|

| Workers produce apparel for export at the factory of the Duc Giang garment company in Long Bien district, Hanoi |

In 2018, the textile-garment sector posted year-on-year exports growth of more than 16 percent to surpass 36 billion USD, making Vietnam the world’s third biggest exporter of these products, after China and India.

Based on these figures, the Vietnam Textile and Apparel Association (VITAS) believes the export target of 40 billion USD for 2019 is achievable, thanks in part to FTAs, including the one with the EU – the second biggest market for Vietnamese textile and garment products.

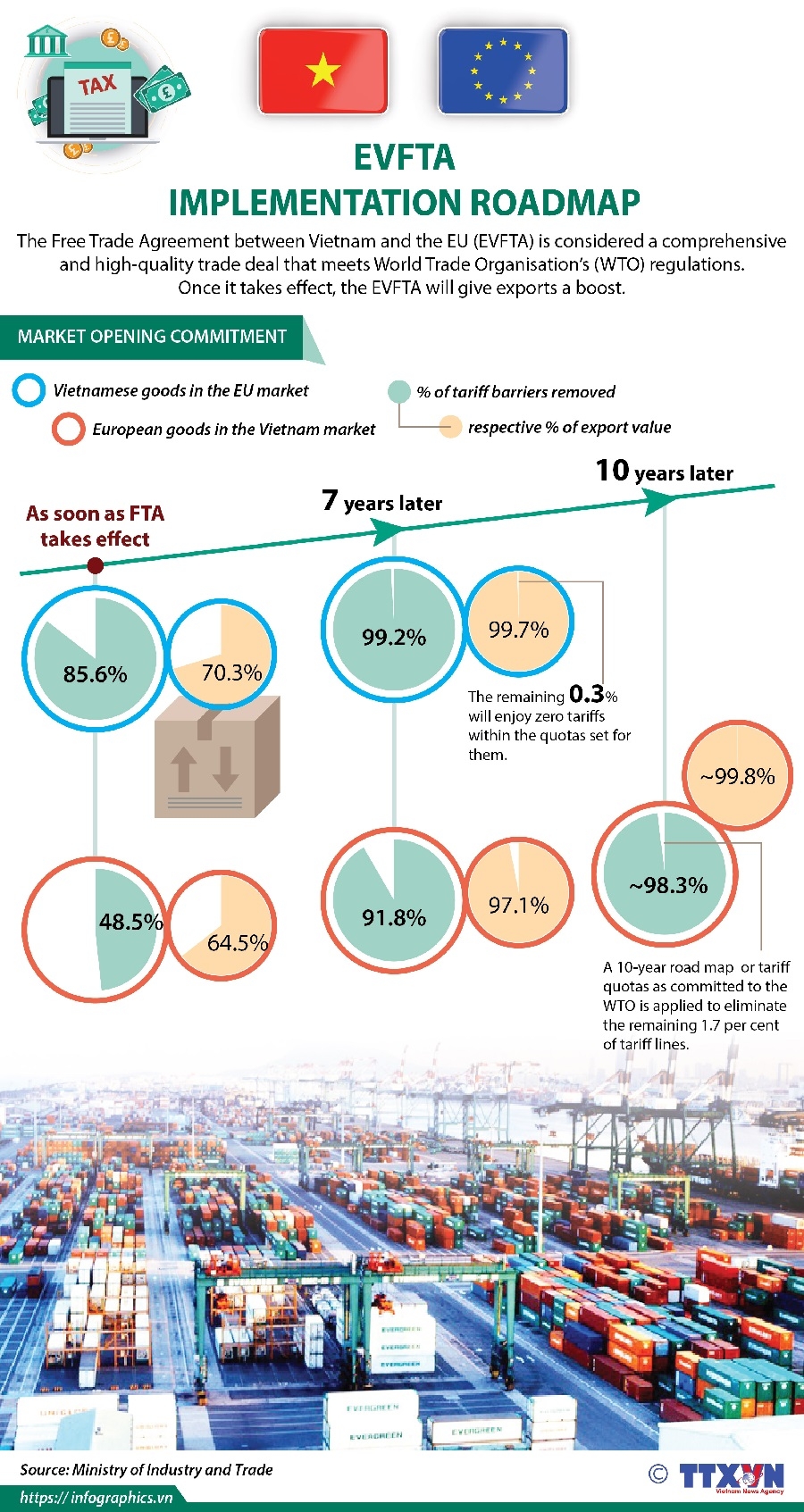

VITAS Chairman Vu Duc Giang said the EVFTA, signed in Hanoi on June 30, promises apparel export potential of more than 100 billion USD annually. Textiles and garments shipped to the EU are currently subject to export tariffs of 9.6 percent, but when the EVFTA takes effect, the rate will be gradually reduced to zero percent in seven years.

He noted most of the countries exporting textiles and garments to the EU don’t have FTAs with the bloc. Therefore, if Vietnamese firms meet origin requirements, the EVFTA will open up enormous opportunities for exports.

|

Managing Director of the Vietnam National Textile and Garment Group Cao Huu Hieu said that to be exempt from tariffs, apparel products must satisfy two conditions: the fabric used to make apparel must hail from Vietnam or the EU, and the production process must be carried out in Vietnam or the EU.

However, the EVFTA is also flexible, he said, elaborating that apparel products can also benefit from preferential tariffs under this deal if the material fabric comes from the countries that have FTAs with both the EU and Vietnam, such as the Republic of Korea.

VITAS Chairman Giang pointed out that although the rules of origin in the EVFTA are not as strict as in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Vietnamese firms still face several challenges because most of them have just engaged in cutting and sewing steps while not producing fabric and yarn. Additionally, most production materials still come from China, which doesn’t have a trade deal with the EU.

To capitalise on the EVFTA, he urged domestic businesses to develop weaving and the supporting industry to provide materials for the sector.

They also need to use more fabric from the Republic of Korea to make use of the trade pact pending the supporting industry’s development. Under the EVFTA, companies can also import materials from Europe to improve their products’ quality and value, he added.

According to Director General of the Garment 10 Corporation Than Duc Viet, his company has high hopes for the EVFTA, and has made preparations to capitalise on this deal.

Exports now account for 80 percent of Garment 10’s total revenue, with 45 percent of export turnover from the US, 35 percent from Europe, and 10 percent from Japan. These figures will change when FTAs come into force as the firm will receive more orders, he noted, adding that the business has made plans to connect its domestic supply chain to satisfy origin requirements. VNA

Relying on Chinese materials, garment manufacturers can’t take full advantage of FTAs

Nearly 100 percent of materials needed to make textile and garment products must be imported, limiting Vietnam’s to take full advantage of preferential tariffs in FTAs.

VN textile and garment producers could face problems meeting CPTPP, EVFTA standards

Vietnam’s textile and garment may not be able to take full advantage of the preferential tariffs of two important FTAs, CPTPP and EVFTA, because of problems in input materials.

Insiders have recommended Vietnam pay attention to developing weaving and other production activities supporting the textile-garment sector to make best use of the EVFTA, a freshly-inked free trade agreement with the EU." itemprop="description" />

Insiders have recommended Vietnam pay attention to developing weaving and other production activities supporting the textile-garment sector to make best use of the EVFTA, a freshly-inked free trade agreement with the EU." itemprop="description" />