- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

HSBC

Update news HSBC

Vietnam becomes among most livable countries for expats

Vietnam has recently been listed among the world’s 10 best countries for expatriates in a recent survey by the bank HSBC.

Vietnam has recently been listed among the world’s 10 best countries for expatriates in a recent survey by the bank HSBC.

Vietnam’s inflation to moderate to 2.7% in 2019: HSBC

After recording its slowest pace in more than three year last month, Viet Nam’s inflation is forecast to hit only 2.7 per cent in 2019 after standing at 3.5 per cent last year.

After recording its slowest pace in more than three year last month, Viet Nam’s inflation is forecast to hit only 2.7 per cent in 2019 after standing at 3.5 per cent last year.

Major US hotel operators plan expansion in Vietnam

A lot of people from China, South Korea, even Japan are buying resort properties in Vietnam, which is considered a sign of an attractive market to investors.

A lot of people from China, South Korea, even Japan are buying resort properties in Vietnam, which is considered a sign of an attractive market to investors.

Vietnam likely to benefit from worldwide shift in production capacity: HSBC

However, to convert its much-touted supply chain potential, Vietnam needs to build more visibility and credibility amongst international firms.

However, to convert its much-touted supply chain potential, Vietnam needs to build more visibility and credibility amongst international firms.

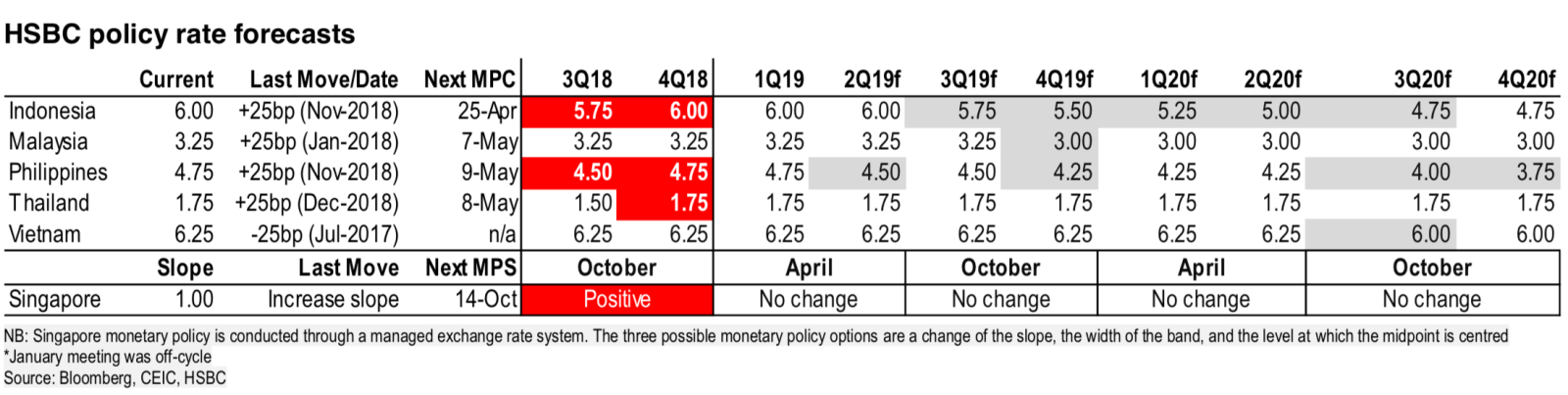

Vietnam expected to cut policy rate in second half of 2020: HSBC

The need to ease policy rates in the near-term is unlikely, given the country’s still-robust growth and heightened foreign direct investment.

Vietnamese banks thrive following foreign partners’ divestment

VietNamNet Bridge - Concerns were once raised when a number of foreign partners decided to divest from Vietnamese banks, but banks’ financial reports show satisfactory business performances.

As bad debt burden lifts, Vietnam banks attract more foreign capital

Foreign investors are rushing to pour money into Vietnam’s banks which see a brighter future as the warming of the real estate market will help them collect debts from mortgaged loans.

State-owned bank also hires foreign CEOs

VietNamNet Bridge - Though foreign CEOs are commonly seen in privately run commercial banks, few banks where the state holds the controlling stake employ foreigners.

Foreign banks step up personal banking, increase M&A activity

VietNamNet Bridge - Two foreign bank names are in the list of top 10 taxpayers – HSBC and Shinhan Bank Vietnam. And both have strong retail banking divisions.

Foreign strategic investors at domestic banks: assets or problem?

VietNamNet Bridge - The divestment of a number of foreign strategic investors from Vietnamese banks is a sign that foreign technology doesn’t always help.

Vietnamese banks no longer burn for foreign capital

VietNamNet Bridge - After separating from HSBC, Techcombank plans to spare no room for foreign investors, and VP Bank, which has been prospering in the last four years, is no longer eager to seek foreign partners.

Where is Vietnam’s banking system on the region’s map?

VietNamNet Bridge - Phan Minh Ngoc, an economist, analyses the indexes to show the health of Vietnamese banks.

Foreign banks scale down business in Vietnam

Some large foreign banks operating in Vietnam have recently scaled down their business or withdrawn capital from Vietnamese banks. What is happening with the banking sector?

Personal consumer credit becoming lucrative business

VietNamNet Bridge - FE Credit is leading the consumer finance market with $1.4 billion worth of loans provided in 2016, accounting for 48 percent of market share.

The real power of Vietnam’s economy

Economic growth based on natural resource exploitation and a cheap labor force has reached the critical point. Economists say Vietnam has no choice but to follow a sustainable development strategy.

Opening of more foreign banks puts pressure on domestic banks

VietNamNet Bridge - The increased demand for capital and bank services has attracted more foreign banks to Vietnam, which is putting pressure on domestic bankers.

HSBC worries about Vietnam’s credit loosening

VietNamNet Bridge – The HSBC Global Research team has expressed concern over Vietnam’s recent move to loosen credit to stimulate private sector and government spending.

Facebook accounts of bank clients hacked, money stolen

VietNamNet Bridge - Vietnamese clients of HSBC and BIDV have lost tens of millions of dong after having their international payment accounts hacked.

HSBC to freeze salaries, hiring in 2016 in battle to cut costs: sources

Europe's largest lender, HSBC, is imposing a hiring and pay freeze across the bank globally in 2016, two sources familiar with the matter told Reuters.

HSBC: Vietnam's 2016 GDP target feasible

VietNamNet Bridge – The Government has set an economic growth target of 6.7 per cent for 2016, which HSBC, in its latest Vietnam at a Glance report, believes is feasible since export growth has rebounded to double digits reflecting new investment.