- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

fintech

Update news fintech

Top lenders latch onto fintech future

Banks and investment funds are racing to partner up with fintech businesses in their quest towards digitalisation.

Banks and investment funds are racing to partner up with fintech businesses in their quest towards digitalisation.

Mobile payments reshaping VN banking

Vietnam is experiencing a boom in mobile payments as more and more e-wallet providers have aggressively joined the market.

Vietnam is experiencing a boom in mobile payments as more and more e-wallet providers have aggressively joined the market.

Fintech putting pressure on banks

Mr. Marc Djandji, Entrepreneur in Residence at VIISA's Fintech Lab, tells about the mark fintech is making in Vietnam.

Mr. Marc Djandji, Entrepreneur in Residence at VIISA's Fintech Lab, tells about the mark fintech is making in Vietnam.

Fintech putting pressure on banks

Mr. Marc Djandji, Entrepreneur in Residence at VIISA's Fintech Lab, talks about the mark fintech is making in Vietnam.

Mr. Marc Djandji, Entrepreneur in Residence at VIISA's Fintech Lab, talks about the mark fintech is making in Vietnam.

Vietnam considers limits on foreign ownership ratio in fintechs

Policymakers believe that the limitation on the foreign ownership ratio in Vietnam’s fintechs would help ensure transparency in payment activities, thus facilitating the development of companies.

Policymakers believe that the limitation on the foreign ownership ratio in Vietnam’s fintechs would help ensure transparency in payment activities, thus facilitating the development of companies.

In Vietnam, e-wallet is hottest segment in fintech field

Vietnam’s fintech includes payment solutions, blockchain, big data management, personal finance and group mobilization, of which payment solutions are the fastest growing segment.

Vietnam’s fintech includes payment solutions, blockchain, big data management, personal finance and group mobilization, of which payment solutions are the fastest growing segment.

The time is right for fintech firms

A typical characteristic of the 4.0 industry revolution is the faster diffusion and larger coverage of new technologies, as well as the higher speed in realizing innovative ideas.

A typical characteristic of the 4.0 industry revolution is the faster diffusion and larger coverage of new technologies, as well as the higher speed in realizing innovative ideas.

1 million workers in IT industry needed for digitalization era

Even with high pay and allowances, it is now difficult to seek and retain workers for the information technology (IT) industry.

Even with high pay and allowances, it is now difficult to seek and retain workers for the information technology (IT) industry.

Vietnam’s fintechs appear late but develop rapidly

VietNamNet Bridge - Vietnam’s fintech market was valued at $4.4 million by the end of 2017, and the figure may reach $7.8 billion by 2020, a study of Solidiance found.

Is QR Payment technologically preeminent?

Making payment via QR Code is now popular in Vietnam as a series of commercial banks, e-wallets and intermediary payment institutions have launched QR Pay feature on mobile apps and mobile banking services.

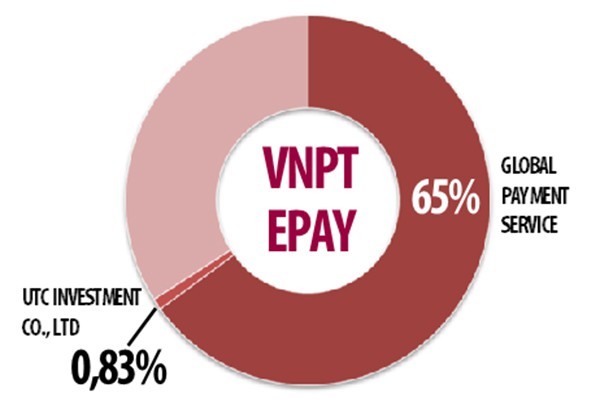

Payment fintechs hunted by big tycoons

VietNamNet Bridge - Many M&A deals have been reported recently which target fintechs operating in the field of payment services. Big investors are behind the deals.

Investment funds’ money funnelled to technology firms

VietNamNet Bridge - More large-scale investment funds are being set up, and the value of investment deals is increasing, especially in technology startups.

Vietnamese startups struggle to seek capital

VietNamNet Bridge - Consultants say that even startups with high capability and good business ideas are finding it difficult to call for investment.

Fintechs causing big changes in financial market

VietNamNet Bridge - Vietnam’s small and medium enterprises (SMEs) are expected to be the key clients and biggest beneficiaries from financial apps provided by fintechs.

Developing consumer finance in VN – a road full of pitfalls

VietNamNet Bridge - The rapid growth of the consumer finance market reflects the high demand in the market. However, there are still barriers, including high interest rates and limited risk management capability of service providers.

Fintech changing the domestic finance system

Fintechs have developing rapidly in Vietnam, attracting capital from both domestic and foreign investors, and receiving special attention from commercial banks and state management agencies.

Fintech changes financial landscape

A handful of winners have been named in a large-scale fintech challenge, providing inspiration and opportunities for many other fintechs to capture.

Vietnam’s fintech market value expected to reach $8 billion by 2020

VietNamNet Bridge - Finance technology solutions are growing rapidly in Asia Pacific. In Vietnam, all conditions are favorable to pave the way for the fintech market to boom.

The lenders and debtors in the 4.0 era

‘Debtors’ in the future in Vietnam will regularly connect to the internet and buy goods online, while ‘lenders’ will be fintechs which can take full advantage of high technology to approach targeted clients and design reasonable credit packages.

Fintechs, with technology and big data, jump into consumer lending market

VietNamNet Bridge - Commercial banks are becoming digitalized, while fintechs, with great advantages in technology, have joined the consumer lending market.