Boeing’s prediction about demand for commercial aircraft shows that the global market needs 44,000 aircraft from now to 2043, including 33,380 narrow-body and 8,065 wide-body aircraft.

As such, the world would need 2,000 aircraft each year. Meanwhile, the average capacity of Boeing and Airbus, the two manufacturers that make up 99 percent of total civil aircraft sold in the world, can provide 600-800 aircraft a year, and no more than 900.

Experts said the two manufacturers can satisfy demand only if they increase production capacity by twofold.

Boeing and Airbus have high numbers of vendors at different levels in their supply chains, from small spare part manufacturers to system integrators and assemblers.

Duong Nguyen Thanh, deputy chair of Giza Industrial Investment Holding Group, said about 500-600 Airbus A320s are put out each year.

In addition to French, German, British and Spanish enterprises which specialize in manufacturing and supplying different aircraft components and spare parts, Chinese enterprises are also a link in the supply chain, which mostly undertakes jobs of assembling and completing aircraft (many Chinese air carriers require aircrafts to be assembled and completed in the country).

In general, there are six levels in the aviation supply chain structure.

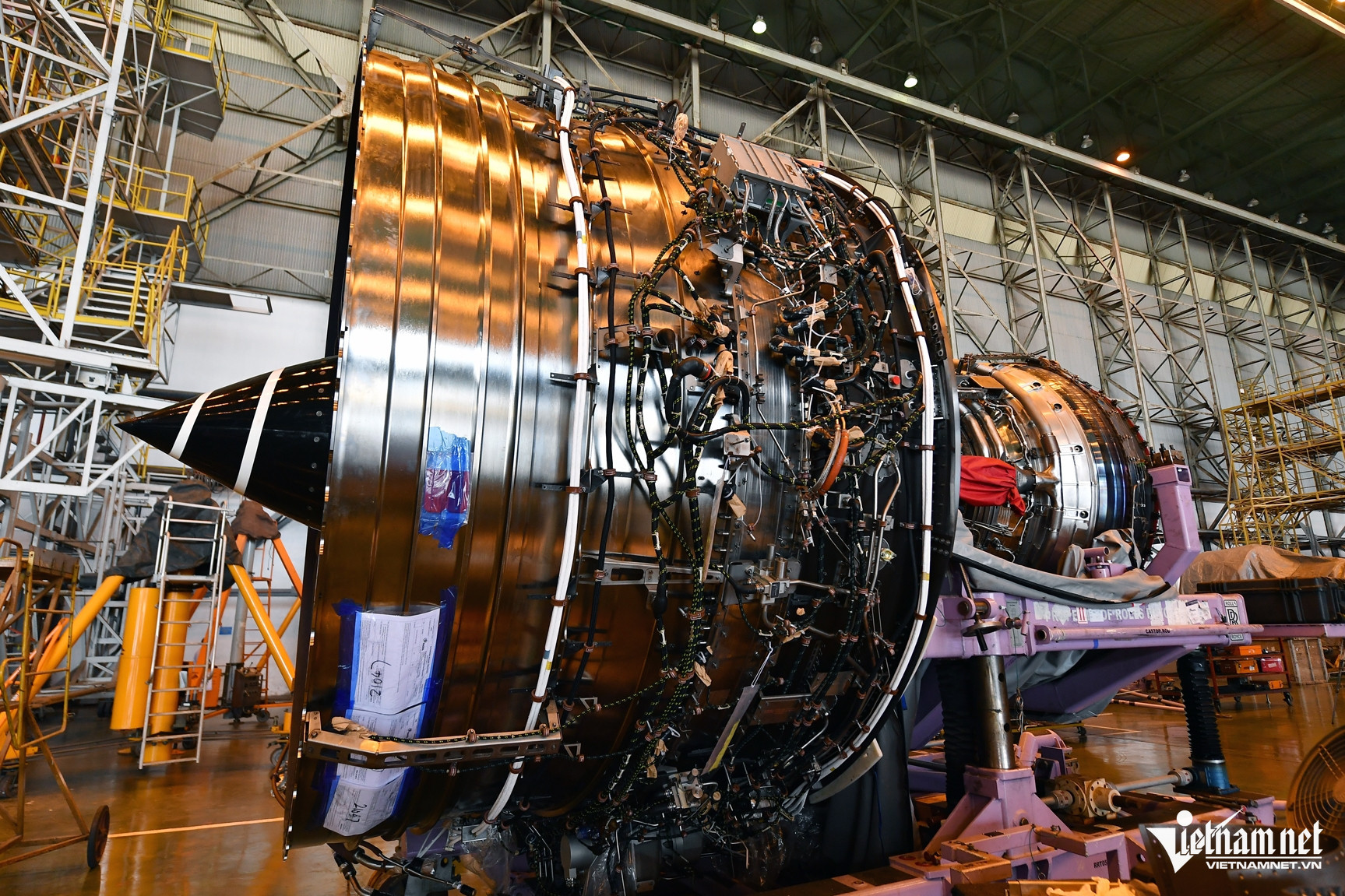

Level 1: builders of large components and structures such as airframes and propulsion engines.

Level 2: system integrators, software developers, assemblers of large sets of spare parts and major complexes.

Level 3: suppliers of specialized electronic components, electric wires and power controllers.

Level 4: outsourcing workshops and component manufacturing workshops that make components as designed.

Level 5: distributors of components, materials, subordinate services such as screws, raw materials and adhesive.

Level 6: raw material suppliers

Asked about the opportunities for Vietnamese enterprises, Thanh believes that they can be level-4 vendors if all materials are determined by Level-1, 2, 3 vendors, or by aircraft manufacturers. Vietnam needs to build a large and qualified workforce to be able to work with higher-level vendors and participate in the world’s aviation supply chain.

Seeking openings

According to Thanh, AS9100D, the certificate on international quality assurance system for institutions providing products and services for the aerospace industry is considered the ‘admission ticket’ for Vietnamese enterprises which want to join the global aviation supply chain.

“Not all companies that have AS9100D can make aerospace components, but if companies don’t have the certificate, they won’t have any opportunities to do this,” Thanh said

However, in order to obtain AS9100D, one of the requirements that companies must meet is former experience in making components for the aviation industry, which is not simple for most Vietnamese enterprises.

Relating the story of Giza, Thanh said when building its factory, its founders decided that they would make aerospace components, but to date, it still has not sold any products.

It takes many months or years to train and practice a system to make it meet AS9100D standards. The workforce plays the decisive role in building and maintaining the system.

“I talked with some aerospace component manufacturers and realized that if we can buy high-quality machines and modern equipment, but don’t have well-trained workforce, we won’t be able to operate exactly in accordance with AS9100D standards,” he said.

The typical characteristic of the global aviation supply chain is that component manufacturing enterprises must be ready to ‘join hands with international clients’. Vietnamese enterprises should make the products that they think ‘big players’ in the aviation industry will need and then introduce their capability to international partners.

There are many enterprises and manufacturers thar have firm positions in the aviation industry willing to provide training to enterprises in many skills, such as reading and understanding drawings, understanding regulations, and maintaining international standards and certificates.

However, according to Thanh, if enterprises don’t have a long-term plan, it will be better not to join the industry. The life expectancy of an aircraft is just 20-25 years and equipment replacement is made during its whole life.

“This means that if you can manufacture spare parts for the aviation industry today, you will have to be sure that clients will come to see you to place orders after 20-25 years,” he said.

Binh Minh