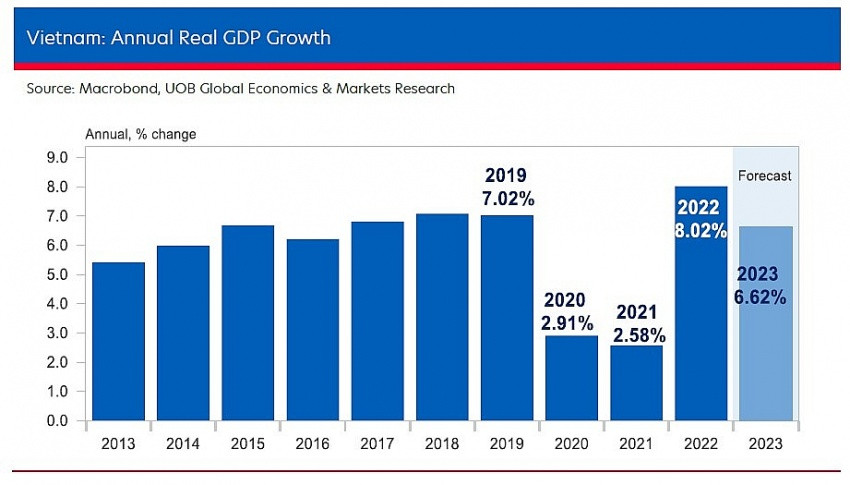

Vietnam’s real GDP growth in Q4 of 2022 normalised to a more sustainable pace of 5.92 per cent on-year, after the 13.67 per cent surge in the previous quarter, as signs of easing are seen in external demand. For the year as a whole, Vietnam’s GDP accelerated by 8.02 per cent, from 2.58 per cent in 2021, the best growth outcome since 1997.

According to UOB's newest report, while the annual data show strong performances across the board, signs of moderating growth are apparent and concerning in the detailed breakdown of the data. The manufacturing sector barely expanded, while exports registered their second consecutive month of decline in December.

However, this was offset by strong performances of domestic sectors, including retail and investment inflows.

Specifically, manufacturing sector output slowed sharply to 3.63 per cent on-year in Q4/2022, from 15.24 per cent gain in Q3. In December, manufacturing output expanded by just 0.56 per cent on-year, slowing for the fourth month after peaking at 16.23 per cent in August.

This is also a reflection of weaker external demand, as both exports and imports declined for the second consecutive month in December, registering -14 per cent on-year and -8.1 per cent on-year, respectively. Despite waning trade momentum, Vietnam recorded a trade surplus of $10.4 billion for the year, more than three times the amount of 2021, for the seventh straight year of trade surpluses.

The purchasing managers index (PMI) for manufacturing is also flagging weakness ahead for several regional economies, including China, Malaysia, and Singapore, as Vietnam's PMI fell to 47.4 in November from 50.6 in October.

However, domestic drivers remained healthy and are likely to be the growth leaders this year. Overall retail trade expanded 17.1 per cent on-year in December, extending from the 17.5 per cent gain the previous month, boosted by the continued strength in retail sales, accommodation and food, and tourism activities.

Foreign direct investment saw record inflows of $22.4 billion in 2022, from $19.7 billion in 2021, and nearly 10 per cent higher than the previous record of $20.4 billion in 2019. However, realised inflows are likely to moderate ahead based on the registered foreign investment pipeline, which came in at just $27.7 billion in 2022 from $31.2 billion in 2021 – the weakest since 2016.

Consumer prices are showing signs of upward pressures in Vietnam with inflation rate increases over the past few months, despite the deployment of administrative measures to offset price hikes.

Overall, the consumer price index (CPI) rose 4.55 per cent on-year in December. The main contributors were costs of food, housing and construction, and education, while pressures from costs of transport have eased off significantly in recent months.

For the full year, headline CPI rose 3.15 per cent on-year against 1.84 per cent in 2021. Core inflation is another concern, as it rose an average of 2.61 per cent in 2022 from 0.81 per cent the previous year.

The strong rebound of 2022 is unlikely to be sustainable, and overall growth momentum is likely to moderate further in 2023, as policy tightening from major central banks weigh on external demand, particularly from the US and Europe, which account for 41 per cent share of Vietnam’s exports.

Added to that, the State Bank of Vietnam (SBV) has also tightened its policy stance in response to inflation pressures and weakened VND, although domestic demand is likely to take the growth leadership in 2023 with rising income and improved business prospects.

"As such, we are keeping our 2023 GDP growth forecast at 6.6 per cent, in line with the official projection of 6.5 per cent," highlighted the UOB report.

With inflation rates likely to remain firm, especially in the first half of 2023, the SBV is expected to balance its monetary policy to support growth while maintaining price stability and ensuring banking safety. The SBV said in late December it will manage monetary policy in a “flexible way” to keep inflation at 4.5 per cent in 2023, aiming to "stabilise the monetary and foreign exchange markets to ensure the safety of the banking system".

"We are factoring in the likelihood of the SBV conducting more basis point hikes in early 2023, and then pause from there, in line with our view on the US Fed’s policy trajectory," said UOB experts.

Source: VIR