- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

M&A

Update news M&A

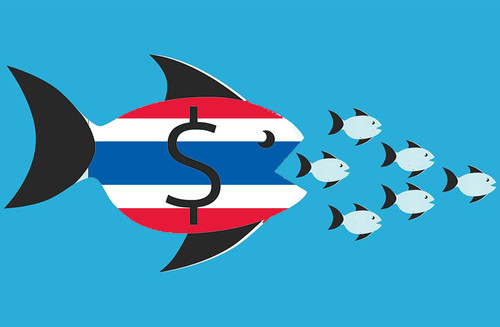

Thai firms pocket big profits after buying major Vietnamese companies

In the last 10 years, powerful Thai corporations have spent big money acquiring many leading Vietnamese enterprises.

Capital thirst to fuel real estate M&A: insiders

Many property developers are planning asset and stock sales as they look to slash debts, restructure business and stay afloat, which is expected to lead to a surge in M&A deals in the market.

Divestment deal at PGBank wraps up after one decade

The divestment of PGBank from Petrolimex is coming to an end. The secret buyer will be made public soon.

M&A deals to boost non-life insurance industry

The non-life insurance sector has seen a flurry of merger and acquisition (M&A) deals over the past two years, partly reflecting the attractiveness and keen competition of the market, which still has room for growth.

Companies come up with big M&A plans from early in the year

A number of companies are pursuing merger and acquisition (M&A) deals this year amid tighter funding from banks.

Experts forecast M&A blockbuster deals in addition to bank restructuring

Many experts made a forecast that there will be many blockbuster deals along with the program of restructuring and forced transfer of weak banks in the coming time.

Asian investors eye more M&A opportunities in Vietnam

Investors from Japan, the Republic of Korea (RoK), and Singapore are looking for more potential merger and acquisition (M&A) opportunities in Vietnam, pinning high hopes on the long-term growth prospects of the market.

Global M&A value falls to $500 billion, but opportunity still exists

The global M&A market has been quiet, but the Ministry of Planning and Investment (MPI) said Vietnam remains a safe and attractive market with great potential.

M&A opportunities in a volatile market

The consumer, industrial, real estate, energy and utilities sectors were the most sought-after targets in 2022-2023, when split by industry.

Fintech future in store for smarter M&A deals

Cross-border merger and acquisition deals are being altered as a direct result of increasing inflation. Nevertheless, foreign investors are exploring untapped potential in the fintech industry to stay competitive in the digital era.

M&A in renewable energy recorded despite economic downturn

By the end of 2021 independent power plants accounted for 41.3 per cent of the total installed capacity of the whole system, up from only 18.4 per cent in 2018 when the solar wave was formed.

M&A deals hit US$5.7 bln during Jan-Oct

Merger and acquisition (M&A) activities carried out by Vietnamese enterprises were estimated to reach over US$1.3 billion during the January-October period.

M&A in technology sector on the rise

Mergers and acquisitions (M&A) in the technology sector have been witnessing a rebound in recent years as tech giants have employed M&A to expand their ecosystems.

M&A in Vietnam forecast to slow down in H2 2022

M&A activities in Vietnam is forecast to slow in the second half as investors become more conservative about several macro trends impacting the country’s economy.

M&A deals in Vietnam reach nearly $5 billion in H1

Mergers and acquisitions (M&A) in Vietnam sustained its strong pace in the first six months of 2022 with a total value of $4.97 billion.

Vietnam’s H2 M&A activity seen slowing over investor caution: EY

Merger and acquisition (M&A) transactions in Vietnam may slow down a bit in the second half of the year as investors have grown more cautious about some macro trends impacting the local economy, according to an analysis of M&A data by EY.

US$1.5 billion value of Bach Hoa Xanh chain is inaccurate figure: Mobile World

Mobile World Investment Joint Stock Company has stated that information posted on August 24-25 on a number of foreign and Vietnamese news sites about its Bach Hoa Xanh chain is inaccurate.

M&A in banking industry expected to stay high in H2

Mergers and acquisitions (M&A) in the banking industry are expected to remain high for the rest of the year as the industry continues the digital transformation process, according to experts.

M&A deals light up property market in first half of 2022

Since the beginning of the year, the real estate market has seen an uptick in merger and acquisition (M&A) activity, including office, residential, and industrial projects.

Big M&A deals forecast in banking industry in 2022

Vietnam’s merger and acquisitions (M&A) market in 2022 is forecast to include big deals worth billions of dollars in the banking industry.