|

| International investors scoop up major stakes in drugmakers. -- Photo: imexpharm.com |

SK Investment Vina III Pte., Ltd., a subsidiary of South Korea’s third-largest conglomerate SK Group, has increasingly raised its ownership at Imexpharm Pharmaceutical JSC. According to information revealed by Imexpharm, SK Investment will spend an additional $430,000 to increase its ownership at the drugmaker to 30.70 per cent.

This month SK Investment has already poured over $1.5 million to scoop up 3.4 million shares of the Vietnamese pharmaceutical company to increase its ownership from 24.02 to 29.22 per cent.

On June 7, Pymepharco announced that STADA Service Holdings B.V., a subsidiary of German pharmaceutical company STADA Arzneimittel AG, will make a public offer to buy 356,000 of its shares, equalling 0.47 per cent. STADA and relevant stakeholders are currently holding 75.66 million voting shares or 99.53 per cent of Pymepharco. If the deal goes through, STADA will fully take over Pymepharco.

STADA initially teamed up with Pymepharco by transferring technology, allowing the Vietnamese pharmaceutical maker to produce a number of the German company’s branded products.

In January, Japanese drugmaker ASKA Pharmaceutical purchased nearly 5.2 million shares of Ha Tay Pharmaceutical JSC (Hataphar), upping its stake from 4.9 per cent to 24.9 per cent, and becoming a major shareholder. The capital from the deal will help Hataphar to build a high-tech pharmaceutical factory project.

Another pharmaceutical giant, Traphaco, also witnessed active foreign net buying with a volume of up to tens of thousands of units per trading session since the end of May. The current foreign ownership rate of Traphaco is 43.35 per cent, close to the maximum limit of 49 per cent. The largest foreign institutional shareholders are Magbi Fund Ltd., and Super Delta Pte., Ltd., which hold 25 per cent and 15.12 per cent respectively.

Taisho Pharmaceutical Co., Ltd. has acquired 51.01 per cent of DHG Pharmaceutical JSC following a number of transactions and public offerings, and pharmaceutical giant Abbott now holds nearly 52 per cent of Domesco.

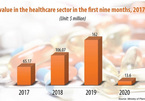

Last year was notable for mergers and acquisitions (M&As) in the pharmaceutical sector. According to SSI Research, the total value of M&A deals was VND1.68 trillion ($73 million) and they involved a number of foreign investors.

According to experts, foreign investor interest in local pharma companies will continue increasing, proven by the closing of a number of M&A deals with the value of trillions of VND from big foreign investors. Several pharmaceutical companies from India, Thailand, Japan, Malaysia, South Korea, and the European Union are now still seeking opportunities for their investment into the Vietnamese market.

Investors are not only pinning their hopes on large pharma businesses but also betting on tech-enabled healthcare facilities. AppWorks, a venture capital company that invests in Taiwan and Southeast Asia, has led a $1 million funding round in Vietnam-based healthtech startup Docosan, which offers searching and booking appointments online with doctors 24/7, checking price lists and reviews by patients.

Another local startup called AiHealth, which helps find personal doctors, book appointments, and buy medication online, has announced its successful call for investment from TNBA Vietnam Scout and some other investors in Southeast Asia.

A slew of other healthcare startups are constantly expanding their offerings in Vietnam such as eDoctor, Jio Health, Doctor Anywhere, and Zoop Care. But while tech-enabled businesses continue to grow in Vietnam and potentially disrupt the industry, there are still business issues that have not been fully addressed by the startups.

Phong Quach, head of business development at Ipsos Strategy3 in Vietnam, said that in the Vietnamese healthcare sector, hospitals and institutes are classified by tiers, unlike other developed markets with a structure between primary care, secondary care, tertiary care, and others. For example, a patient can easily access a special tier hospital such as Bach Mai via its out-of-pocket service even on the weekend if that patient has a specific need for on-demand service.

In addition, special tier hospitals such as Bach Mai or Cho Ray are often perceived to be superior compared to lower tier local hospitals and easy access is a driving factor where higher-tier hospitals often attract more traffic to their facilities. Similarly, healthcare practitioner profiles and experiences are also influenced by the facilities that they serve.

Quach said, “It is certainly a key question of how healthcare services from tech-enabled businesses can provide trust to a Vietnamese patient. So if these businesses want to build a solid portrait, they have to attract highly-respected professionals to their services, which is a very challenging task.”

Source: VIR

New M&As in healthcare can evade pandemic uncertainties

Mergers and acquisitions in Vietnam’s healthcare and pharmaceutical sector in 2020 have been held up due to the global health crisis – but prospects remaining enticing thanks to new drivers of interest.

Japanese investors secure foothold in leading Vietnamese brands through M&A

Japanese investors have poured billions of dollars to purchase stakes at Vietnamese businesses over the past decade.