- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

e-wallet

Update news e-wallet

More than 34 million e-wallets active

More than 34 million e-wallets were active as of June 30, accounting for 59 per cent of the total 58 million activated e-wallets.

E-wallet faces intense competition against VietQR, bank apps

Amid increasingly fierce competition in the digital payments sector, e-wallets are facing significant challenges to maintain their long-term viability.

Four out of five Vietnamese consumers use e-wallet

Of every five Vietnamese consumers, four use e-wallets regularly. Most are Gen X or luxury consumers, according to a report released by Visa on March 19 in HCM City.

E-wallets, banks are being used to buy cryptocurrencies

On Metamask, different payment methods using e-wallets, domestic banks and VietQR have appeared, serving Vietnamese who buy cryptocurrencies.

Businesses must rely on data to compete with rivals

Tran Tinh Minh Triet, solution director of SAP Vietnam, has emphasized the need for business data amid the era of digital transformation.

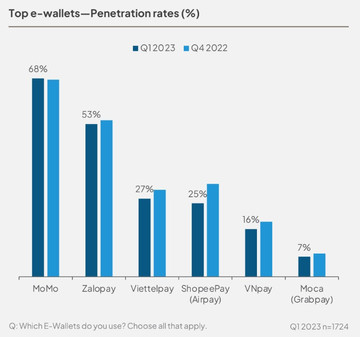

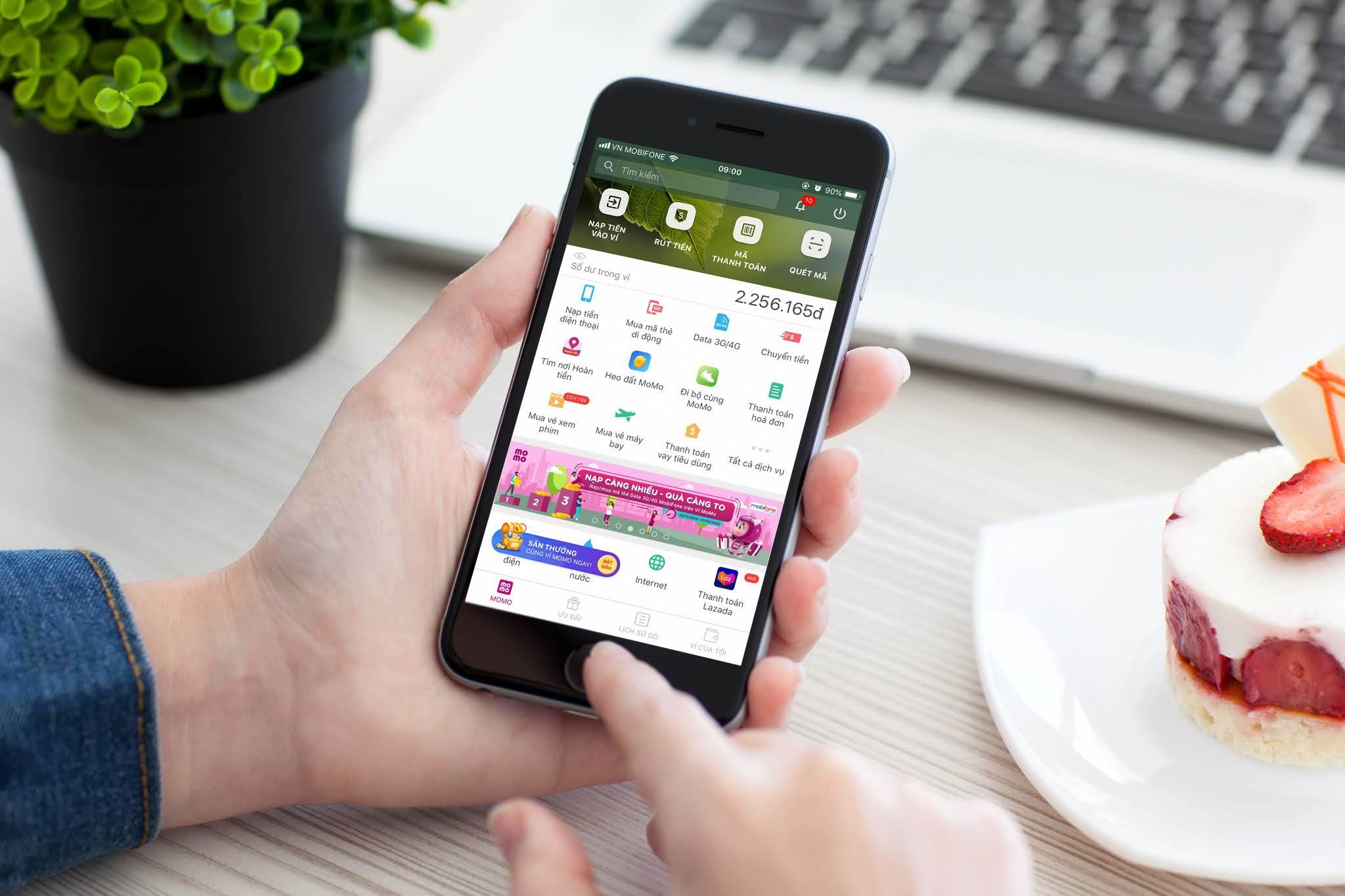

What is the most popular e-wallet in Vietnam?

A report by Decision Lab shows important information about the Vietnamese e-wallet market. Unicorn MoMo is leading in terms of popularity.

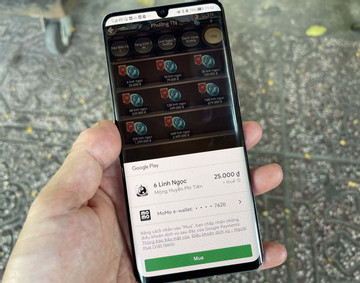

Pirated games flood the market as discounts are slashed on app stores

With app stores’ decisions to reduce discounts and support from payment service providers such as credit cards and e-wallets (MoMo), pirated games of international distributors, especially Chinese games, can easily enter Vietnam.

E-wallet market in Vietnam estimated to reach 50 million users by 2024

The modern e-wallet market in Viet Nam is surging and is expected to reach 50 million active users by July 2024, experts said.

Nearly 60% of digital consumers in Vietnam use fintech solutions

Vietnam is a top market in adopting new technologies, in which 58% of digital consumers have used online banking solutions, e-wallets, money transfer applications, and digital banking.

Non-cash payments to change status of digital economy

