|

| Consumers beware of e-swindlers preying on fledgling cashback apps - illustration photo |

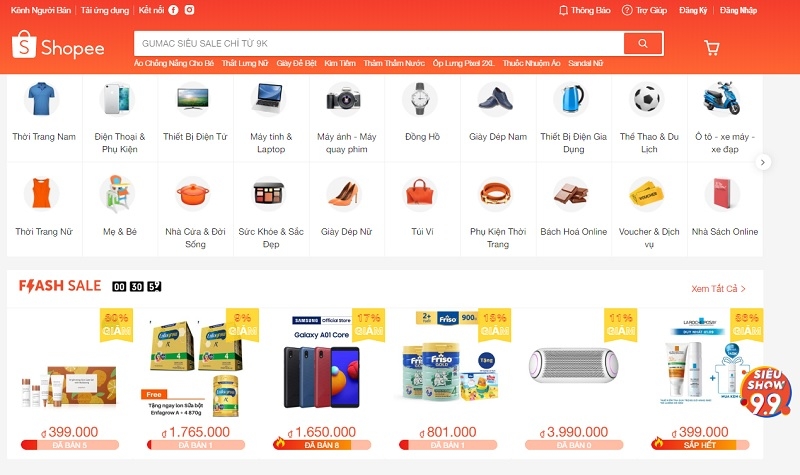

The increasing number of internet users, rising internet penetration, and steady increase of the share of e-commerce in total retail sales in Vietnam make it a core and high-potential market for modern cashback applications attempting to succeed in the digital space, with large marketplaces such as Shopee, Lazada, Tiki, and Sendo already experiencing record-breaking growth in the past year.

However, the Vietnam Competition and Consumer Protection Authority (VCCA) under the Ministry of Industry and Trade has warned about scam activities on numerous cashback websites and apps after police in the southern province of Binh Phuoc uncovered violations.

According to a police report in the province, there has been an increase in Facebook accounts posting statuses and sharing videos related to consumer rewards app MyAladdinz, encouraging people to install the programme on their smartphones. One person in the province even organised a conference to introduce the app.

MyAladdinz offers to pay electricity and water bills, tuition, and insurance fees, as well as buy houses and cars on a hire purchase plan. The highlight of the app is that users can earn up to 80 per cent cashback for bills and payment. The more people who use the app regularly, the more cashback rewards they can enjoy.

However, in order to enjoy these incentives, users are forced to place at least $100 into the account and share their private information. The money is converted into “gems”, each one costing $1. The cashback rewards after each transaction are only calculated with gems instead of real money.

Simultaneously, if users invite other people to install this app, they will enjoy commission similar to multi-level marketing models.

According to Binh Phuoc Police, this app has yet to be licensed by any state agencies. MyAladdinz does not conduct any trading or manufacturing activities to create products and services.

In reality, the model uses the money put in by latter participants to pay commission for previous ones. Once there are no more new participants, the system is prime for collapse. In addition to that, users face the risk of their personal data being used for illegal purposes.

In order to prevent an increase in such scams, the VCCA has warned customers about cashback-related programmes. Users are asked to seriously consider the possible outcomes before installing apps that offer rewards equivalent to 80-100 per cent of each purchase they make, as usually rewards are mostly presented in points and users receive only a tiny fraction of the reward in cash.

Besides that, the points used by some cashback websites and apps are related to certain types of cryptocurrency or e-wallets such as Gem, CBP, Silling, USDT, and VNDC, which are not recognised by Vietnamese laws. Therefore, consumers will not be protected by the laws if any disputes arise.

Meanwhile, the cashback playground has attracted more legitimate players from overseas in the shape of startups and banks. In early August, leading rewards and discovery platform ShopBack debuted its cashback website and app.

Accordingly, online shoppers in Vietnam can now earn up to 25 per cent cashback from the group’s Vietnamese roster of over 150 merchants.

According to Jacky Ha, commercial director of ShopBack Vietnam, the biggest challenge since day one has been consumer education as the cashback concept has existed for decades in other countries but is still relatively new in Asia-Pacific.

“Furthermore, consumers in this region tend to be more conservative and can be wary about being ‘paid’ to shop online, even though it is completely free of charge to create an account and use ShopBack,” Ha explained.

“It is an uphill task to first capture consumers’ attention in the crowded online retail scene and educate them about ShopBack’s service and credibility before we can persuade them to embrace and use the service.”

At the end of the day, Ha added, if it sounds too good to be true, it probably is. “Consumers should exercise caution when faced with such a situation,” he added.

Shopback is affiliated with merchants that reward commission for referring customers to shop on their sites. Shopback then shares a portion of that commission with the consumer.

Vietnam has the third-largest population in Southeast Asia and has a sizable and young consumer base with growing disposable income – 70 per cent of the population is under 35 years of age and its emerging middle-class is expected to reach 26 per cent of the population by 2026.

With the potential reach for bright new startups as well as unscrupulous fraudsters, consumers are being urged to carry out research and exercise caution and common sense when dealing with unknown and dubious sites promising to reward cashback.

Van Oanh

Users warned over new 'cashback' apps

The Vietnam Competition and Consumer Protection Authority (VCCA) has issued a warning over cashback apps which lack transparency and showed signs of illegal multi-level marketing.