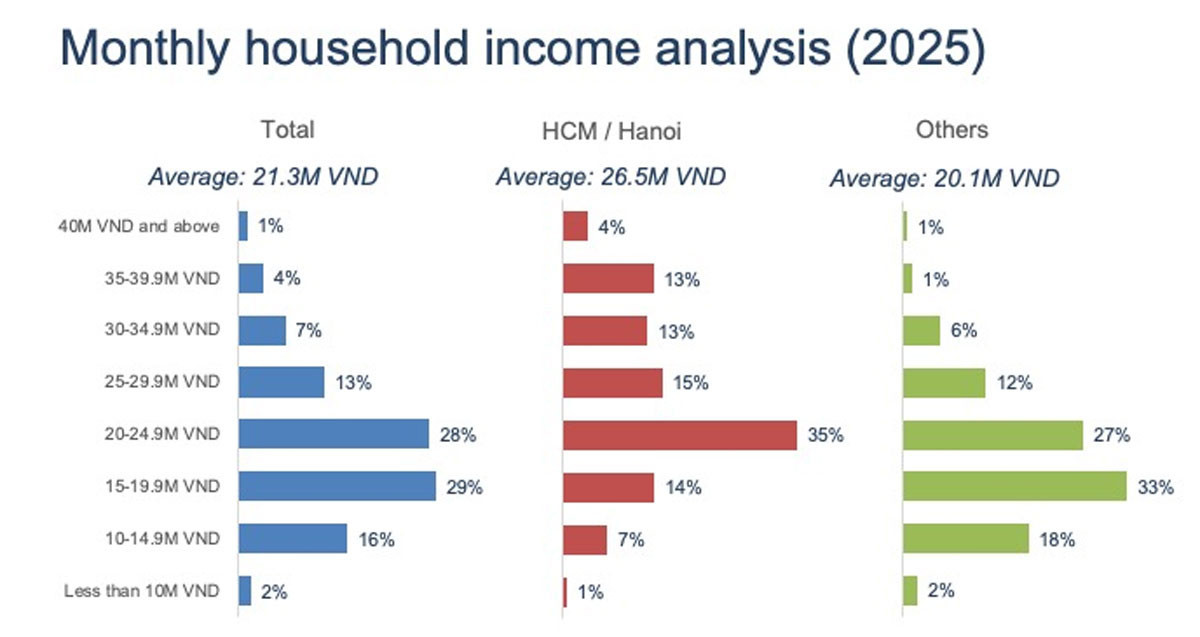

In Hanoi and Ho Chi Minh City, 4% of households have a monthly income of 40 million VND or more. Source: QM

A recent market survey by Qandme has revealed a widening gap between income growth and rising apartment prices in Vietnam’s largest cities, particularly Hanoi and Ho Chi Minh City.

Despite having the highest household earnings in the country, residents in these urban centers are struggling to afford housing, with the average apartment price in Hanoi now reaching around 4 billion VND ($160,000).

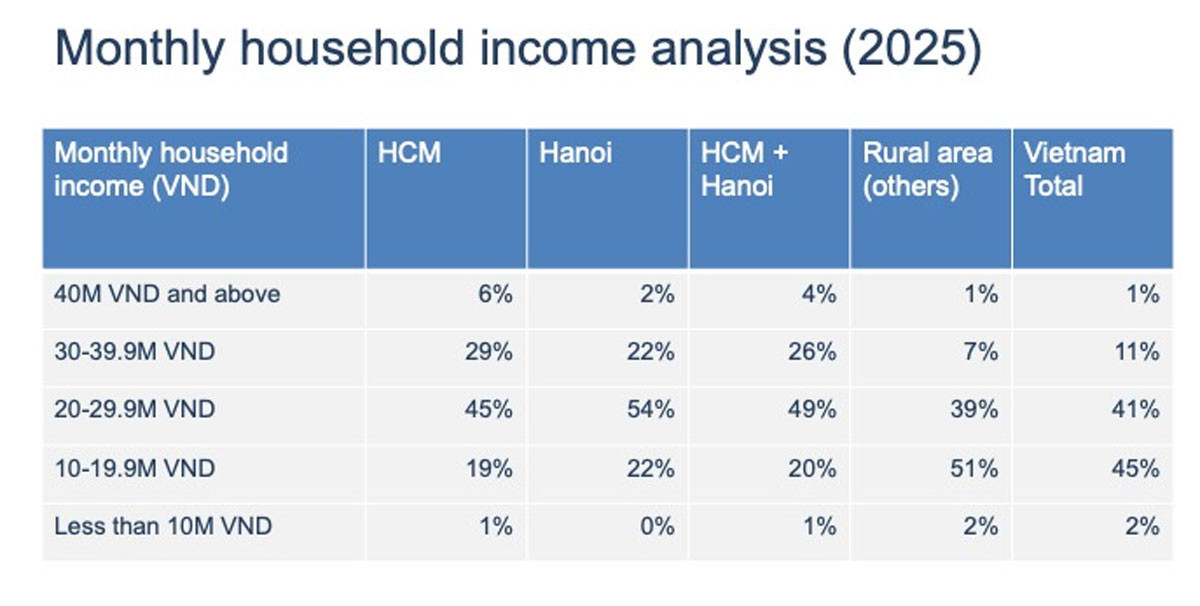

According to the survey, 30% of households in Hanoi and Ho Chi Minh City earn over 30 million VND ($1,200) per month, a significantly higher proportion compared to rural areas.

