Björn Koslowski, deputy chief representative of the Delegation of German Industry and Commerce in Vietnam (AHK Vietnam), describes the options for businesses and the effects COVID-19 will have on these developments.

|

| Björn Koslowski, deputy chief representative of the German Chamber of Industry and Commerce in Vietnam |

In Asia, German companies are highly dependent on their Chinese supply chains. Through the COVID-19 crisis, these have been severely interrupted. We are hence often being asked if German companies are now re-orienting their sourcing strategies by diversifying their holdings in Asia to mitigate supply chain risks. This would culminate in a so-called China+1 strategy whereas Vietnam could play a vital role as an additional sourcing location.

Germany and the European Union are deeply intertwined with global supply chains. In 2015, 31 per cent of the German and 28 per cent of the EU value-add of their respective economic outputs actually originated in third-party countries. This is far more than in China or the United States where only 17 per cent and 10 per cent respectively of the added value originated abroad.

In Germany, even complex products such as machinery are highly dependent on foreign inputs. In 2015, 23 per cent of the added value of the machinery manufacturing has been provided by suppliers from other countries. Same as for Vietnam, China is a leading supply source for the German industry. It added 2.3 per cent of the added value of the German machinery manufacturers in 2015.

Last year, China delivered over 10 per cent of all imported input materials of the German industry. For many types of goods, this country is the most important – if not dominant – supplier. It is therefore not surprising that supply chain interruptions due to the COVID-19 crisis are a major challenge for the German industry. According to the German Mechanical Engineering Industry Association, the current situation “must be seen as an economic worst-case scenario which has to result in a reassessment of macro- and micro-economic risks.”

So, there is currently a lot of soul-searching going on in the sourcing departments of corporate Germany. The core question is "how we mitigate supply risks in order to establish more resilient sourcing strategies.”

Optimise single sourcing

Single sourcing implies that a company works with just one supplier for certain goods. Because suppliers awarded with contracts will be able to manufacture large quantities of products they can achieve economies of scale which they can pass on to their customers in the form of price reductions.

Furthermore, choosing just one supplier reduces the need for communication and thus leads to seamless sourcing processes. Because this approach has proved to be extremely (cost) efficient it has become an integral part of global supply chains. On the downside though, working with just one supplier exposes the customer to a lot of risk. If certain suppliers should not be able or ready to fulfil their orders – such as through factory closures due to COVID-19 – the customer will be in dire straits.

Moving away from single sourcing will prove challenging for some companies, for several reasons. Customers may have long-standing, well-established relationships with their suppliers. This might be difficult to alter. Also, developing new suppliers takes a lot of effort, time, and costs.

Some industries have developed into oligopolies with only a few manufacturers without viable alternatives. For example in metal processing, there are only a few producers in China left for certain processes. For small purchase volumes it might be difficult to split them between multiple suppliers. Also, single sourcing is a proven concept offering too many advantages to ignore.

The current situation nevertheless shows the feebleness of single sourcing. Changes will likely happen to mitigate risk. Some experts think that if companies cannot alter their supply chains they should at least increase stock-keeping and reduce just-in-time processes.

Reshoring

Reshoring denotes processes in which out- or off-shored production processes are being retrieved back to the home country of a certain company. Some pundits and scientists believe that current disruptions will bring back production capacities from abroad to Germany and the EU. Some German media are even hailing the “end of globalisation”. They believe that multilateralism is at its end and that nation states must be self-sufficient.

Certain economists argue that automation and 3D printing will make the retrieval of labour-intensive industries into high-wage countries economically feasible. And indeed, some enterprises such as Adidas and General Electric have piloted reshoring projects.

However, at least in short-term, reshoring will most likely not happen on a larger scale. While it might reduce the reliance of companies on global supply chains it does not necessarily mitigate the risk of disruption within the home country or region. New production methods might reduce costs in high-wage countries in the future.

However, right now they still tend to be more capital-intensive and overall more expensive than engaging with global supply chains to fully utilise comparative advantages within the world economy. Finally, Germany is facing a lack of availability for qualified technical experts. This squeeze would only intensify if reshoring became a major trend.

Local-for-local

An alternative to reshoring could be so-called “local-for-local” strategies. This means that companies manufacture close to their sales markets. For example, production for Germany could be done in Eastern Europe or manufacturing for China in Vietnam. Following these strategies, the global supply chains would be much more diversified and regionalised.

