- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

devaluation

Update news devaluation

Vietnam central bank fighting against dollarization

The level of dollarization of an economy is based on the ratio of foreign currency deposits to total money supply (M2), or total deposits; and the ratio of outstanding foreign currency loans to M2, or total outstanding loans.

The level of dollarization of an economy is based on the ratio of foreign currency deposits to total money supply (M2), or total deposits; and the ratio of outstanding foreign currency loans to M2, or total outstanding loans.

Vietnam will not use exchange rate as tool to boost exports: central bank

The central bank believes that for an open economy like Vietnam, the sharp devaluation of the local currency will not help boost exports, but will do more harm than good.

The central bank believes that for an open economy like Vietnam, the sharp devaluation of the local currency will not help boost exports, but will do more harm than good.

Vietnam’s forex reserves peak at $70 billion

After two big purchases of foreign currencies in the first four months of the year and from July until now, Vietnam’s forex reserves reached the highest level, now at $70 billion.

After two big purchases of foreign currencies in the first four months of the year and from July until now, Vietnam’s forex reserves reached the highest level, now at $70 billion.

Where will manufacturers go if US-China trade war gets worse?

Will Vietnam be chosen as the destination for investors who plan to move out of China?

Will Vietnam be chosen as the destination for investors who plan to move out of China?

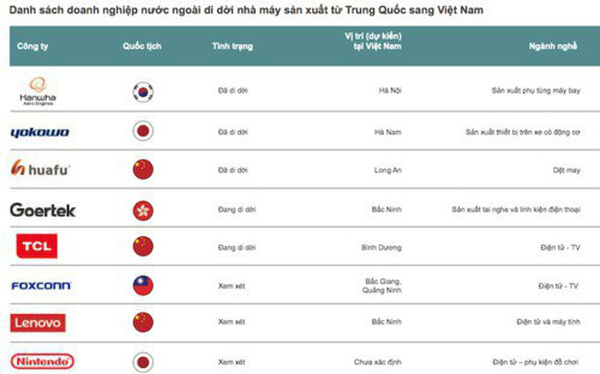

Industrial conglomerates leave China, head for Vietnam

Foxconn (Taiwan), TLC and Lenovo (China), Hanwa (South Korea) and Yokowo (Japan) are relocating their factories to Vietnam as a shelter from the ‘storm’ of the US-China trade war.

Foxconn (Taiwan), TLC and Lenovo (China), Hanwa (South Korea) and Yokowo (Japan) are relocating their factories to Vietnam as a shelter from the ‘storm’ of the US-China trade war.

Vietnam’s businesses fear getting involved in US-China trade war

Businesses have expressed concern over the escalation of the US-China trade war, and are hurrying to seek solutions to anticipated problems.

Businesses have expressed concern over the escalation of the US-China trade war, and are hurrying to seek solutions to anticipated problems.

Can CNY payments help control the underground economy in border areas?

SBV has allowed CNY for payment for goods, hoping that the decision will help promote cross-border trade, create favorable conditions for trade, and control underground transactions.

Business continue to worry about exchange rate fluctuations

VietNamNet Bridge - The currencies of many countries have depreciated sharply against the dollar, thus affecting the competitiveness of Vietnam’s goods.

Dollar up on flea market; hits new SBV ceiling rate

Dollar rates soared in the flea market and touched the latest ceiling rate set by the State Bank of Viet Nam in commercial banks August 24.

VND will be devaluated, but when and how?

VietNamNet Bridge – Vietnam considers devaluating the dong in an effort to boost the export after a long period of keeping the dong/dollar exchange rate stable.

Dollar price increase raises rumor about dong devaluation

Commercial banks all have raised the dollar selling price to the ceiling level of VND21,036 per dollar. The State Bank’s Exchange late last week quoted the selling price at VND21,360 per dollar.