thanks in part to its surging manufacturing industry led by foreign direct investment driving exports forwards.

|

A fortnight ago, general director of Samsung Vietnam Choi Joo Ho worked with authorities of the northeastern province of Quang Ninh. Along with attracting more foreign direct investment (FDI) there, Ho said that Samsung is also focusing funding into the northern provinces of Bac Ninh and Thai Nguyen, and Ho Chi Minh City, with the total investment capital of over $17.5 billion, in addition to a $230 million research and development (R&D) centre under construction in Hanoi.

A representative from Quang Ninh Investment Promotion Centre told VIR, “We expect that Samsung will invest in a project in Quang Ninh. Ho has visited the province’s Dong Mai Industrial Park, which covers 168 hectares and is currently home to 18 projects registered at over $350 million.”

A few weeks ago, South Korea’s GS Engineering & Construction also worked with Quang Ninh authorities, saying that it is planning to expand investment to the northern region, in addition to some large-scale projects currently implemented in the south.

In Quang Ninh now, the company is seeking investment opportunities in some projects about environmental protection and wastewater treatment, according to the representative. Over the past few months, Quang Ninh has received a number of other big investors from South Korea and Japan who want to cultivate investment projects in Vietnam following their gradual shifts of investment out of China.

“Last month, nine projects were licensed with total registered capital of several hundreds of millions of US dollars,” the representative said.

According to the Ministry of Planning and Investment (MPI), Quang Ninh is among many nations currently eyed by many foreign investors who are seeing the country successfully control COVID-19 and achieve a high economic growth as special advantages for them to invest in. Over the past few months, a number of high-profile international organisations have rated Vietnam the best performer in Asia for 2020 – fuelled by the country’s good job in reining in COVID-19 and managing the economy.

Highest growth in Asia

Global data analyst and provider FocusEconomics told VIR that under its fresh forecast for Vietnam, “Growth should jump next year, supported by a likely strengthening of the external sector, and Vietnam should continue outperforming its regional peers.”

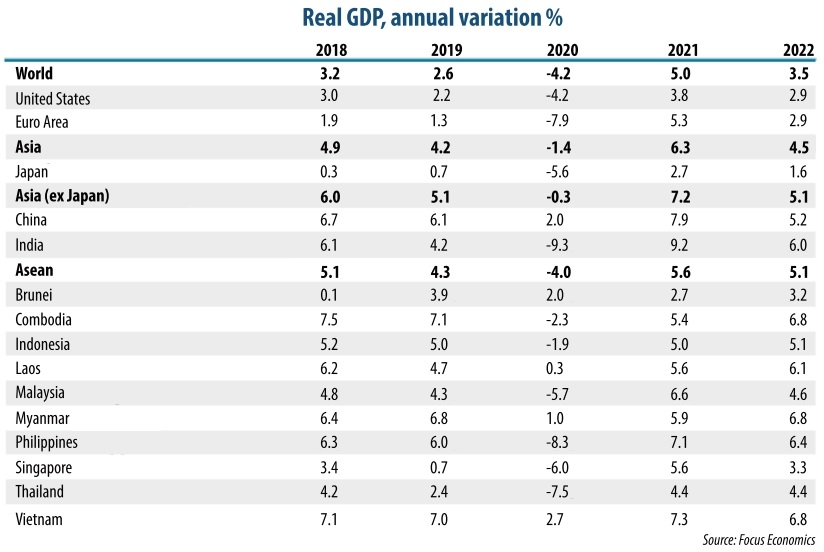

The panelists expect GDP to expand 2.7 per cent this year, the highest in Asia, before soaring to 7.3 per cent in 2021, and 6.8 per cent in 2022 (see box).

Under a new economic report by the Asian Development Bank (ADB) released over a week ago, Vietnam’s growth is also forecast to stay at the highest level this year. Specifically, economic growth in Southeast Asia remains under pressure as COVID-19 outbreaks and containment measures continue, particularly in Indonesia, Malaysia, and the Philippines.

The subregion’s growth forecast for 2020 is revised down to -4.4 from -3.8 per cent in September. The subregion’s outlook for 2021 is also downgraded, with Southeast Asia now expected to grow 5.2 per cent next year as compared to the 5.5 per cent growth forecast in September.

In Vietnam, growth accelerated from 0.4 per cent in the second quarter of 2020 to 2.6 per cent in the third quarter, lifting average growth for January-September to 2.12 per cent. The growth forecast for 2020 is revised by the ADB up from 1.8 to 2.3 per cent on the strength of accelerated public investment, revived domestic consumption, trade expansion, and rapid recovery in China. Vietnam’s growth forecast for 2021 is slightly revised down to 6.1.