While local-for-local does not achieve the same economies of scale or low pricing as single sourcing, it reduces logistics costs and enables companies to swiftly react to changing demand patterns and disruptions.

Indeed, Vietnam has profited for years from local-to-local strategies. Many foreign investors use the country as a supply hub for Asia-Pacific. The latest new German local-for-local entry is tesa, which will produce adhesive tape in the northern city of Haiphong for the ASEAN and China. The group has said that time-to-market is especially important to them. “Access to markets, fast and flexible delivery to customers, and the development of local raw materials are important factors in international competition.”

Dual/multiple sourcing

Creating redundancies within the supply chain by engaging with multiple suppliers for certain input materials could be the silver bullet to become more resilient to supply shocks. Over the past few years, we have had many customers from Germany looking for additional suppliers or manufacturing investment locations in Vietnam to complement their activities in China.

They are aiming to develop dual sourcing (having two suppliers for a certain product) or multiple sourcing (having more than two suppliers for a certain product) strategies beyond China. The goal for these clients is to become less dependent on single suppliers or jurisdictions. They may be more flexible in reacting to disruptions plaguing individual suppliers. This kind of strategy is called China+1. It is a movement mainly triggered by rising insecurity regarding trade and investment policies as well as escalating labour costs.

However, there are a few setbacks to these diversification strategies, too. Firstly, they are often more expensive than traditional single sourcing because sourcing volumes have to be divided between suppliers and thus economies of scale are shrinking. Secondly, quality and delivery may be inconsistent. Also, companies need additional resources to manage an increasing number of suppliers. This is an extremely important point for small- and medium-sized enterprises. Splitting their smaller procurement volumes between suppliers is sometimes not economically feasible.

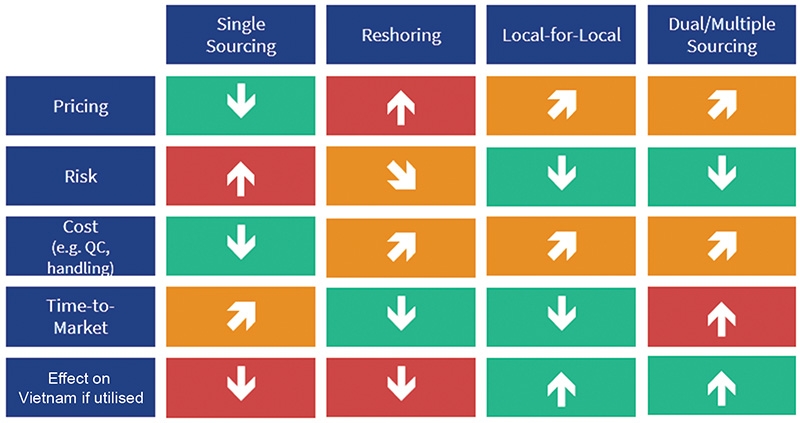

Comparison of supply chain strategies

|

Source: AHK Vietnam

What happens next

The COVID-19 crisis may be considered a “black swan” event. Its massive effects could not have been eliminated by the aforementioned strategies. However, for similar future events a certain mitigation of risks is possible if companies prepare accordingly. It can be expected that purchasers from now on will take worst-case scenarios like the COVID-19 crisis into account when calculating risks.

There is just one sure thing: purchasing will become more costly than in the past. Stockpiling, investment diversification, and multi-supplier strategies will all come with increased price tags.

Companies will follow diverse paths regarding sourcing strategies fitting to their individual needs. For some, single sourcing might be the only feasible option. For others, setting up a diversified supply network with multiple redundancies will be the goal.

Comparison of supply chain plans

Vietnam could and will be profiting from an increased significance of local-for-local and dual/multiple sourcing strategies. Following these, there most likely will be more sourcing and more manufacturing investments of German companies in the country.

However, a certain time lag has to be expected. Currently, companies are mostly re-orienting their business because of the crisis. Embarking on new projects will only happen when the world economy stabilises and travel restrictions are lifted. Qualifying new suppliers can then take 12-18 months from first contact to serial production. Setting up factories can take up to four years from location analysis to standard operation procedure.

In any case, the disruptive effects of the COVID-19 crisis in combination with the imminent coming-into-effect of the EU-Vietnam Free Trade Agreement will present a lot of opportunities for Vietnam to fetch more sourcing and investment from the EU and Germany. VIR

Björn Koslowski