Vietnam's power expansion is predicted to continue being largely driven by coal despite increasing pressures on the fuel source of late, Fitch Solution has said in a report.

The National Steering Committee for Power Development has recommended scaling the share of coal down for the upcoming Power Development Plan (PDP) VIII, eliminating nearly 15GW of planned coal projects and for coal to account only 37% of Vietnam’s electricity by 2025, due to slow progress and environmental opposition to in some coal projects.

|

|

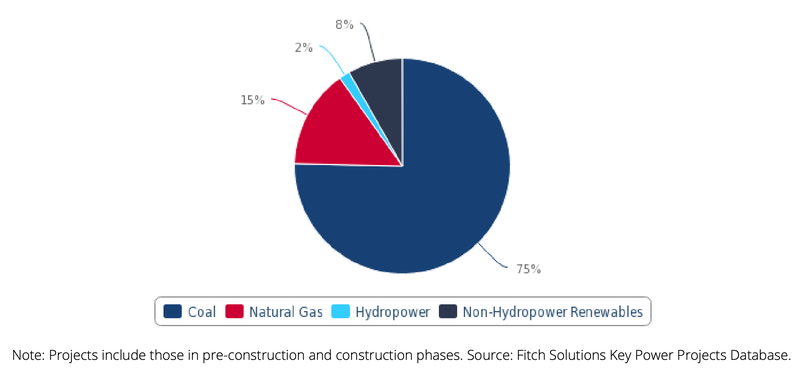

Vietnam - Capacity of Power Project Pipeline by Fuel Type, MW.

|

According to Fitch, the government initially had a coal capacity target of 106 gigawatts (GW) by 2025, and for an additional 55GW of coal capacity from 2017 to 2030. There is yet to be a decision made on capacity targets, and it is expected that the government is likely to retain an ongoing commitment to coal at present.

Fitch Solutions referred to its key project database that there are more than 17GW of coal power plants that are already under construction, and almost another 29GW under preconstruction stages.

“It is unclear how the government will halt the development of these projects that are already under construction without incurring significant compensation costs,” it said.

Furthermore, Vietnam is facing looming threats of power shortages over the coming years, given an expected surge in power demand, and has in fact been trying to fast-track the development of some of these projects since 2019.

|

|

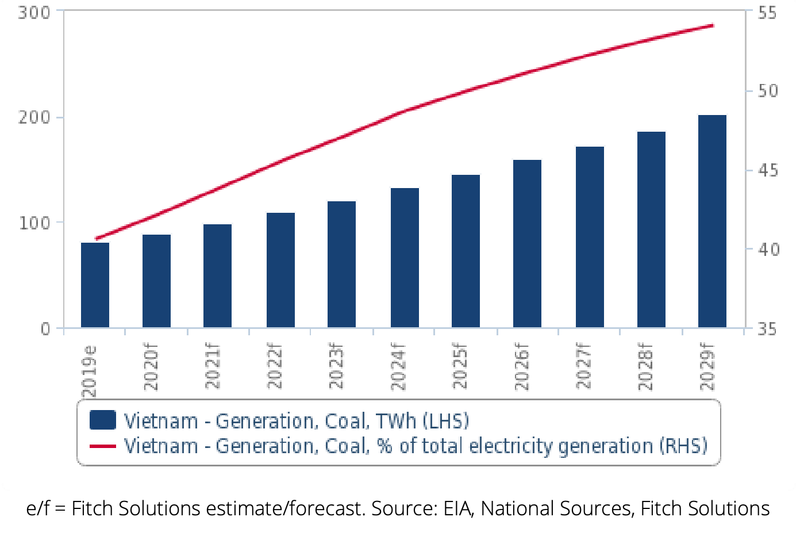

Vietnam - Coal Power Generation, TWh and % of Total Power Generation.

|

It is clear that the government is prioritizing the development of the power sector in general to support the country’s strong economic growth. Meanwhile, coal remains the most practical option in the near-term to stimulate affordable electricity generation growth at the pace and scale needed by the country, given its affordability, accessibility and reliability, stressed Fitch.

A key supportive factor for continued coal-fired power growth is the continued access to financing from China and South Korea. While a shifting international financing environment for coal amid environmental concerns possess some downside risks, it is expected that alternative financing sources, particularly from China, will likely remain forthcoming.

|

|

Vietnam - Total Power Capacity by Type, MW

|

Fitch’s report noted that the 1,200MW Vung Ang 2 and 1,980MW Vinh Tan 3 coal-fired power plants have come under the spotlight following OCBC Bank, Standard Chartered Bank and HSBC Bank recent announcements to withdraw financing from the plants. Japan, a key financing source in the region, is also looking towards reviewing their coal financing and export policies by end of June 2020.

That said, most Chinese and South Korean banks, which form a substantial majority to Vietnam’s coal financing, have not flagged any commitments to exit coal yet. Crucially, these countries aim to generate external demand for coal power equipment through the use of their respective export credit agencies, amid a decline in domestic coal power markets.

Fitch stressed that many banks with effective coal bans also have financing loopholes and exemptions, which unlock funding for certain projects in light of its importance to economic development. As such, the extent and scope of Japan’s coal financing review also remains uncertain at present, said Fitch. Hanoitimes

Ngoc Thuy

Ford expansion’s impact on Vietnam’s vehicle output muted by imports: Fitch Solutions

U.S. automaker Ford Motors’ latest announcement that it intends to expand its Vietnamese plant will provide only a modest boost to the country’s vehicle output over this year and next, according to Fitch Solutions.

Wuhan coronavirus could negatively affect Vietnam's economy: Fitch

Vietnam last year received some 18 million foreign tourists, including 5.8 million Chinese guests.

Coal remains the most practical option in the near-term to stimulate affordable electricity generation growth at the pace and scale needed by the country, said Fitch Solutions." itemprop="description" />

Coal remains the most practical option in the near-term to stimulate affordable electricity generation growth at the pace and scale needed by the country, said Fitch Solutions." itemprop="description" />