However, even among these higher-income groups, the dream of homeownership remains out of reach due to soaring real estate prices.

In Hanoi, apartment prices have surged to an average of 4 billion VND ($160,000), meaning that even the wealthiest 2% of households - earning over 40 million VND ($1,600) per month - would need over 8 years of full savings to buy a home outright. In reality, after accounting for basic living expenses, most families would need at least 16-20 years to afford a home without loans.

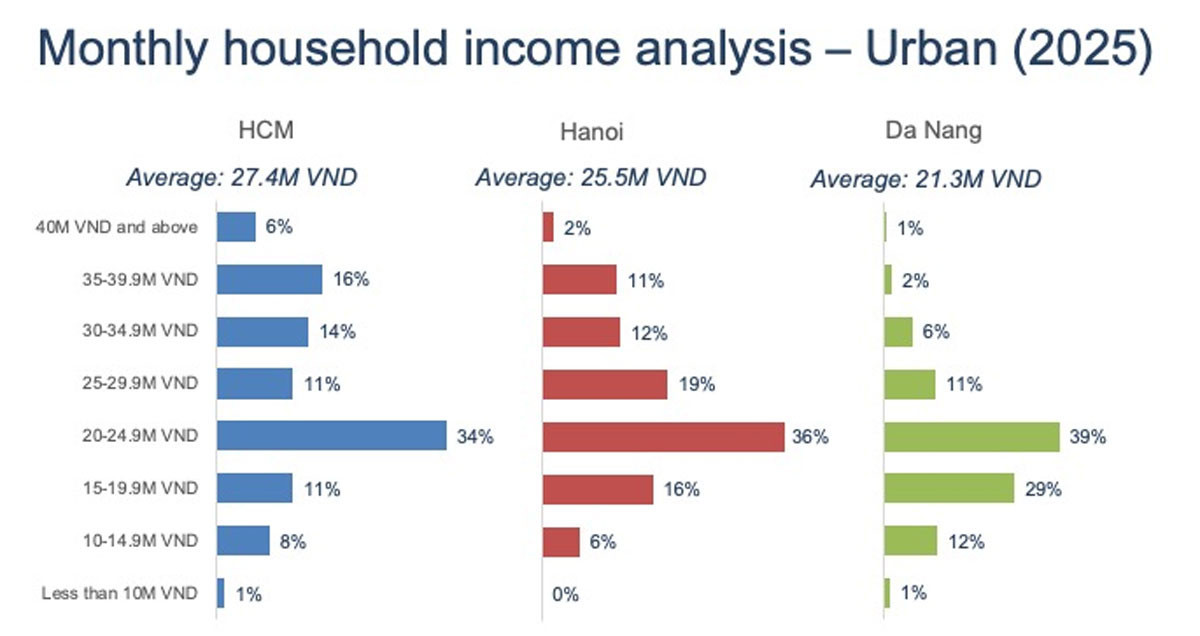

Comparison of income in three cities. Source: QM

Compared to rural areas. Source: QM

Meanwhile, the average household income in Hanoi is around 250 million VND ($10,000) per year, meaning that an average family would need to save every penny for 16 years to afford a standard apartment.

However, given inflation, fluctuating property prices, and rising mortgage rates, even this timeline is unrealistic.

For middle-income families earning 20-25 million VND ($800-$1,000) per month, which is the most common income bracket in Hanoi and Ho Chi Minh City (35% of households), the challenge is even greater.

Even if they save half their income, it would take over 30-40 years to afford an apartment - far longer than a typical mortgage term.

Mortgage financing remains the only realistic option, but with rising interest rates, borrowing to buy a home can result in a repayment period spanning multiple decades, adding further financial strain on families.

Vietnam’s housing affordability crisis is not unique. In China, for example, cities like Beijing and Shanghai have even higher housing prices relative to income. However, government policies, long-term financial instruments, and social housing programs have provided alternative pathways to homeownership.

In contrast, Vietnam lacks extensive social housing programs, and while there are government-backed mortgage incentives, they are often limited in scope and accessibility. Without further intervention, the gap between income and property prices in Hanoi and Ho Chi Minh City will continue to widen.

As housing prices continue to surge beyond the reach of even upper-middle-class households, policymakers and industry experts are urging for:

More affordable housing projects

Stronger mortgage support for first-time homebuyers

Better regulation of speculative real estate pricing

Without these changes, homeownership in Vietnam’s largest cities will become an exclusive privilege of the ultra-wealthy, leaving younger generations and middle-income families facing an increasingly uncertain future.

Manh Ha