- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

e-wallet

Update news e-wallet

E-wallets still competing for slice of the payment pie

Ewallets are still not reporting profits, though they have been making heavy investments in their businesses.

Ewallets are still not reporting profits, though they have been making heavy investments in their businesses.

Which road will fintech take?

According to PricewaterhouseCoopers, fintech startups have attracted $40 billion worth of investment over the last four years. Asia Pacific alone received $15 billion worth of investment in fintechs in 2018.

According to PricewaterhouseCoopers, fintech startups have attracted $40 billion worth of investment over the last four years. Asia Pacific alone received $15 billion worth of investment in fintechs in 2018.

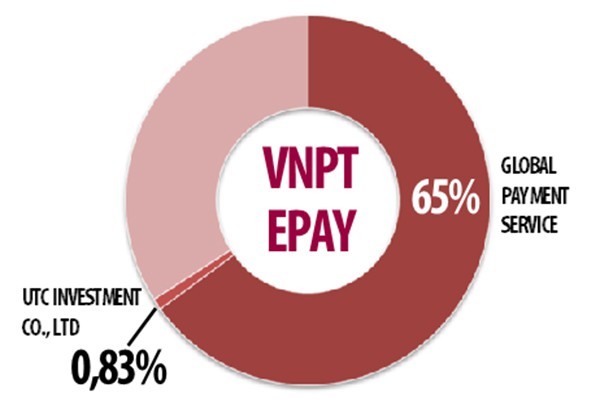

Foreigners make up 90 percent of e-wallet market share

E-wallets are believed to be a very promising business field in Vietnam, but the market is now controlled by foreign firms.

E-wallets are believed to be a very promising business field in Vietnam, but the market is now controlled by foreign firms.

Cashless payments making steady inroads

Attempts to date to move the population away from their preference for cash need to be continually built upon.

Attempts to date to move the population away from their preference for cash need to be continually built upon.

Vietnam considers limits on foreign ownership ratio in fintechs

Policymakers believe that the limitation on the foreign ownership ratio in Vietnam’s fintechs would help ensure transparency in payment activities, thus facilitating the development of companies.

Policymakers believe that the limitation on the foreign ownership ratio in Vietnam’s fintechs would help ensure transparency in payment activities, thus facilitating the development of companies.

In Vietnam, e-wallet is hottest segment in fintech field

Vietnam’s fintech includes payment solutions, blockchain, big data management, personal finance and group mobilization, of which payment solutions are the fastest growing segment.

Vietnam’s fintech includes payment solutions, blockchain, big data management, personal finance and group mobilization, of which payment solutions are the fastest growing segment.

The time is right for fintech firms

A typical characteristic of the 4.0 industry revolution is the faster diffusion and larger coverage of new technologies, as well as the higher speed in realizing innovative ideas.

A typical characteristic of the 4.0 industry revolution is the faster diffusion and larger coverage of new technologies, as well as the higher speed in realizing innovative ideas.

E-payments becoming easier than ever

E-payment channels are flourushing but few people are choosing the payment channels.

E-payment channels are flourushing but few people are choosing the payment channels.

Could foreign e-wallets lead to a foreign currency drain?

Nepal on May 21 imposed a ban on transactions with Chinese e-wallets Alipay and WeChat Pay in the country. What about Vietnam?

Nepal on May 21 imposed a ban on transactions with Chinese e-wallets Alipay and WeChat Pay in the country. What about Vietnam?

Will virtual stores become popular in Vietnam?

The first virtual store has opened in Vietnam, giving more choices to shoppers. However, it is still unclear if it will become a new trend.

The first virtual store has opened in Vietnam, giving more choices to shoppers. However, it is still unclear if it will become a new trend.

Investors spend big money to develop payment tools

An intermediary payment tool is the goal of many businesses, which want to develop their own ecosystems.

An intermediary payment tool is the goal of many businesses, which want to develop their own ecosystems.

Vietnam to removes daily transaction limit for e-wallet users

Following the removal of the limit, Vietnam’s central bank said it would only maintain the monthly limit of VND100 million (US$4,284) for each individual.

Following the removal of the limit, Vietnam’s central bank said it would only maintain the monthly limit of VND100 million (US$4,284) for each individual.

E-wallets boom, struggle to survive amid competition

Nearly 30 e-wallets have been licensed, but only a few of them have real users.

Nearly 30 e-wallets have been licensed, but only a few of them have real users.

VN Central Bank attempts to set limits on transaction value via e-wallets

The attempted restriction on transaction value via e-wallet has faced strong opposition from both wallet users and goods and service providers.

The attempted restriction on transaction value via e-wallet has faced strong opposition from both wallet users and goods and service providers.

Users concerned about e-wallet security

VietNamNet Bridge - The simple procedures required for remittance and payment transactions have sparked doubt about the security of e-wallets.

Payment for public services: gold mine for banks

VietNamNet Bridge - Money collection services have brought big money to commercial banks.

Who will win the fintech vs bank-pay battle?

At least 1.3 million e-transactions are processed through NAPAS, the national payment system, and commerce banks, on average, each day, according to a report.

Is QR Payment technologically preeminent?

Making payment via QR Code is now popular in Vietnam as a series of commercial banks, e-wallets and intermediary payment institutions have launched QR Pay feature on mobile apps and mobile banking services.

Payment with QR code booms in Vietnam

VietNamNet Bridge - Payments for many different kinds of goods and services, from air tickets to electricity bills, can be made by scanning QR codes with mobile cameras.

E-wallets struggle to find users

VietNamNet Bridge - More than 20 e-wallets have been jostling for market share in Vietnam, which is believed to be a potential market. However, it is not easy to find users.