From Q1 2021 to Q1 2022, the number of online transactions in Vietnam increased twofold, and transaction value increased by three times. These are important factors that help develop the digital economy.

E-wallets: new competition emerges amid pandemic

Scanning a code to pay for products and services has become popular among consumers in Vietnam’s big cities. Under the impact of the Covid-19 pandemic, non-cash payments have been growing rapidly.

“Super apps”: aspiration of Southeast Asian businesses

Southeast Asian companies are in the race to develop their own super apps. Some Internet businesses are expanding beyond their core businesses to offer services such as on-demand transportation, food delivery and telemedicine.

E-wallets need 'sandbox' to boom

There are about 40 e-wallets for 97 million people. Vietnam, a market with nearly 100 million people, a part of the Southeast Asian market with 700 million people and dominated by cash payments, is attractive to big players.

SBV combats illegal gambling and betting activities through e-wallets

The State Bank of Vietnam is intensifying investigations to fight against illegal gamblings via e-wallets, following recent media reports covering allegations related to MoMo's e-wallet.

Revenue, number of users of e-wallets double

Over the past two years, the pandemic has had a strong impact on digital transformation in general and cashless payments in particular.

Revenue, number of users of e-wallets double

Over the past two years, the pandemic has had a strong impact on digital transformation in general and cashless payments in particular.

Vietnam sees boom in e-wallet market

Vietnam records one of the highest e-payment growth rates in the world, about 35% per year.

E-wallet, QR Code favored by Vietnamese

Forms of digital payment have become more popular in Vietnam, particularly e-wallets and QR codes.

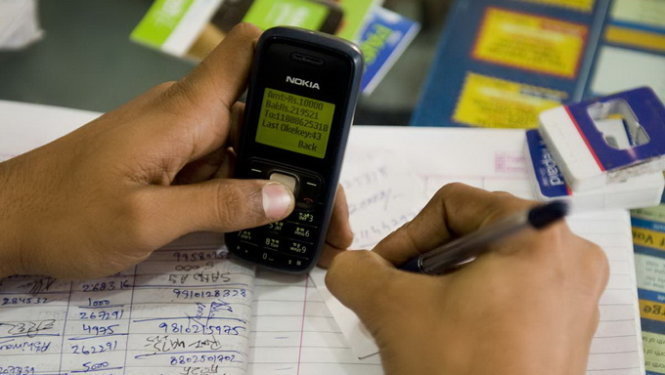

Fintechs to partner with telecom carriers to offer Mobile Money

The pilot program on providing the Mobile Money service is expected to increase non-cash transactions, especially in remote areas. To improve users' experience, fintechs should work with network operators, experts say.

Mobile Money to increase pressure on banks

The payment market is expected to see big changes with the appearance of Mobile Money.