- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

foreign funds

Update news foreign funds

Domestic businesses in danger of being swallowed up by foreign funds

While newly registered businesses are getting smaller in scale, foreign companies and funds are growing in investment capital.

Real estate on course for foreign funding elevation

This year could see abundant cash flow in real estate, particularly from foreign funders, professional investment funds, and individual investors.

Startups expand with fresh funding and portfolios

Despite the global recession, Vietnamese startups have still been attracting millions of US dollars from foreign funds in the beginning of 2021.

Foreign funds fond of startups amidst pandemic

Although the global economy is heavily affected by Covid-19, a series of Vietnamese startups have lately obtained millions, even tens of millions of U.S. dollars, from domestic and foreign funds.

Vietnam’s startups raise funds amid pandemic

Foreign funds are still pouring millions of dollars into Vietnamese startups because many believe they will see a startup boom when the pandemic ends.

Foreign funds are still pouring millions of dollars into Vietnamese startups because many believe they will see a startup boom when the pandemic ends.

Foreign funds to exit logistics firm Gemadept

The UK-based Vietnam Investments (VI) Fund II LP plans to sell more than 58 million shares of logistics firm Gemadept JSC.

The UK-based Vietnam Investments (VI) Fund II LP plans to sell more than 58 million shares of logistics firm Gemadept JSC.

Vietnam’s startup scene picks up pace

Foreign funds tend to pour a great deal of money into Vietnamese startups with novel ideas.

Foreign funds tend to pour a great deal of money into Vietnamese startups with novel ideas.

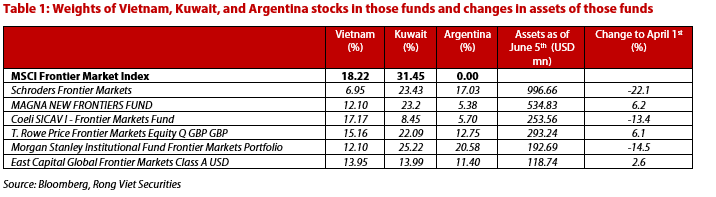

Foreign funds projected to increase Vietnam’s weights in near future

Six biggest funds, managing a combined of US$2.4 billion in assets, that benchmark to MSCI Frontier Market Index, may add Vietnam market weights in the near future.

Six biggest funds, managing a combined of US$2.4 billion in assets, that benchmark to MSCI Frontier Market Index, may add Vietnam market weights in the near future.

Foreign companies to pour big capital in Vietnam

VietNamNet Bridge - Many foreign investment funds with assets of hundreds of million of dollars are eyeing Vietnam for disbursement plans in 2019.

How Vietnam will control AIDS absent foreign funds

Nguyen Hoang Long, head of the Ministry of Health’s Department for HIV/AIDS Prevention and Control, talks to the Tuoi Tre (Youth) about plans for HIV/AIDS treatment.

Fintechs enter new development period with huge investments

VietNamNet Bridge - Fintech is not an easy playing field for startups, but the firms have been growing rapidly with capital from investment funds.

Golden opportunities expected for financial investments

A series of large state-owned conglomerates are being equitized, and the state is moving ahead with the plan to divest its shares in profitable enterprises. Many family-run businesses are calling for investment.

Foreign funds develop new strategies

VietNamNet Bridge - Though it has $112 million in a new fund, Mekong Capital has chosen to invest in only two companies, a sign that foreign investors have changed funding strategies.

BUSINESS IN BRIEF 20/8

Foreign funds reap gains of buying domestic stocks; Hanoi to host TPP talks in September; Brokers undeterred by August fears; Australian cattle export to Vietnam up 9,000 pct; Local livestock industry faces import pressure

BUSINESS IN BRIEF 29/7

Philippines is Vietnam’s second largest rice importer; Experts expect 6.27% economic growth rate in second half; FDI hits US$9.53 billion in 7 months; Monopoly in railway sector set to go; Cooking oil giant raises $24m in IPO

BUSINESS IN BRIEF 28/7

Opportunities await rice exporters; Vietnamese auto industry aims high by 2020; Foreign funds seek to invest in local tech firms; Vietnam looks to restructure transport sector by 2020; Major coastal apartment and resort projects in Danang stalled

Foreign funds withdraw more money than pour into PE firms

VietNamNet Bridge – A lot of foreign funds have withdrawn their capital from private equity firms (PE), which is attributed to the fewer good investment opportunities.

Securities now as dirt cheap as onions

The Vietnamese stocks have become cheapest than ever. Investors now keep the wait-and-see attitude and look forward to the measures to rescue the market promised by watchdog agencies.