Many banks disappeared or merged with others in recent years. There are many new rising stars in the banking sector.

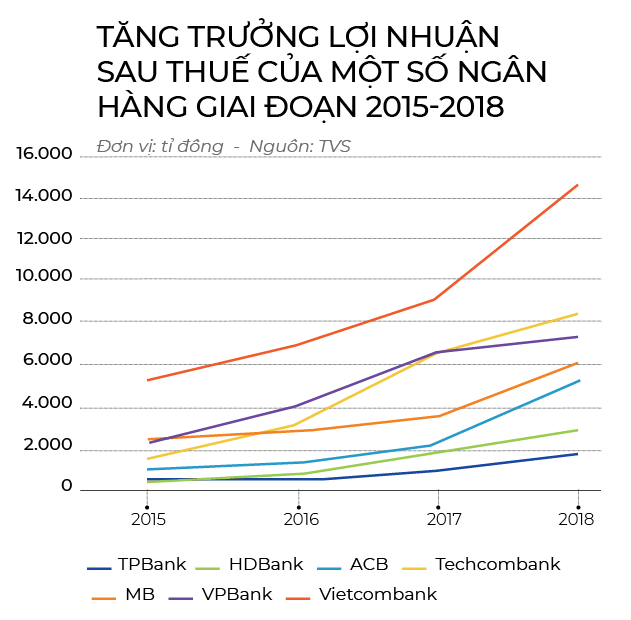

The post-tax profit of some banks in 2015-2018

Nhip Cau Dau Tu said this shows that the old growth model and way of governance are no longer suitable to new circumstances. Many banks which grew quickly in previous years cannot maintain high growth rates in the next development period.

Eximbank once praised lending to large corporations but now most banks focus on providing loans to individual and small & medium sized enterprises (SMEs).

|

Many banks disappeared or merged with others in recent years. There are many new rising stars in the banking sector. |

Even Vietcombank, known as a wholsaling bank, has seen the number of individual clients increase significantly. Vietcombank has recruited a foreigner for the post of director of retail banking, showing changes in the bank’s strategy.

Ban Viet Securities, in one of its reports, pointed out that Vietcombank’s growth rate in consumer lending is even higher than that of FE Credit and HB Saison, the consumer lending companies belonging to VP Bank and HD Bank, respectively, which dominate the consumer credit market.

VP Bank focuses on providing loans to SMEs and individual clients. Techcombank is earnning big money from lending to individual clients, and funding real estate investments and from investment products. TP Bank is pouring big money into technologies and branding.

Asia Commercial Bank (ACB), after a period of difficulties, has come back with impressive business results. In 2018, ACB’s profit, for the first time, exceeded the peak it gained in 2011 with profit of VND6.4 trillion.

Meanwhile, Military Bank has recently accelerated the activities of subsidiaries, from MB Securities, MIC Insurance, MB Aegas Life (life insurance) to MB Capital Mcredit (consumer credit), with an aim of developing an ecosystem which helps boost the sale of products.

Luu Trung Thai, CEO of Military Bank, said subsidiaries are hoped to bring VND1.421 trillion this year, twice as much as the previous year. Of this, the life insurer is striving to break even after taking a loss of VND319 billion in 2018.

In general, the profits of the banks now come from many sources, rather than on credit as seen in the past.

Rong Viet Securities predicted that income from services at banks would increase by 26.4 percent in 2019, accounting for 10 percent of total income (it was 8.6 percent last year).

Kim Chi

Eximbank chairman resigns after one month in the job

Cao Xuan Ninh, chairman of Vietnam Export Import Bank (Eximbank), has tendered his resignation after only one month in the job. The HCMC-based bank has been plagued with leadership disputes.

VN banks more vulnerable to shocks as leverage rises: Fitch Ratings

Vietnam’s banking system is becoming more susceptible to shocks as household leverage continues to increase, but near-term risk appears limited amid the benign operating environment and strong economic growth.

Credit was the major source of income of banks. In 2018, when credit grew by 14 percent compared with the years before, the profit of banks increased by 40 percent, according to the National Finance Supervision Council." itemprop="description" />

Credit was the major source of income of banks. In 2018, when credit grew by 14 percent compared with the years before, the profit of banks increased by 40 percent, according to the National Finance Supervision Council." itemprop="description" />