- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

investment

Update news investment

Sands shifting as pandemic shakes up geopolitical arena

With the current upheaval taking place around the world due to the coronavirus pandemic, how can geopolitical frictions between the major powers impact nations like Vietnam that are looking to attract top investment?

Developers can ride funding waves

Competitive prices, along with advantages in climate and natural resources, are helping Vietnamese second home and holiday properties become one of the hottest investment channels in the country.

Competitive prices, along with advantages in climate and natural resources, are helping Vietnamese second home and holiday properties become one of the hottest investment channels in the country.

Post-pandemic focus for new investments

A series of favourable policies are expected to be issued by the government’s upcoming taskforce in the country’s bid to attract a new investment wave after the health crisis.

A series of favourable policies are expected to be issued by the government’s upcoming taskforce in the country’s bid to attract a new investment wave after the health crisis.

Developers dine on industrial land

As Vietnam has emerged as an attractive option for companies seeking to diversify their manufacturing operations, industrial zone developers are planning to expand their land banks to welcome new investments heading to the country.

As Vietnam has emerged as an attractive option for companies seeking to diversify their manufacturing operations, industrial zone developers are planning to expand their land banks to welcome new investments heading to the country.

Investment promotion on the world wide web

Given the government’s proposed spending cuts for overseas business trips and conferences, Vietnam should quickly adopting online investment promotion.

Given the government’s proposed spending cuts for overseas business trips and conferences, Vietnam should quickly adopting online investment promotion.

Fate of five of 12 loss-making projects uncertain with EPC contractors out of reach

The fate of five of the 12 notorious loss-making projects remain uncertain because the Chinese contractors cannot be taken to court.

The fate of five of the 12 notorious loss-making projects remain uncertain because the Chinese contractors cannot be taken to court.

Keys to nation’s investment optimism

Recent analyses by the World Bank indicate that Vietnam will be one the few countries in the entire world to experience positive economic growth in 2020.

Recent analyses by the World Bank indicate that Vietnam will be one the few countries in the entire world to experience positive economic growth in 2020.

COVID-19 outbreak enhances trend of "make where you sell"

The COVID-19 outbreak is accelerating the shifting of corporate mindsets on diversifying from China and onboarding the trend of “make where you sell”.

The COVID-19 outbreak is accelerating the shifting of corporate mindsets on diversifying from China and onboarding the trend of “make where you sell”.

Three decades of investment attraction victories in Vietnam

Since the issuance of Vietnam’s Law on Foreign Investment in 1987 right after the doi moi policy was adopted, Vietnam has continuously revised its policies to keep improving the opportunities for international investors.

Since the issuance of Vietnam’s Law on Foreign Investment in 1987 right after the doi moi policy was adopted, Vietnam has continuously revised its policies to keep improving the opportunities for international investors.

Long Son Petrochemical Complex receives $1.4 billion added capital

The $1.386 billion added investment will help accelerate Long Son Petrochemical Complex that has fallen behind schedule.

The $1.386 billion added investment will help accelerate Long Son Petrochemical Complex that has fallen behind schedule.

Vietnamese e-wallets charm investors

Hefty sums found their way to Vietnamese e-wallets from diverse partners during the year, turning the segment into one of the investment hotspots.

Hefty sums found their way to Vietnamese e-wallets from diverse partners during the year, turning the segment into one of the investment hotspots.

Consumer finance in Vietnam charm foreign players

As Vietnam has a fertile consumer finance market, more foreign players are considering joining the bandwagon by tying up with local peers.

As Vietnam has a fertile consumer finance market, more foreign players are considering joining the bandwagon by tying up with local peers.

Two foreign banks' representative offices have licences withdrawn

The State Bank of Vietnam (SBV) has withdrawn the licences of the representative offices of Kookmin from South Korea and Commonwealth Bank of Australia.

The State Bank of Vietnam (SBV) has withdrawn the licences of the representative offices of Kookmin from South Korea and Commonwealth Bank of Australia.

Thai Stark Corporation PCL purchases Vietnamese cable manufacturers for $240 million

Stark Corporation of Thailand has completed the purchase of 100 per cent equity in Thipha and Dong Viet Non-Ferrous & Plastic JSC for $240 million.

Stark Corporation of Thailand has completed the purchase of 100 per cent equity in Thipha and Dong Viet Non-Ferrous & Plastic JSC for $240 million.

Potential of eco property during COVID-19

Ecological real estate is considered a safe investment channel amid the pandemic, meeting the demand for green living space and ensuring health safety for dwellers.

Ecological real estate is considered a safe investment channel amid the pandemic, meeting the demand for green living space and ensuring health safety for dwellers.

Vietnam makes it into top 5 economic freedom gainers in Asia-Pacific region

With the strides in opening its economy, Vietnam has improved its ranking to 105th on the 2020 Index of Economic Freedom by The Heritage Foundation.

With the strides in opening its economy, Vietnam has improved its ranking to 105th on the 2020 Index of Economic Freedom by The Heritage Foundation.

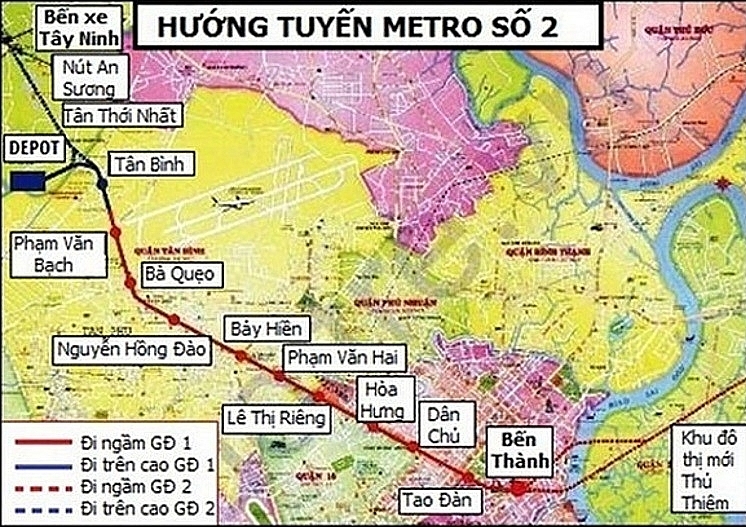

Investment cost and construction time increased for Metro Line No.2

Ho Chi Minh City sent a proposal to the relevant ministries to increase the investment capital and construction time for a component project of Metro Line No.2.

Ho Chi Minh City sent a proposal to the relevant ministries to increase the investment capital and construction time for a component project of Metro Line No.2.

Overseas Vietnamese invest nearly $2 billion in HCM City

More than 3,000 overseas Vietnamese had invested VNĐ45 trillion (US$1.94 billion) as of the end of last year in HCM City, an official said at a meeting yesterday in the city.

More than 3,000 overseas Vietnamese had invested VNĐ45 trillion (US$1.94 billion) as of the end of last year in HCM City, an official said at a meeting yesterday in the city.

COVID-19 outbreak to accelerate relocation wave from China to Vietnam

While COVID-19 will have a negative impact on Vietnam's economic growth in 2020, it will boost the relocation of manufacturing facilities from China to Vietnam.

While COVID-19 will have a negative impact on Vietnam's economic growth in 2020, it will boost the relocation of manufacturing facilities from China to Vietnam.

Investors dive into VN supporting industries

The local supporting industries have seen positive movements after Vietnam has more thoroughly embraced its diverse new-generation free trade agreements.

The local supporting industries have seen positive movements after Vietnam has more thoroughly embraced its diverse new-generation free trade agreements.