Deputy Minister of Planning and Investment Tran Quoc Phuong said that despite causing serious aftermath in Vietnam, the health crisis seems not to be able to prevent FDI inflows to Vietnam in the long term, and an increasing manufacturing industry in the country. These are big drivers of Vietnam’s economic growth this year and beyond.

“Many big foreign groups and companies are eyeing the Vietnamese market, which has now basically succeeded in controlling COVID-19 – this has strengthened their confidence in the market,” Phuong said. “The pandemic is only slowing down the FDI inflows into the country. Many projects are temporarily halted, but will be strongly implemented when the pandemic eases.”

He expected that in 2021 there will be many foreign investors coming to Vietnam as the prime minister has allowed foreign experts into the country to implement projects. “FDI is also contributing greatly to boosting exports,” he said.

Vietnam attracted $26.43 billion in newly-registered, newly-added, and stake-purchased, and capital contribution-based FDI in the first 11 months of 2020, when the total disbursed sum hit $17.2 billion, according to the Ministry of Planning and Investment. Also in the first 11 months, Vietnam’s total export turnover hit $254.6 billion, up 5.3 per cent on-year. In which, Vietnamese exporters earned $73 billion, up 1.6 per cent on-year and accounting for 28.7 per cent of the country’s total export turnover, while foreign exporters fetched $181.6 billion (including crude oil exports), up 6.9 per cent, and responsible for 71.3 per cent of the economy’s total.

In November, economic recovery continued to firm up as the industrial production and retail sales expanded by 9.2 and 13.2 per cent on-year, respectively - which are the highest since the outbreak of coronavirus in February.

“Vietnam’s economy is now gradually bouncing back, and highly valued by international organisations for its economic potential and great efforts in curbing the pandemic,” said Prime Minister Nguyen Xuan Phuc at a cabinet meeting for November.

Enterprises enticed

Over a week ago, Malaysia’s Maybank released its fresh forecast for Vietnam’s growth, calling the country the best ASEAN growth story. “We expect GDP growth to rebound to 6.8 per cent in 2021 and remain strong at 6.7 per cent in 2022, versus 2.9 per cent in 2020, cementing Vietnam’s position as one of the best growth stories in ASEAN,” said the Maybank report. “Exports and manufacturing will remain the main growth engines. Private consumption (68 per cent of GDP) and investment (32 per cent of GDP) are recovering from the COVID-induced slowdown. Investments will return on the back of a pick-up in private investments and FDI.”

According to Maybank, FDI will continue remaining a structural growth driver as manufacturing gradually recovers in 2021. Vietnam’s participation in the recently concluded free trade agreements (FTAs) will further strengthen its position as an attractive production base.

“Electronics manufacturers, including Foxconn, Pegatron, Wistron, and Samsung, are planning additional manufacturing plants and R&D facilities.

Under a fresh survey by the Association of German Chambers of Industry and Commerce over German firms’ sentiment in Vietnam, 80 per cent of German businesses are now performing well in Vietnam, regardless of the ongoing COVID-19 pandemic, 40 per cent of respondents said they feel satisfied when performing in the country – this rate in Vietnam ranks third in the Asia-Pacific region, after China and New Zealand.

About 55 per cent of German firms expected that the Vietnamese economy will strongly recover in 2021. Around 72 per cent of respondents said that they will continue implementing their investment plans in Vietnam in the time to come, and 27 per cent said that they will recruit more staff.

This has reflected a big achievement in Vietnam’s great efforts in improving the domestic investment climate, and positive impacts from FTAs, especially the EU-Vietnam FTA, according to the Delegation of German Economy in Vietnam. This agreement is expected to be a major tool that can help the Vietnamese economy recover, achieve high growth, and attract more investment from German and the EU in the middle and long term.

According to FocusEconomics, looking to next year, industrial production should continue to recover as economic activity ramps up abroad. Moreover, the underlying strength of Vietnam’s industrial sector remains intact despite COVID-19: Vietnam is an attractive low-cost base for manufacturing firms, including those looking to relocate from China due to the US-China trade spat, thanks to a cheap workforce and business-friendly government.

FocusEconomics estimated that industrial output will grow 8 per cent in 2021, and 8.1 per cent for 2022. VIR

Thanh Thu

Vietnam's economy to grow 6.8 percent in 2021: World Bank

Vietnam’s prospects appear positive as the economy is projected to grow by about 6.8 percent in 2021 and, thereafter, stabilise at around 6.5 percent, according to the latest World Bank’s economic update for Vietnam “Taking Stock”.

Vietnam economy continues to strengthen, reports VDSC

Optimism for the year ahead has been improved to the highest thanks to the country's effective control of Covid-19 pandemic.