- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

lazada

Update news lazada

Are Vietnam’s e-commerce platforms inferior to foreign competitors?

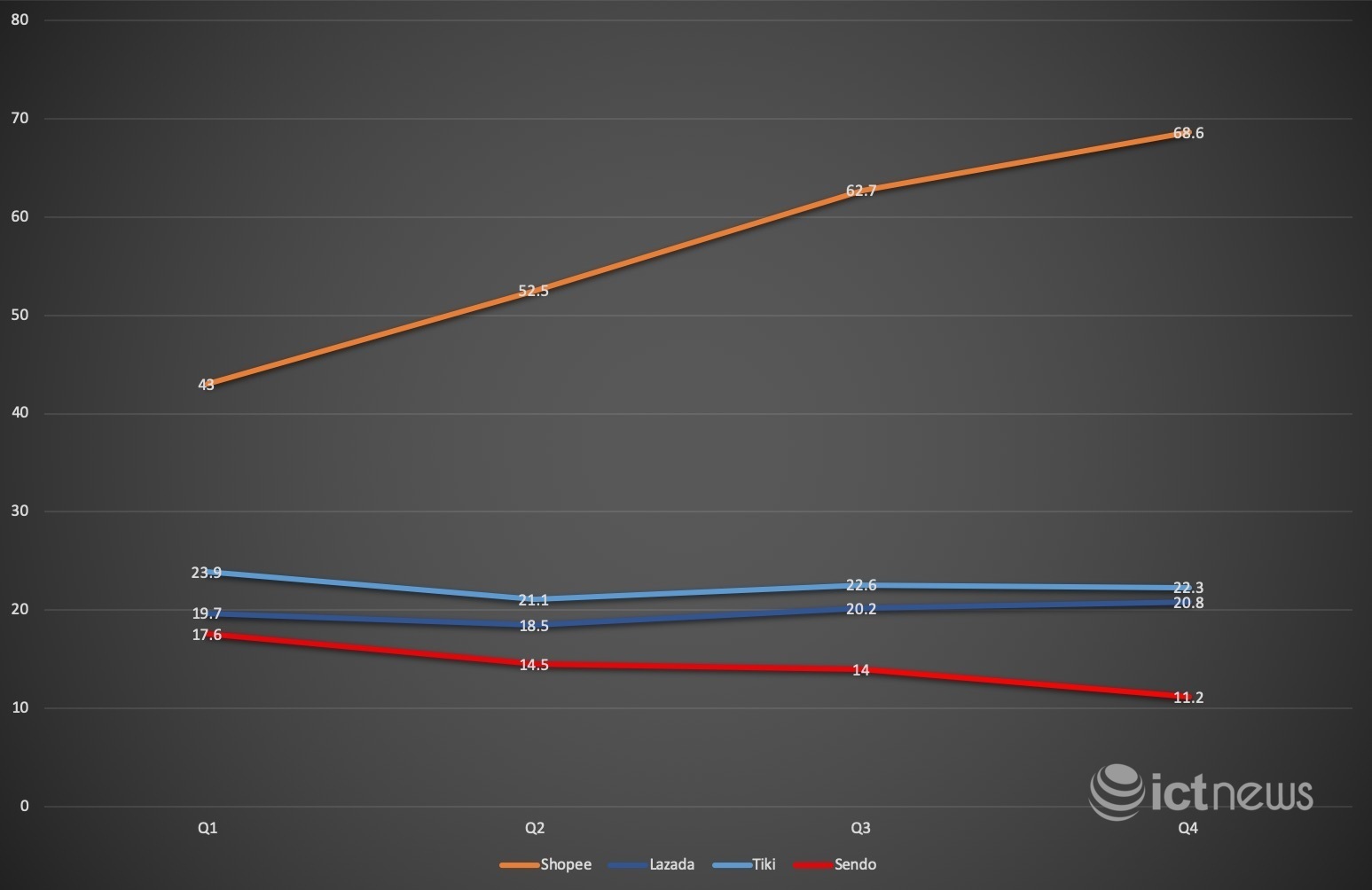

Some reports show that Shopee has left its rivals far behind, and that Tiki is competing equally with Lazada, while Sendo is in the fourth position.

Online shopping sees record growth, ranked 3rd in region

The total number of visits to online shopping apps in Vietnam reached 12.7 billion in the first six months of the year, the highest ever figure.

Pandemic shock therapy turns retailers towards omnichannel

The coronavirus pandemic has changed consumer shopping behaviour, prompting retailers to embrace online commerce to keep up with new trends.

E-commerce titans step up fake product fight

Overseas e-commerce companies Lazada and Shopee may lose their positions in Vietnam if they keep demonstrating limitations in protecting consumers from low-quality and fake goods.

Overseas e-commerce companies Lazada and Shopee may lose their positions in Vietnam if they keep demonstrating limitations in protecting consumers from low-quality and fake goods.

Big Four in e-commerce keep taking on losses despite firm market presence

The "money burning" race in the local e-commerce scene is not over yet, with all Big Four competitors scampering to gain a larger market share.

