Vietnam has recently discovered gold reserves estimated at 30 tons in the Northwest region - worth over USD 3 billion. Among the country's gold mining companies, one enterprise produces nearly one ton of gold per year.

Vietnam is home to several large-capacity gold mining companies, most notably the Vietnam Minerals Corporation – TKV (Vimico), stock symbol KSV. This state-affiliated company extracts approximately 1 ton of gold annually and reported a profit of VND 1.275 trillion (around USD 52 million) in 2024.

Specifically, Vimico produced 1,143 kg of gold in 2022, 973 kg in 2023, and 852 kg in 2024. It plans to mine 911 kg in 2025 and 1,020 kg in 2026.

According to its 2026–2030 strategy, Vimico targets a total output of 4,777 kg - averaging more than 955 kg of gold per year.

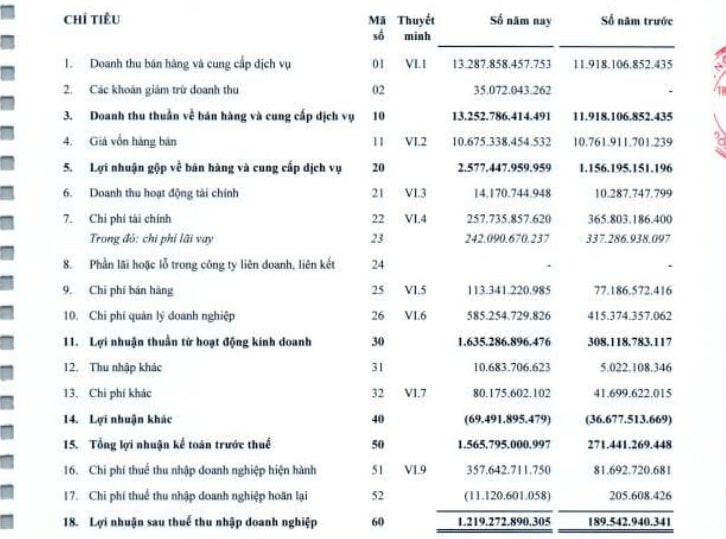

Its audited consolidated financial report for fiscal year 2024 shows revenue reached VND 13.288 trillion (USD 542 million), up from VND 11.926 trillion (USD 487 million) in 2023. After-tax profit surged to VND 1.219 trillion (USD 49.7 million), compared to VND 189.5 billion (USD 7.7 million) the year before.

With these figures, Vimico stands as Vietnam’s largest gold producer. A subsidiary of Vinacomin (Vietnam National Coal and Mineral Industries Group), the company also manages Dong Pao - the country’s largest rare earth mine, covering nearly 133 hectares in Lai Chau Province.

KSV shares are currently trading at around VND 188,000 (USD 7.65), sharply up from VND 100,000 (USD 4.07) at the beginning of the year, though still far below their peak of VND 300,000 (USD 12.20) on February 17.

Another notable name in the sector is Lao Cai Gold Joint Stock Company (GLC), although the business has been struggling in recent years, facing operational challenges and leadership turnover. From 2020 to 2023, GLC reported zero revenue.

GLC previously operated the Minh Luong gold mine in Van Ban District, Lao Cai Province, where it was licensed to extract and refine native gold ore. All output was sold to Vimico for downstream production and distribution.

However, since its mining license expired in April 2019, the company has suspended all extraction activities.

By the end of 2023, GLC was still in the process of applying for license renewal but had not yet received approval. Its short-term liabilities exceeded short-term assets by over VND 22 billion (USD 900,000), while cumulative losses had reached more than VND 113 billion (USD 4.6 million).

GLC was established in September 2007 in Minh Luong Commune, Van Ban District, Lao Cai, with an initial charter capital of VND 45 billion (USD 1.84 million). Founding shareholders included: Vietnam Minerals Corporation – TKV (33%), Minerals Company 3 – Vimico (27%), Lao Cai Minerals Company (15%), Thai Nguyen Company Ltd. (15%), and Dong Bac Company (10%).

By the end of 2018, shareholding had shifted to TKV (46.14%), Minerals Company 3 – Vimico (21.71%), Uong Huy Giang (8.65%), Bitexco Minerals Co., Ltd. (6.43%), and Indochina Minerals JSC (6.33%).

In early 2019, after GLC was listed, TKV divested entirely. Most of the company's original personnel resigned, leaving the new investors to restructure from scratch.

At the time, the company reported geological reserves of 92,670 tons of gold ore and an approved extractable reserve of 89,702 tons. Annual extraction capacities were licensed at 22,000 tons (2016), 28,000 tons (2017–2018), and 11,702 tons (2019), with the license expiring on April 26, 2019.

Recently, GLC has focused its resources on completing legal procedures to renew its investment registration and mining license. As a result, operational costs have continued to rise despite virtually no revenue from production.

Manh Ha