- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: [email protected]

commercial banks

Update news commercial banks

Banks likely to enjoy big fat earnings again this year

Though the fiscal year 2019 is yet to end, early reports suggest major commercial banks in Vietnam will enjoy big fat earnings this year.

Though the fiscal year 2019 is yet to end, early reports suggest major commercial banks in Vietnam will enjoy big fat earnings this year.

Chinese P2P lenders flock to Vietnam

After the lending model collapsed in China, many P2P lenders flocked to Vietnam to seek opportunities in the country.

After the lending model collapsed in China, many P2P lenders flocked to Vietnam to seek opportunities in the country.

Banks rush to issue bonds ahead of capital requirement deadline

Rising medium- and long-term capital demands to meet stricter regulations on credit safety limits and capital adequacy early next year were putting pressure on commercial banks to issue bonds in the final months of the year, experts said.

Rising medium- and long-term capital demands to meet stricter regulations on credit safety limits and capital adequacy early next year were putting pressure on commercial banks to issue bonds in the final months of the year, experts said.

Vietnam’s credit growth projected to reach 10-year low of 13.2% in 2019

The slow growth comes mainly from state-owned banks, which have become more stringent on their loan disbursements.

The slow growth comes mainly from state-owned banks, which have become more stringent on their loan disbursements.

Vietnam's banks get more support to cut interest rates

Commercial banks are expected to lower lending interest rates after getting more support to cut input costs from the State Bank of Viet Nam (SBV)’s...

Commercial banks are expected to lower lending interest rates after getting more support to cut input costs from the State Bank of Viet Nam (SBV)’s...

Vietnam's banking sector sees series of M&A deals

Many M&A deals in the banking sector have wrapped up recently amid continued influx of foreign investment in Vietnam.

Many M&A deals in the banking sector have wrapped up recently amid continued influx of foreign investment in Vietnam.

Vietnamese banks look to Asian investors for more capital

Some small banks in Vietnam are seeking investors from Asia such as South Korea, China and Japan.

Some small banks in Vietnam are seeking investors from Asia such as South Korea, China and Japan.

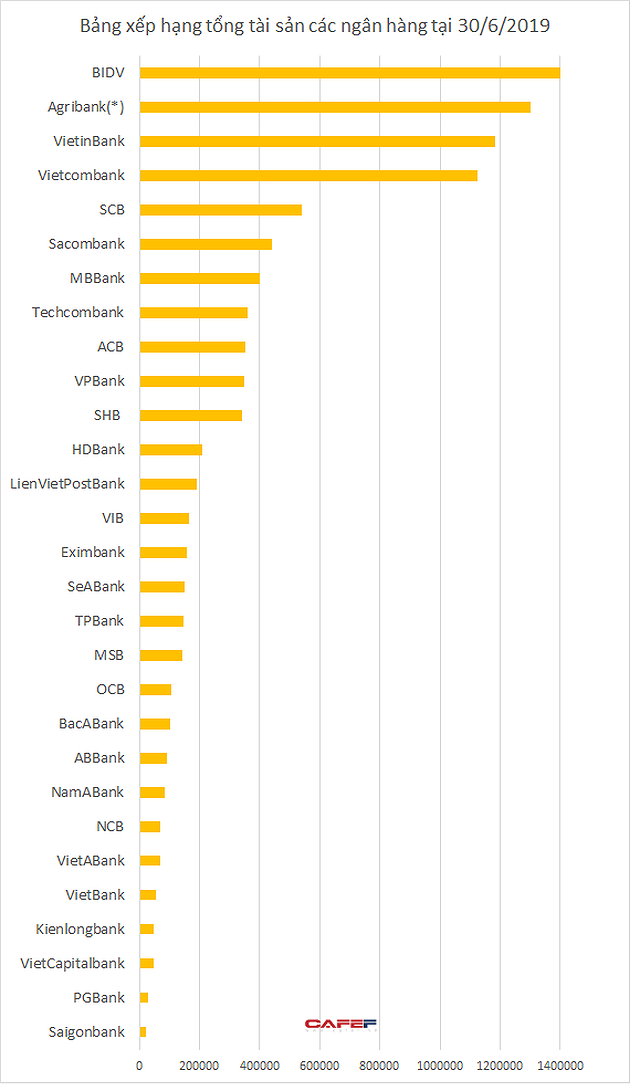

How big are Vietnamese banks?

The 11 top commercial banks have total assets of over $10 billion, while nearly 15 smallest banks have l total assets of less than VND100 trillion. The rankings of banks have changed a lot over the last decade.

The 11 top commercial banks have total assets of over $10 billion, while nearly 15 smallest banks have l total assets of less than VND100 trillion. The rankings of banks have changed a lot over the last decade.

Banks to face worker shortage in 4.0 industrial era

More than 56 percent of banks recruited new workers in Q3, but 26.6 percent said they still lacked workers, while more than 61 percent of banks planned to recruit more workers in the fourth quarter, a report says.

Fintech changes financial landscape

A handful of winners have been named in a large-scale fintech challenge, providing inspiration and opportunities for many other fintechs to capture.

The lenders and debtors in the 4.0 era

‘Debtors’ in the future in Vietnam will regularly connect to the internet and buy goods online, while ‘lenders’ will be fintechs which can take full advantage of high technology to approach targeted clients and design reasonable credit packages.

VN considers allowing private investors to access ODA

VietNamNet Bridge - Economists agree that private investors should also be allowed access to official development assistance capital, but warn that credit may be used improperly.

Banks begin tightening screws on property credit

VietNamNet Bridge – Huynh Quang Khanh invests in real estate by leveraging credit.

Foreign investors pouring more money in Vietnamese fintech firms

Foreign investment funds and technology firms have poured hundreds of millions of dollars in Vietnamese fintech firms in anticipation of an increase in non-cash payments in the country.

A prosperous year for Viet Nam’s banking industry

VietNamNet Bridge – Profits of many commercial banks this year will hit the highest levels since 2012 thanks to rising capital demand, experts have forecast.

2016 – a peaceful year for banks

VietNamNet Bridge - Dong and foreign-currency liquidity was plentiful throughout the year. The interest rate was stable at a five-year low while the dong/dollar exchange rate was also stable with the dong depreciating by 1.2 percent.

Capital, though plentiful, still cannot be easily disbursed

Commercial banks have pumped VND5,000 trillion into to the economy so far this year. But funds raised from banks through government bond issuances are still waiting to be disbursed.

Bankers suggest lifting foreign ownership ratio ceiling

While Vietcombank and VietinBank have proposed to lift the foreign ownership ratio ceiling to 35-40 percent to satisfy requirements of the Basel II Accord, ABBank and SCB want higher foreign ownership ratios to speed up the restructuring process.

Newly appointed State Bank Governor to settle bad debts

VietNamNet Bridge - The Governor of the State Bank of Vietnam (SBV) Le Minh Hung, as soon as he took office, released two documents with instructions to settle commercial banks’ debts.

New expansion wave in banking sector begins

VietNamNet Bridge - Commercial banks are rushing to set up more branches and transaction offices after a long period of interruption.