- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

Fed

Update news Fed

Central banks brace after new Fed move

Central banks across the globe have announced their recent rate hike in a bid to tame inflation, but market watchdogs predict that the tempo of rate rises is starting to slow down.

VN central bank shifts up interest rates to combat US Fed adjustments

After the State Bank of Vietnam implemented the new operational interest rate on September 23, all joint-stock commercial banks, with the exception of state-owned ones, have adjusted the deposit interest rate for most terms.

Businesses want more than just an interest rate cut, seek bailout

Not putting high hopes on the interest rate cuts made by the State Bank of Vietnam (SBV) recently, the market is still waiting for a bailout to cover all business fields.

Not putting high hopes on the interest rate cuts made by the State Bank of Vietnam (SBV) recently, the market is still waiting for a bailout to cover all business fields.

What benefits can Vietnam’s economy expect from an interest rate cut?

The US FED has launched an unprecedented bailout to help the economy cope with Covid-19. Meanwhile, the State Bank of Vietnam (SBV) has cut the 1-6 month term deposit interest rate ceiling.

The US FED has launched an unprecedented bailout to help the economy cope with Covid-19. Meanwhile, the State Bank of Vietnam (SBV) has cut the 1-6 month term deposit interest rate ceiling.

Loosening monetary policy means ‘trying to extinguish fire with oil’

Many experts believe that loosening the monetary policy won’t help much in the context of Covid-19, saying that it will do more harm than good.

Many experts believe that loosening the monetary policy won’t help much in the context of Covid-19, saying that it will do more harm than good.

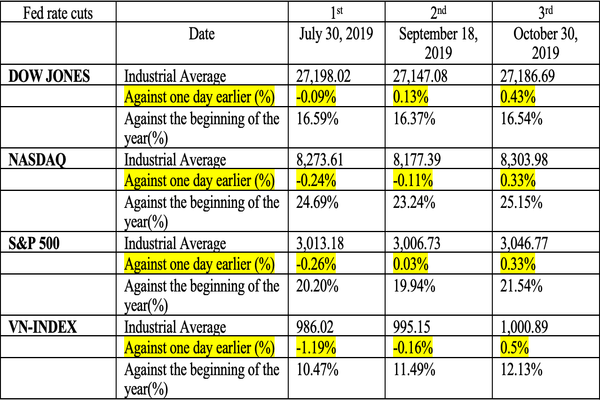

Vietnam’s financial markets respond positively to Fed rate cut

This time, Vietnam’s stock market responded differently compared to the previous two rate cuts with minimal impacts.

This time, Vietnam’s stock market responded differently compared to the previous two rate cuts with minimal impacts.

Good short-term effects for Vietnam after Fed's rate cut

The US Federal Reserve’s latest rate cut will benefit commodity and equity markets in the short term, according to specialist Nguyen Tri Hieu.

The US Federal Reserve’s latest rate cut will benefit commodity and equity markets in the short term, according to specialist Nguyen Tri Hieu.

VN Central Bank takes steps to shrink dollar credit

VietNamNet Bridge - Having bought a large amount of foreign currency to increase forex reserves, the State Bank (SBV) is continuing its strategy to downsize foreign currency credit.

Macroeconomic indexes support VND: experts

VietNamNet Bridge - The US FED’s ‘less hawkish policy’ on raising interest rate has affected the exchange rate for the Vietnamese dong this year.

Banks’ liquidity unexpectedly getting tight

Since the beginning of August, the interbank interest rates have stayed at high levels of 4.5-4.6 percent per annum for overnight, 1-week, 2-week and 1-month term loans, the highest rates since late 2016.

Foreign capital flow into VN depends on FED moves

The US Federal Reserve plans to raise the prime interest rate of the dollar once more, while the 10-year term US government bond interest rate has exceeded the 3 percent per annum threshold.

Vietnam should prepare for US Fed’s rising prime interest rate

The US Federal Reserve may adjust the prime interest rate once more, according to Can Van Luc, chief economist of the Bank for Investment & Development of Vietnam (BIDV).

Fed announces US rate increase

The US central bank has said it will raise its benchmark interest rate citing a strengthened economic outlook.

Federal Reserve policymakers more confident about economy

The US Federal Reserve is preparing for stronger-than-expected economic growth this year, a view that boosts the case for higher interest rates.

US weak-dollar policy to have impact on Vietnam economy

VietNamNet Bridge - As the State Bank of Vietnam (SBV) pursues a stable dong/dollar exchange rate policy, the depreciation of the US dollar in the world market will also lead to the weakening of the dong.

USD continue to flow into stock market

VietNamNet Bridge - Commercial banks say that people are converting dollar into dong and investing dong in securities.

US Federal Reserve raises interest rates again

The US Federal Reserve has raised interest rates by 0.25%, the third rate rise in 2017.The US central bank said the move, which was widely expected, underscores "solid" gains in the US economy.

Vietnam’s forex reserves climb to record high

Vietnam needs a gradual sustainable increase in forex reserves, rather than a shocking increase as seen in the last two years, according to analysts.

After the flood, Fed likely to see little change in economy, policy course

The economic fallout from Hurricane Harvey will make the Federal Reserve’s job more difficult when it meets in three weeks, but U.S. central bankers have looked past major storms before with little change in monetary policy

Dollar holds firm before Fed minutes, stocks rise

The dollar held on to big gains on Wednesday before minutes of the U.S. Federal Reserve's latest meeting, while European shares followed Asian stocks higher.