|

|

|

According to the European Council, any online sellers or e-commerce platforms must apply for business registration in an EU member state if they want to sell products to the EU.

Their deals will be subject to VAT applicable in countries where buyers reside.

With the new rule, if the seller registers for Import One Stop Shop (IOSS) of each member state, consumers will know the final prices, inclusive of VAT. If unregistered, online buyers must pay VAT when goods are imported to the EU.

The office suggested that online sellers should seek a partner in the EU to handle VAT filing and payment procedures in line with regulations./.

Source: VNA

Vietnam improves ranking on global B2C e-commerce index 2020

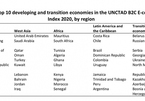

The B2C E-commerce Index 2020 of Vietnam has climbed one rank over the last year, remaining among the top 10 developing and transition economies in the region.