If business performance is below expectation, the State Bank of Vietnam (SBV), the country’s central bank, may reduce policy rates by another 0.25 – 0.5 percentage points in the future, according to Bao Viet Securities Company (BVSC).

On March 17, the SBV decided to cut the benchmark interest rates by 0.5 – 1 percentage point as the Covid-19 pandemic was taking a heavy toll on the economy.The cut was applied to the refinancing interest rate, discount interest rate, interest rate applicable to overnight loans, and interest via open market operations (OMO).

Following the decision, the refinancing interest rate is down from 6% per annum to 5%, rediscount rate from 4% to 3.5%, overnight interest rate from 7% to 6% and interest rate via OMO from 4% to 3.5%.

The SBV also lowered the interest rate cap to 4.75% annually from 5% for deposits with maturities of one month to less than six months.

BVSC also suggested a declining inflation will support further reductions in deposit rates by 0.3 – 0.5 percentage points.

In April, both central rate and bank rates were lower than in March. Compared to late 2019, at the end of April, the mid-point USD/VND rate set by the SBV gained VND102 (+0.4%), while actual exchange rate quoted at commercial banks rose up VND254 (+1.1%).

Inflation rate estimated at 3 – 3.5%

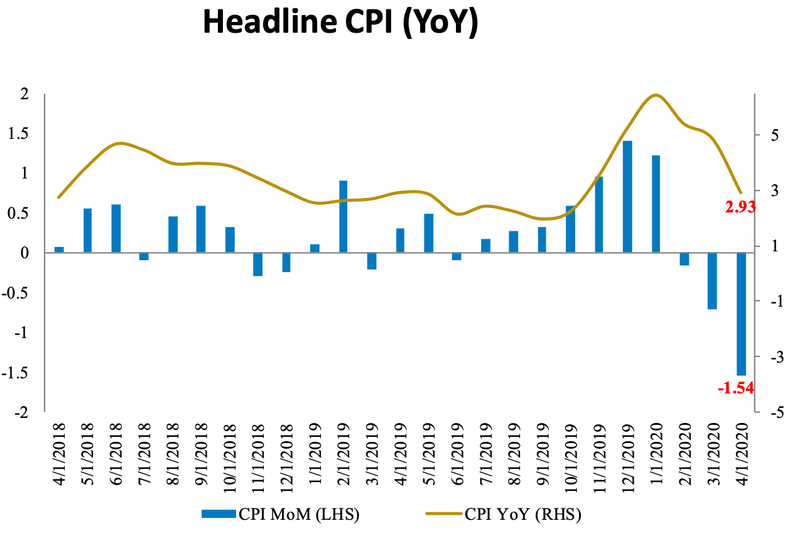

The consumer price index (CPI), a gauge of inflation, dropped 1.54% month-on-month in April yet increased 2.93% year-on-year, nearly halving the peak of 6.4% at the end of January.

|

| Source: BVSC. |

Six out of 11 commodity groups saw a price decrease last month, of which transport lost the most, down 13.8% month-on-month, driven by the oil price fall.

With the slowdown in CPI growth, apparently, impacts from demand shock are overwhelming those of supply.

Unexpected developments of the Covid-19 pandemic also led to a significant reduction in prices of various commodities compared to late 2019, especially petroleum, foods, electricity, culture, tourism, and entertainment.

The regulated prices of basic commodities and services, such as health and education are expected to stay unchanged for a foreseeable future. On that basis, BVSC forecast that the average inflation rate in 2020 will be around 3-3.5% (instead of 4% as previously forecast). Meanwhile, inflation forecast for late 2020 is also lowered to 2-2.5% year-on-year (from 3.2-3.6% previously).

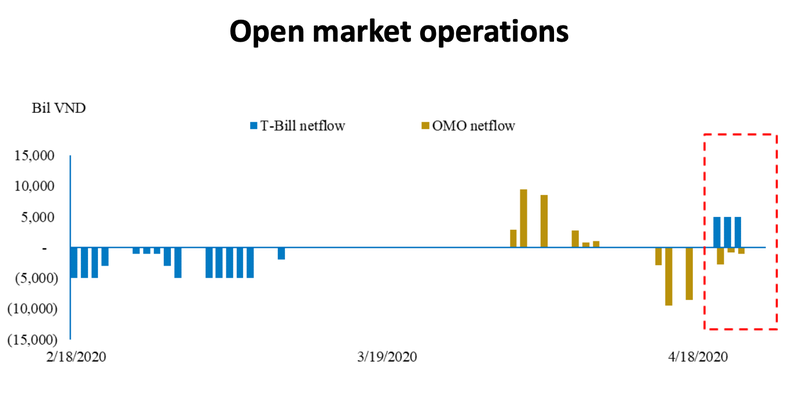

Meanwhile, it is highly likely that businesses’ demand for loans will remain low as the economy is struggling with the negative impacts of the pandemic, resulting in an abundant liquidity in the banking system in May.

|

| Source: BVSC. |

While credit growth may remain low, the banking system is expected to receive a large amount of cash inflow through T-bill channel (issued in February for 91-day term). The matured amount is anticipated to be over VND120 trillion (US$5.12 billion). Accordingly, interbank interest rates will possibly remain low with a potential increase in G-bond winning rate in May. Hanoitimes

Hai Yen

Despite Covid-19, VN banks continue to recruit new staff

Commercial banks are seeking more workers even though the economy has been hit hard by the pandemic. Recruitment notices say banks need both officers and medium- and high-ranking managers.

State-owned banks told to sacrifice profits to support businesses

Deputy Governor of the State Bank Dao Minh Tu said at a conference between the Prime Minister and ministries’ leaders that state-owned banks will have to sacrifice 30-40 percent of profit to help businesses cope with Covid-19.

The central bank of Vietnam had previously cut the benchmark interest rates by 0.5 – 1 percentage point in March." itemprop="description" />

The central bank of Vietnam had previously cut the benchmark interest rates by 0.5 – 1 percentage point in March." itemprop="description" />