The "money burning" race in the local e-commerce scene is not over yet, with all Big Four competitors scampering to gain a larger market share.

Online shopping: no boom in first quarter as expected

Three out of four of the largest e-commerce sites saw the numbers of visits decreasing in Q1, a time when experts predicted would see a boom as the COVID-19 epidemic reached its peak.

Three out of four of the largest e-commerce sites saw the numbers of visits decreasing in Q1, a time when experts predicted would see a boom as the COVID-19 epidemic reached its peak.

Online sales rise sharply amid pandemic

As Vietnamese are now favoring ‘contactless purchases’ in Covid-19, online sales have increased rapidly.

As Vietnamese are now favoring ‘contactless purchases’ in Covid-19, online sales have increased rapidly.

Vietnam’s e-commerce sees few benefits during Covid-19 crisis

While Amazon has had to recruit 100,000 more workers to satisfy orders, at Vietnam’s marketplaces, purchases remain weak except for face masks and hand sanitizers.

While Amazon has had to recruit 100,000 more workers to satisfy orders, at Vietnam’s marketplaces, purchases remain weak except for face masks and hand sanitizers.

Shopee, Lazada struggle to dominate Vietnam’s e-commerce market

Shopee and Lazada have successfully controlled most of the Southeast Asian market. But in Vietnam, Tiki, Sendo and The Gioi Di Dong are preventing them from doing so.

Shopee and Lazada have successfully controlled most of the Southeast Asian market. But in Vietnam, Tiki, Sendo and The Gioi Di Dong are preventing them from doing so.

Trade Ministry fines online sellers hiking prices of face masks and hand sanitiser

Sellers hiking the prices of face masks and hand sanitiser on some e-commerce websites have been fined.

Sellers hiking the prices of face masks and hand sanitiser on some e-commerce websites have been fined.

Crackdown on over-charging online sites

More than 30,000 stores have been closed on online shopping sites including Shopee, Tiki, and Lazada due to overcharging.

More than 30,000 stores have been closed on online shopping sites including Shopee, Tiki, and Lazada due to overcharging.

Tiki and Sendo in merger talks?

Tiki and Sendo may be in talks over a potential merger to break the dominance of Shopee and Lazada and their foreign backers.

Tiki and Sendo may be in talks over a potential merger to break the dominance of Shopee and Lazada and their foreign backers.

E-commerce: are players getting worn out in the online race?

Successfully calling for capital from international investors, e-commerce firms are nevertheless taking losses.

Successfully calling for capital from international investors, e-commerce firms are nevertheless taking losses.

Year-end promotions heat up Vietnam's e-commerce market

The year-end online shopping frenzy has kicked off with giant local and foreign players like Lazada, Tiki, Sendo, and Shopee rolling out promotions since the middle of last month.

The year-end online shopping frenzy has kicked off with giant local and foreign players like Lazada, Tiki, Sendo, and Shopee rolling out promotions since the middle of last month.

Legal framework lags behind e-commerce development in Vietnam

E-commerce development is improving, but state management in this field is facing many difficulties because the legal framework cannot cover all e-commerce activities.

E-commerce development is improving, but state management in this field is facing many difficulties because the legal framework cannot cover all e-commerce activities.

Singaporean e-logistics groups making waves in Vietnam

Singaporean investors are continuing to pour capital into e-logistics firms to tap into the fast-growing market in Vietnam.

Singaporean investors are continuing to pour capital into e-logistics firms to tap into the fast-growing market in Vietnam.

Cross-border e-commerce serves as channel to boost Vietnam's exports

The Internet boom, a young labor force and the strong development of e-commerce all help Vietnamese businesses access foreign markets, especially now that many next-generation FTAs have been signed.

The Internet boom, a young labor force and the strong development of e-commerce all help Vietnamese businesses access foreign markets, especially now that many next-generation FTAs have been signed.

Alibaba sets its sights on Vietnamese market

A workshop organized in HCM City, attracting representatives of 200 SMEs, in late September was held to help Vietnamese SMEs boost exports through transnational e-commerce, as well as help Vietnamese enterprises connect with Singaporean ones.

A workshop organized in HCM City, attracting representatives of 200 SMEs, in late September was held to help Vietnamese SMEs boost exports through transnational e-commerce, as well as help Vietnamese enterprises connect with Singaporean ones.

Lazada and Tiki fall further behind e-commerce competition

Despite non-stop spending, Lazada remains overwhelmed by local platforms Sendo and Mobile World, in addition to other players Shopee and Tiki.

Despite non-stop spending, Lazada remains overwhelmed by local platforms Sendo and Mobile World, in addition to other players Shopee and Tiki.

E-commerce: exorbitant losses for a single percent

Each e-commerce platform needs to spend millions of US dollars to gain a single per cent of market share from competitors, showing just how serious the competition is.

Each e-commerce platform needs to spend millions of US dollars to gain a single per cent of market share from competitors, showing just how serious the competition is.